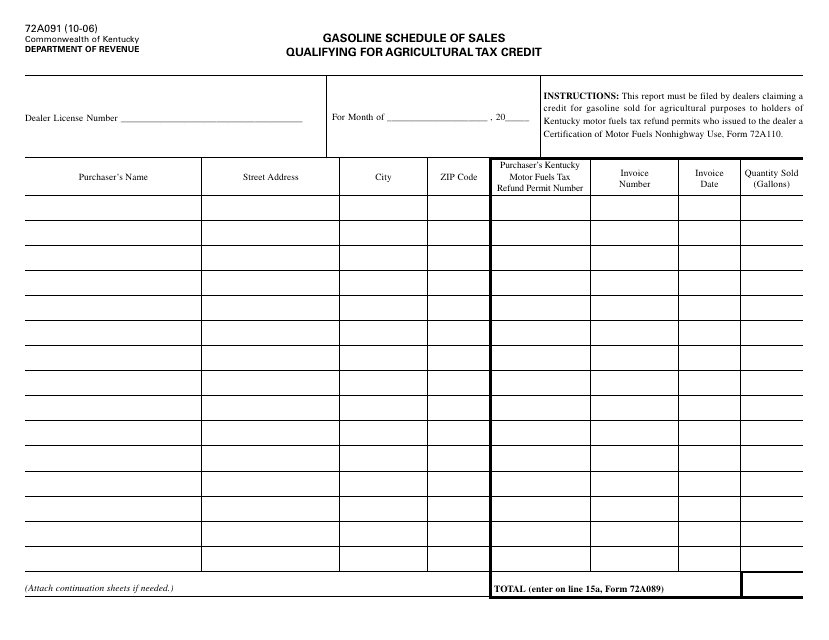

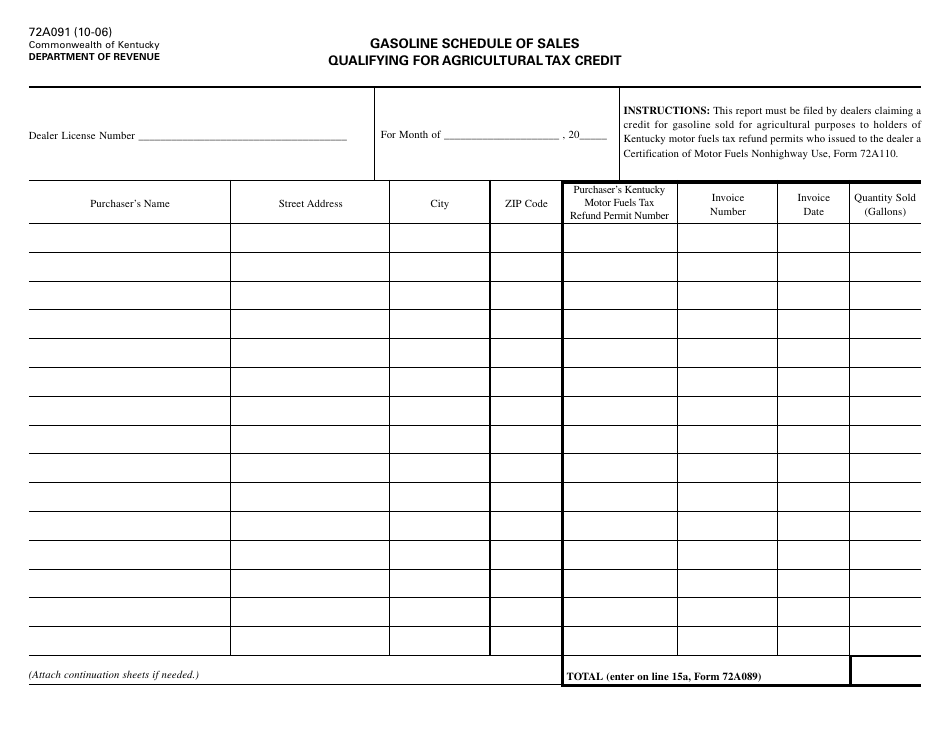

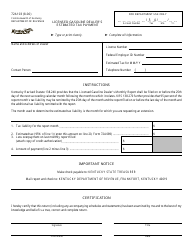

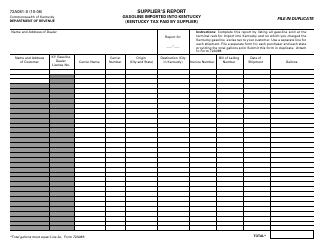

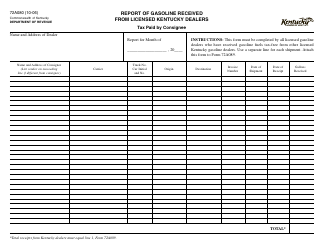

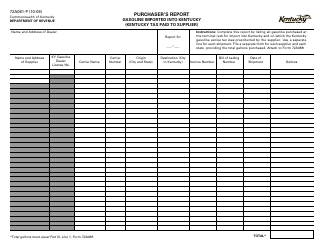

Form 72A091 Gasoline Schedule of Sales Qualifying for Agricultural Tax Credit - Kentucky

What Is Form 72A091?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A091?

A: Form 72A091 is the Gasoline Schedule of Sales Qualifying for Agricultural Tax Credit in Kentucky.

Q: What is the purpose of Form 72A091?

A: The purpose of Form 72A091 is to report gasoline sales that qualify for the Agricultural Tax Credit in Kentucky.

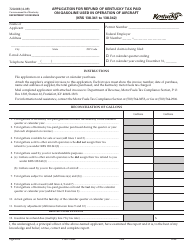

Q: Who needs to file Form 72A091?

A: Any individual or business that sold gasoline qualifying for the Agricultural Tax Credit in Kentucky needs to file Form 72A091.

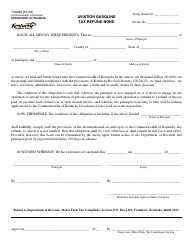

Q: What is the Agricultural Tax Credit?

A: The Agricultural Tax Credit is a tax incentive provided to individuals or businesses that sell gasoline for agricultural purposes in Kentucky.

Q: How often should Form 72A091 be filed?

A: Form 72A091 should be filed on a monthly basis.

Q: Are there any deadlines for filing Form 72A091?

A: Yes, Form 72A091 must be filed by the 20th day of the following month.

Q: What information is required on Form 72A091?

A: Form 72A091 requires you to provide detailed information about the gasoline sales qualifying for the Agricultural Tax Credit, including the quantity sold and the documentation supporting the agricultural use.

Q: Are there any penalties for not filing Form 72A091?

A: Yes, failure to file Form 72A091 or filing it late may result in penalties and interest charges.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A091 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.