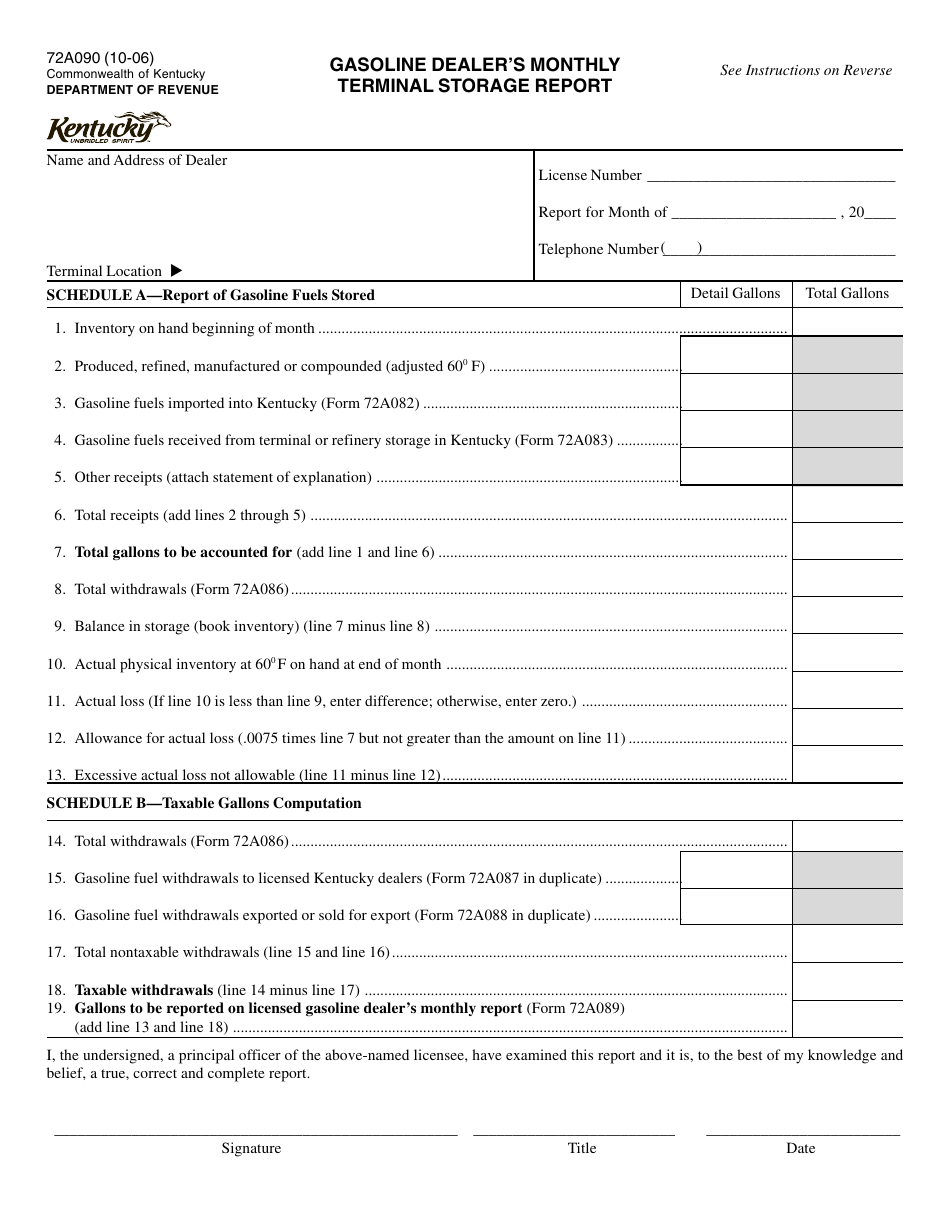

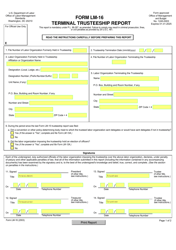

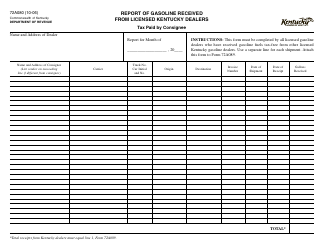

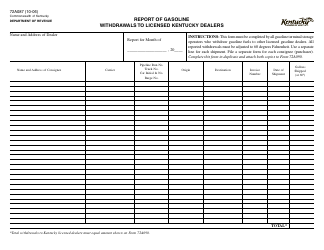

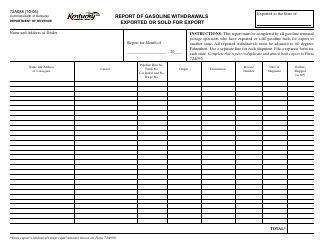

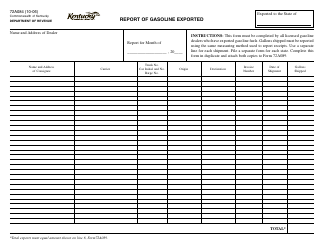

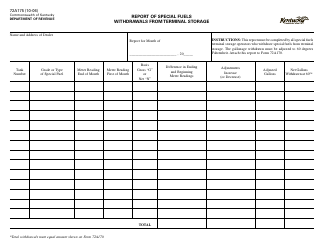

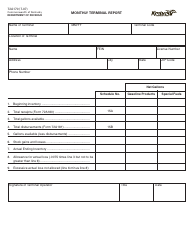

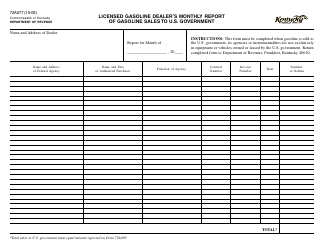

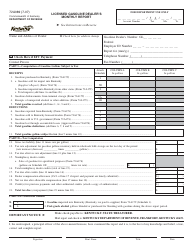

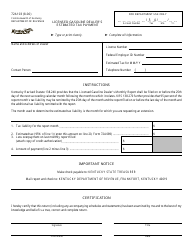

Form 72A090 Gasoline Dealer's Monthly Terminal Storage Report - Kentucky

What Is Form 72A090?

