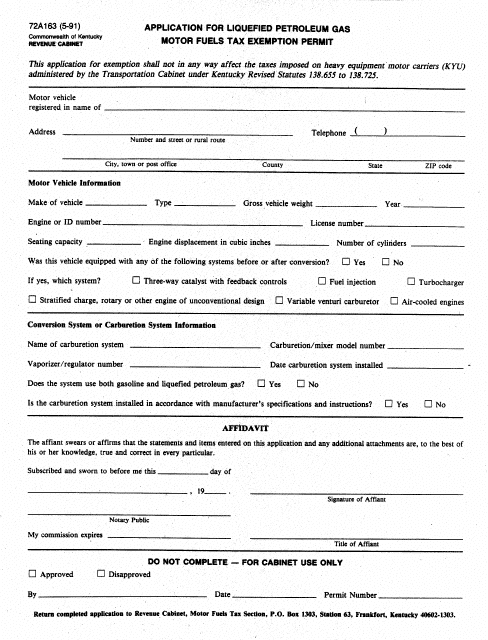

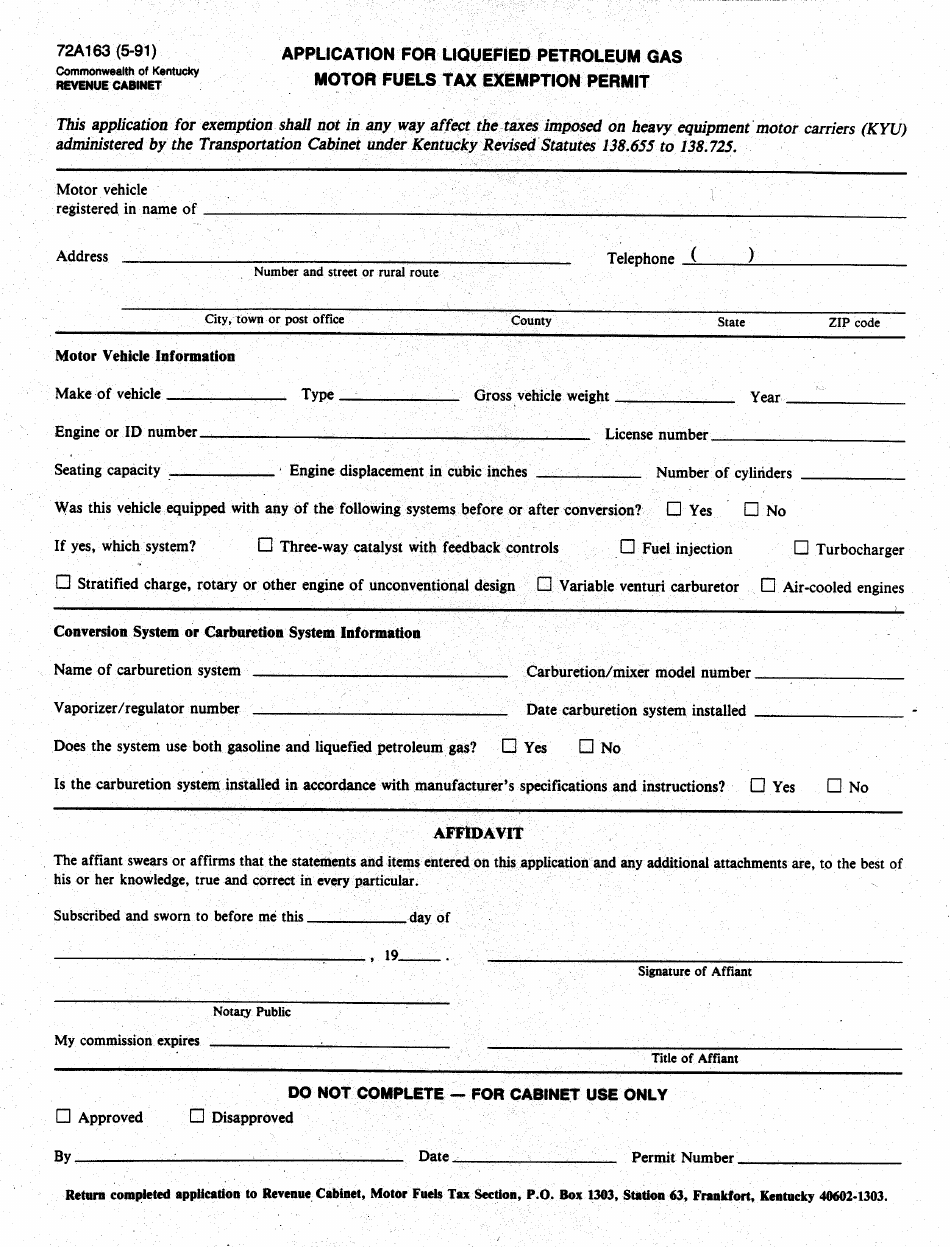

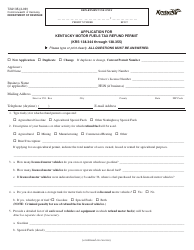

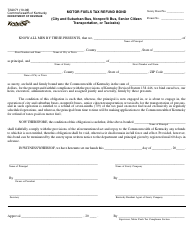

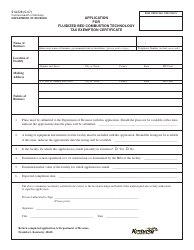

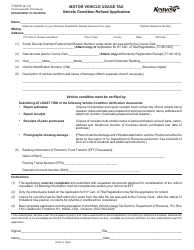

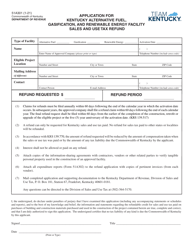

Form 72A163 Application for Liquefied Petroleum Gas Motor Fuels Tax Exemption Permit - Kentucky

What Is Form 72A163?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A163?

A: Form 72A163 is the Application for Liquefied Petroleum Gas Motor Fuels Tax Exemption Permit in Kentucky.

Q: What is the purpose of Form 72A163?

A: The purpose of Form 72A163 is to apply for a tax exemption permit for the purchase of liquefied petroleum gasmotor fuels in Kentucky.

Q: Who needs to fill out Form 72A163?

A: Anyone who wants to claim a tax exemption for the purchase of liquefied petroleum gas motor fuels in Kentucky needs to fill out this form.

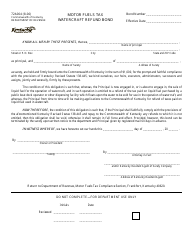

Q: Is there a fee to file Form 72A163?

A: No, there is no fee to file Form 72A163.

Form Details:

- Released on May 1, 1991;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A163 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.