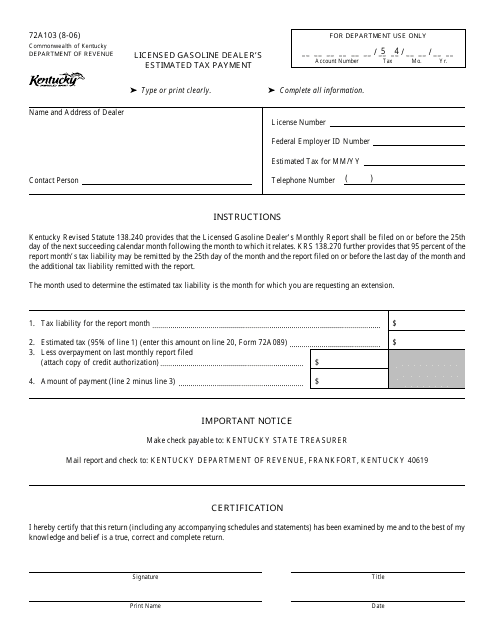

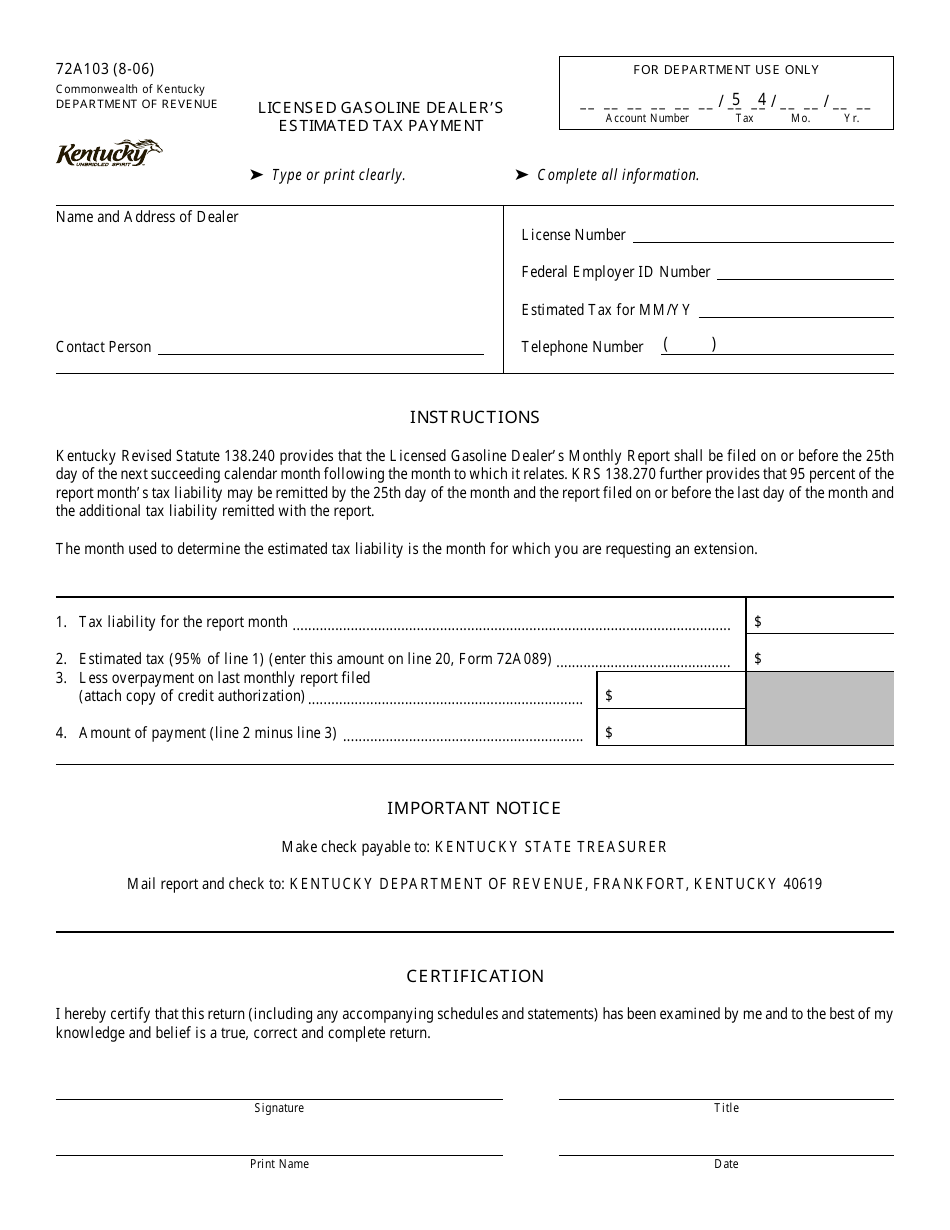

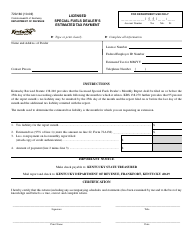

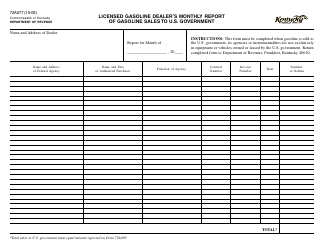

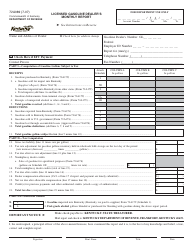

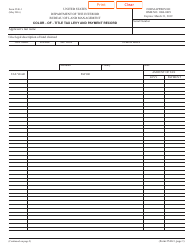

Form 72A103 Licensed Gasoline Dealer's Estimated Tax Payment - Kentucky

What Is Form 72A103?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A103?

A: Form 72A103 is the Licensed Gasoline Dealer's Estimated Tax Payment form in Kentucky.

Q: Who is required to file Form 72A103?

A: Licensed gasoline dealers in Kentucky are required to file Form 72A103.

Q: What is the purpose of Form 72A103?

A: The purpose of Form 72A103 is to report and make estimated tax payments for gasoline sales.

Q: When is Form 72A103 due?

A: Form 72A103 must be filed and paid on a monthly basis, and the due date is the 20th day of the following month.

Form Details:

- Released on August 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A103 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.