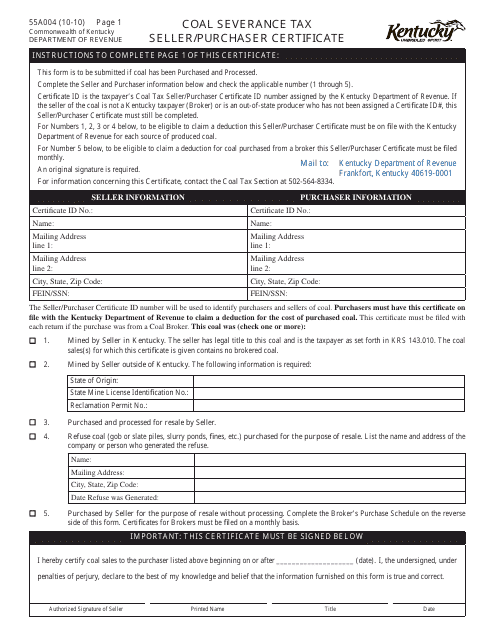

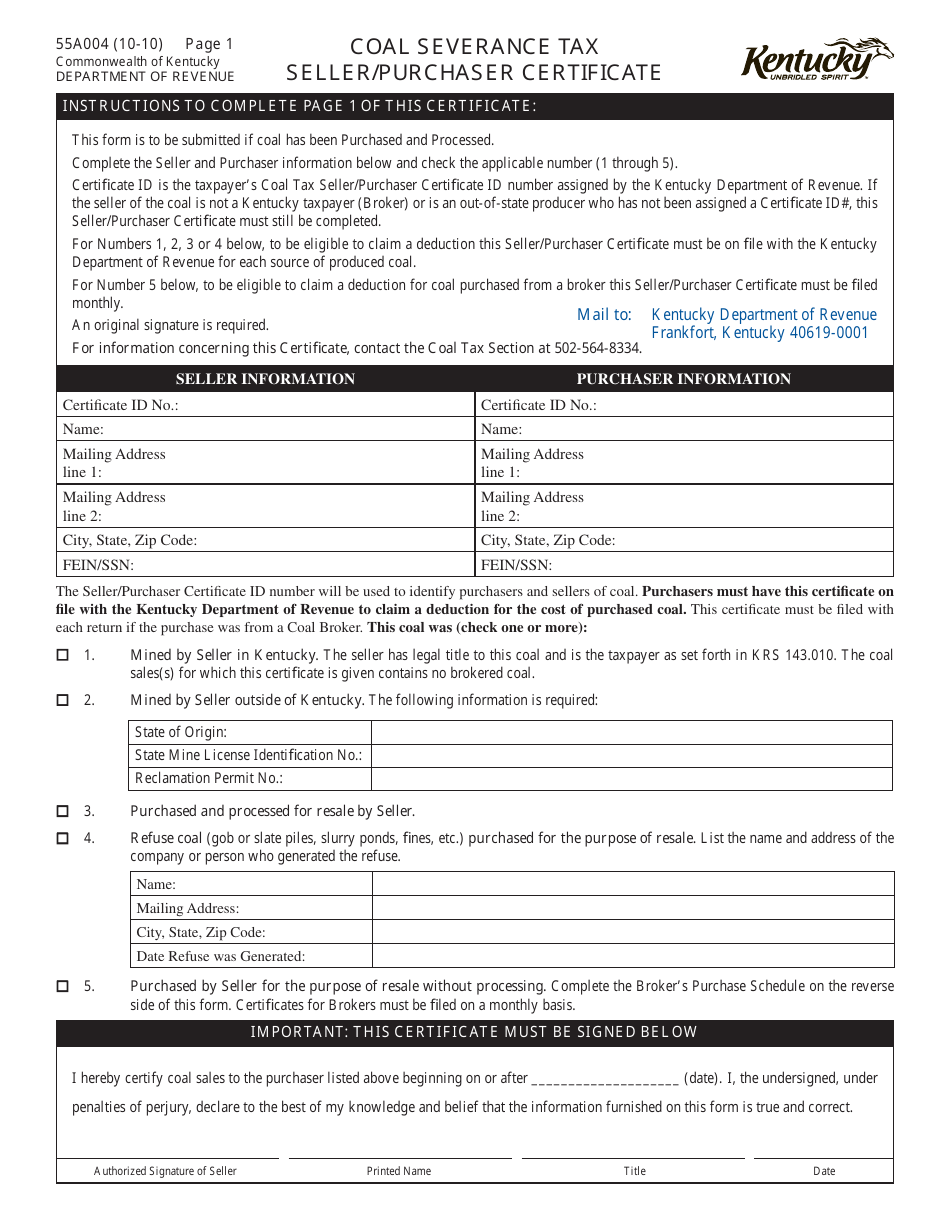

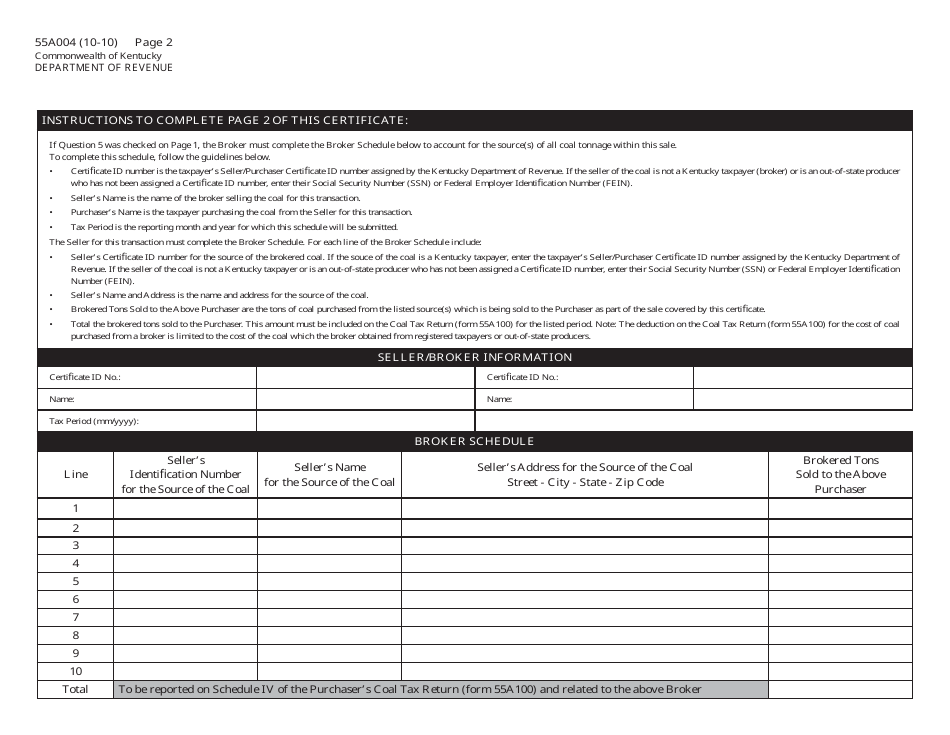

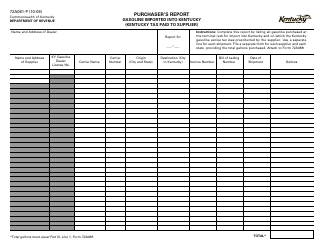

Form 55A004 Coal Severance Tax Seller / Purchaser Certificate - Kentucky

What Is Form 55A004?

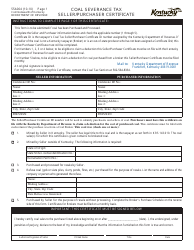

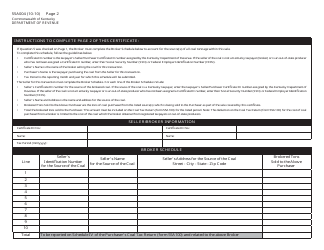

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 55A004?

A: Form 55A004 is the Coal Severance Tax Seller/Purchaser Certificate in Kentucky.

Q: What is the purpose of Form 55A004?

A: The purpose of Form 55A004 is to certify that a seller or purchaser is eligible for exemptions or reductions in the coal severance tax.

Q: Who needs to fill out Form 55A004?

A: Sellers and purchasers of coal in Kentucky need to fill out Form 55A004.

Q: Is there a deadline for submitting Form 55A004?

A: Yes, Form 55A004 must be submitted on or before the due date for filing the coal severance tax return.

Form Details:

- Released on October 1, 2010;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 55A004 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.