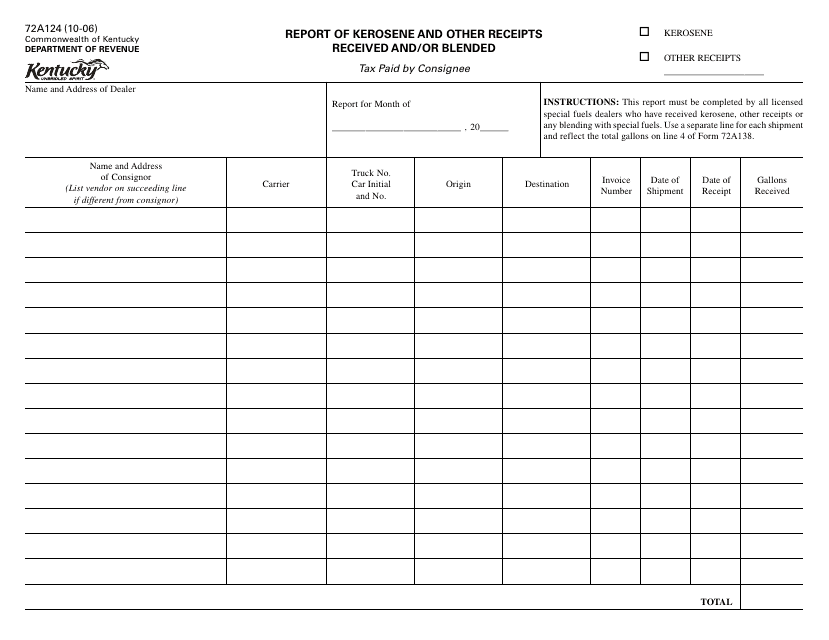

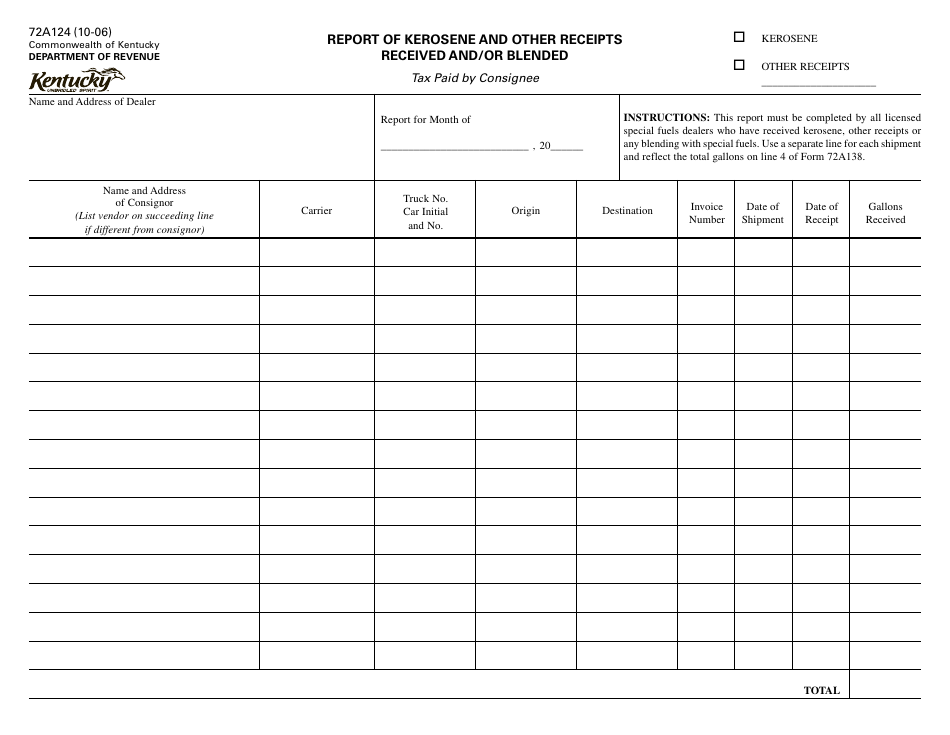

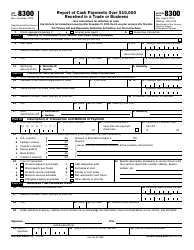

Form 72A124 Report of Kerosene and Other Receipts Received and / or Blended - Kentucky

What Is Form 72A124?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A124?

A: Form 72A124 is a report used in Kentucky for reporting kerosene and other receipts received and/or blended.

Q: Who needs to file Form 72A124?

A: Any business or individual in Kentucky that receives or blends kerosene and other receipts needs to file Form 72A124.

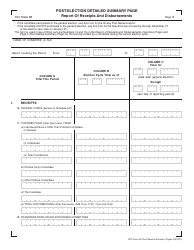

Q: What information is required on Form 72A124?

A: Form 72A124 requires information such as the total gallons received, total gallons blended, and other specifics related to kerosene receipts.

Q: How often should Form 72A124 be filed?

A: Form 72A124 should be filed monthly.

Q: Are there any penalties for not filing Form 72A124?

A: Yes, there may be penalties for not filing Form 72A124 or for filing it late. It is important to meet the filing requirements and deadlines.

Q: Is Form 72A124 only for kerosene receipts?

A: No, Form 72A124 is also used to report other receipts such as biodiesel fuel, alternative fuel, and undyed diesel fuel in Kentucky.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A124 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.