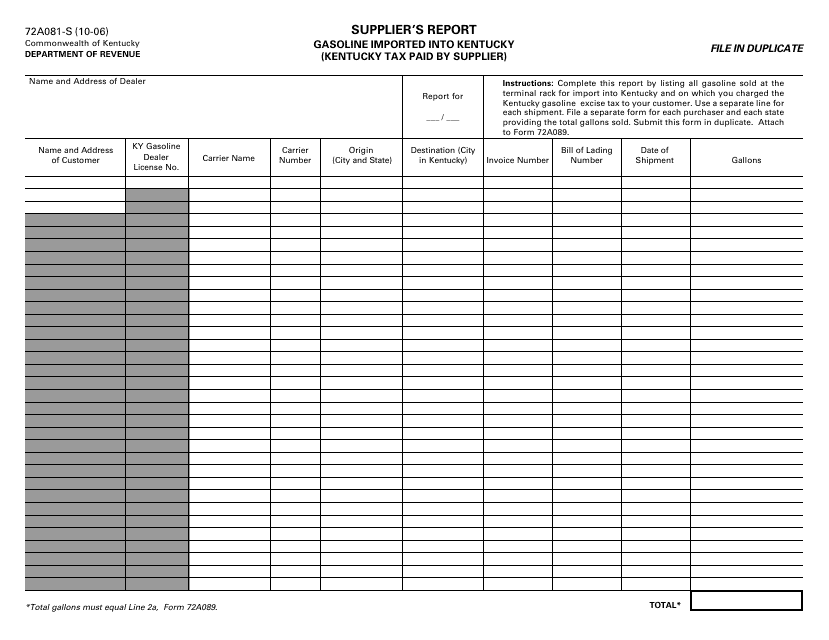

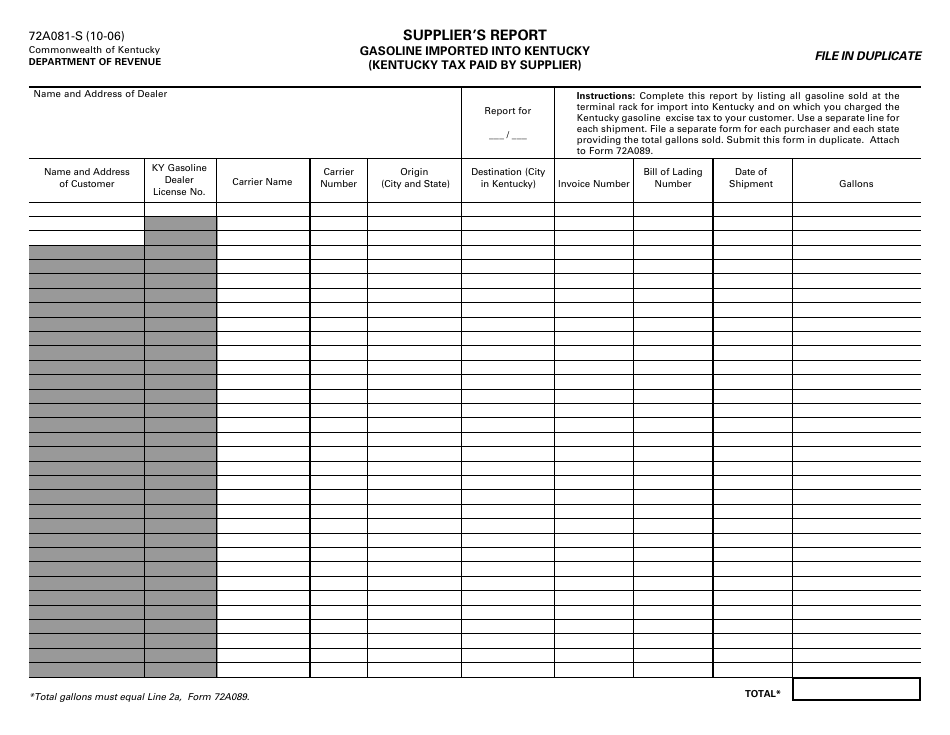

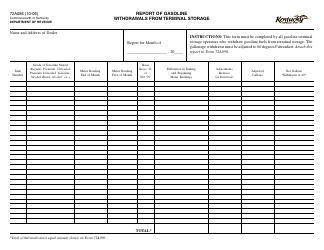

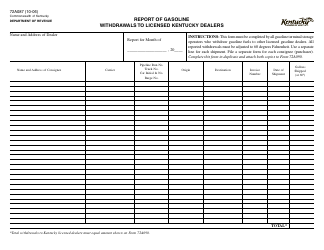

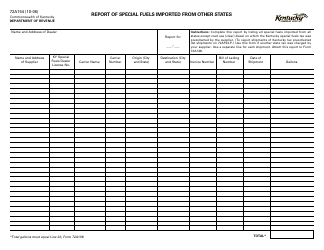

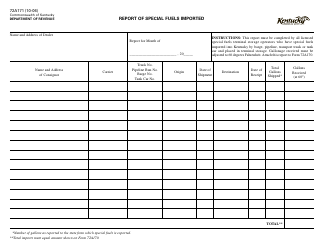

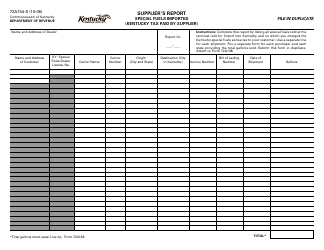

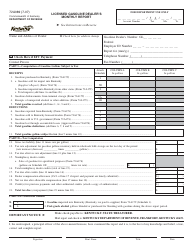

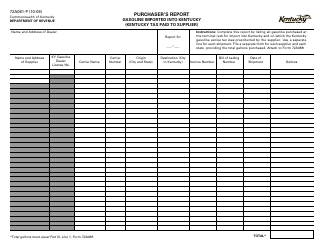

Form 72A081-S Supplier's Report - Gasoline Imported Into Kentucky (Kentucky Tax Paid by Supplier) - Kentucky

What Is Form 72A081-S?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 72A081-S?

A: Form 72A081-S is the Supplier's Report for gasoline imported into Kentucky. It is used to report Kentucky tax paid by the supplier.

Q: Who needs to file Form 72A081-S?

A: Suppliers who import gasoline into Kentucky and have paid Kentucky tax on the gasoline need to file Form 72A081-S.

Q: What is the purpose of Form 72A081-S?

A: The purpose of Form 72A081-S is to report the Kentucky tax paid by the supplier on gasoline imported into the state.

Q: How often do I need to file Form 72A081-S?

A: Form 72A081-S needs to be filed on a monthly basis, with the return due by the 20th day of the following month.

Q: Are there any penalties for not filing Form 72A081-S?

A: Yes, there may be penalties for failure to file or late filing of Form 72A081-S. It is important to submit the form on time to avoid these penalties.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A081-S by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.