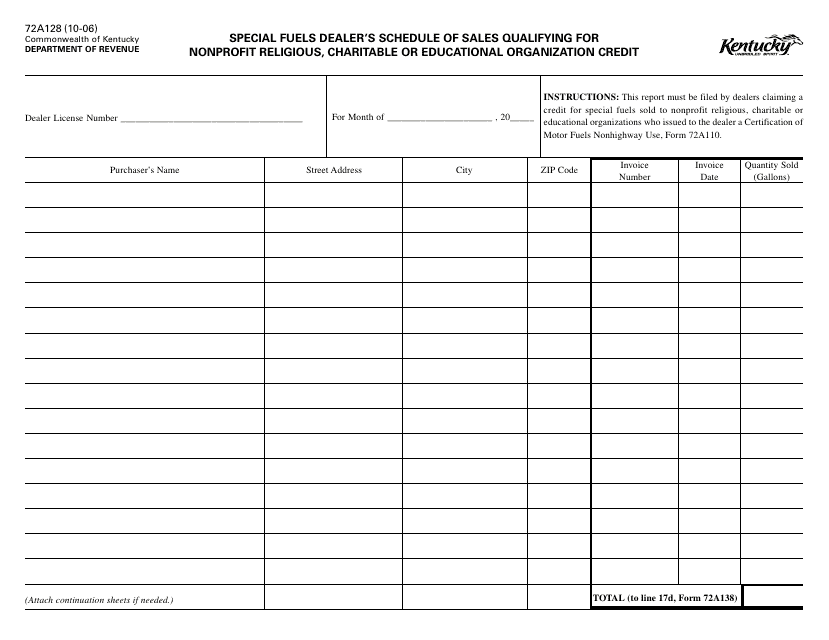

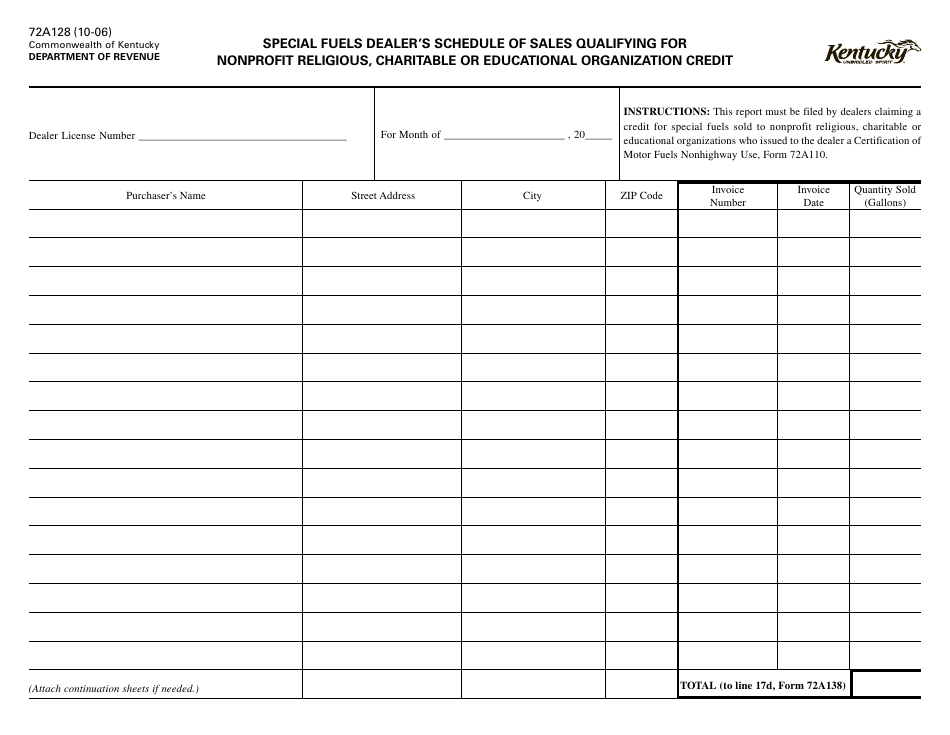

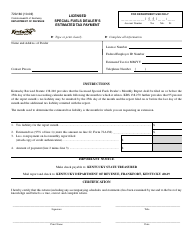

Form 72A128 Special Fuels Dealer's Schedule of Sales Qualifying for Nonprofit Religious, Charitable or Educational Organization Credit - Kentucky

What Is Form 72A128?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A128?

A: Form 72A128 is the Special Fuels Dealer's Schedule of Sales Qualifying for Nonprofit Religious, Charitable or Educational Organization Credit in Kentucky.

Q: Who needs to file Form 72A128?

A: Special fuels dealers in Kentucky who want to claim a credit for sales made to nonprofit religious, charitable or educational organizations.

Q: What is the purpose of Form 72A128?

A: The purpose of Form 72A128 is to report sales of special fuels made to nonprofit religious, charitable or educational organizations in order to claim a credit.

Q: How do I complete Form 72A128?

A: You need to provide the required information about your sales of special fuels to nonprofit religious, charitable or educational organizations, as well as any supporting documentation.

Q: Is there a deadline for filing Form 72A128?

A: Yes, Form 72A128 must be filed by the due date specified by the Kentucky Department of Revenue.

Q: Are there any penalties for not filing Form 72A128?

A: Yes, failure to file Form 72A128 or filing it with incorrect information may result in penalties imposed by the Kentucky Department of Revenue.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A128 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.