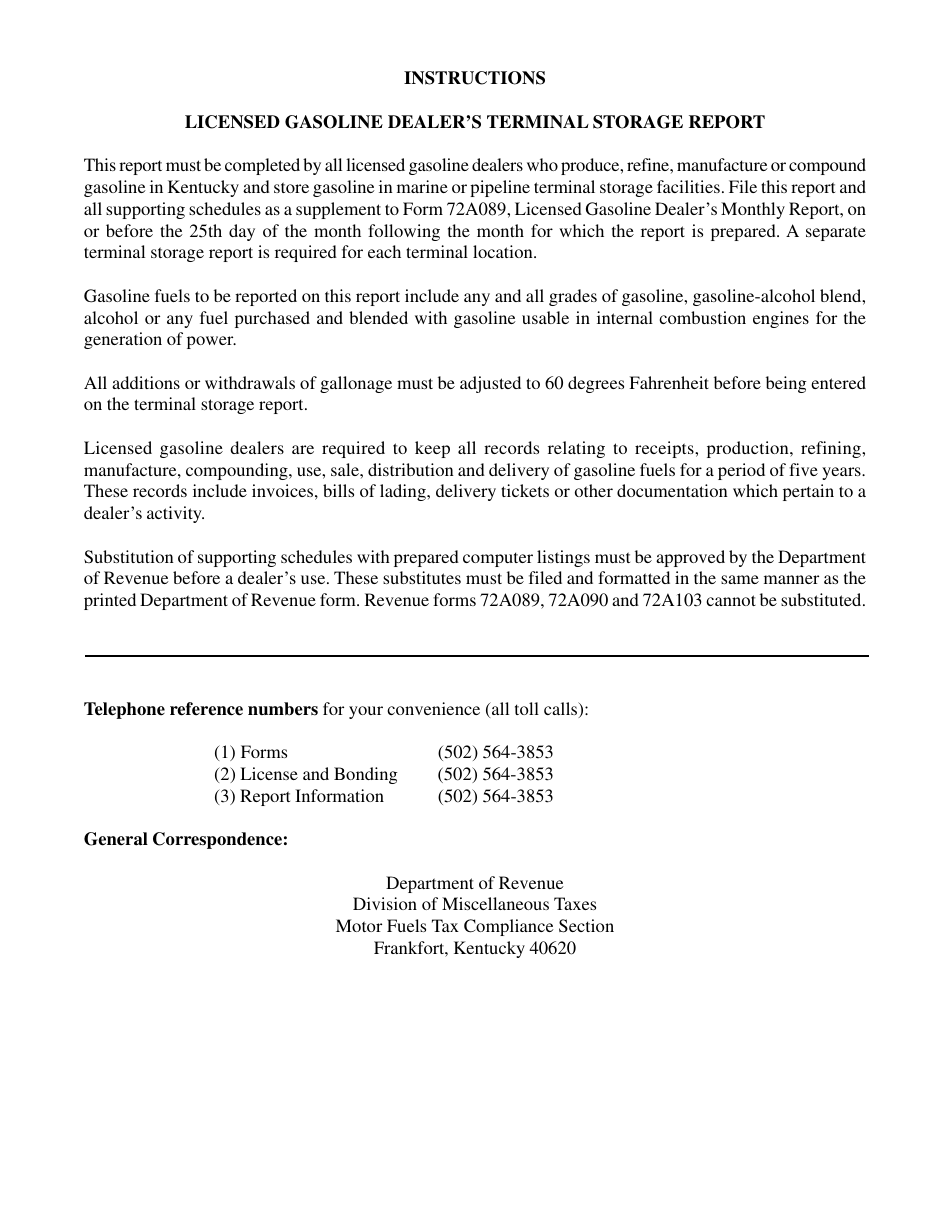

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A090?

A: Form 72A090 is the Gasoline Dealer's Monthly Terminal Storage Report for Kentucky.

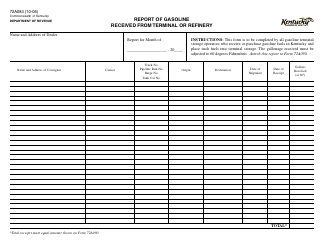

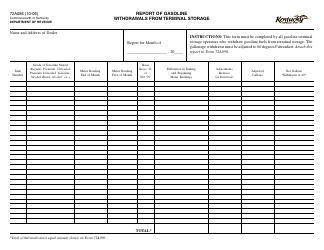

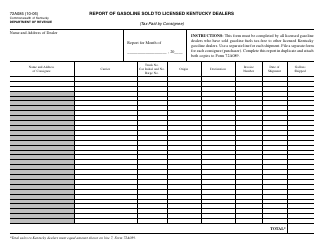

Q: Who needs to fill out Form 72A090?

A: Gasoline dealers in Kentucky need to fill out Form 72A090.

Q: What is the purpose of Form 72A090?

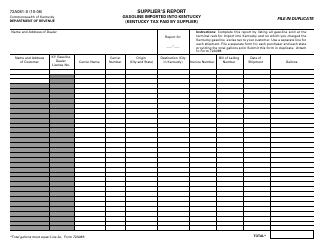

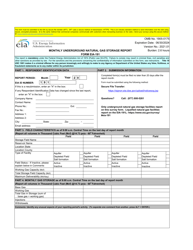

A: Form 72A090 is used to report the monthly terminal storage of gasoline by dealers in Kentucky.

Q: How often should Form 72A090 be filled out?

A: Form 72A090 should be filled out on a monthly basis by gasoline dealers.

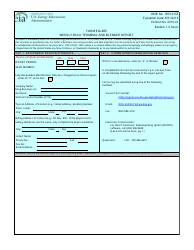

Q: What information is required on Form 72A090?

A: Form 72A090 requires information such as the dealer's name, address, terminal supplier, and the amount of gasoline in storage.

Q: Are there any penalties for not filing Form 72A090?

A: Yes, there are penalties for not filing Form 72A090, including fines and potential legal action.

Q: Can Form 72A090 be filed electronically?

A: Yes, Form 72A090 can be filed electronically through the Kentucky Department of Revenue's eServices platform.

Q: Is Form 72A090 only for gasoline dealers in Kentucky?

A: Yes, Form 72A090 is specifically for gasoline dealers in Kentucky.

Q: What is the due date for filing Form 72A090?

A: Form 72A090 must be filed by the 25th day of the month following the month being reported.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A090 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.