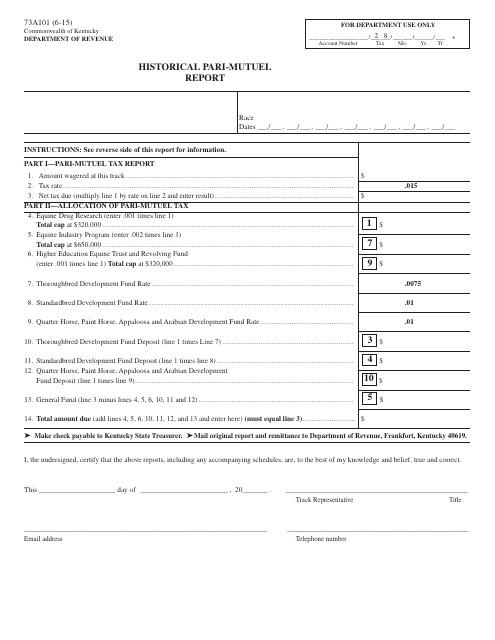

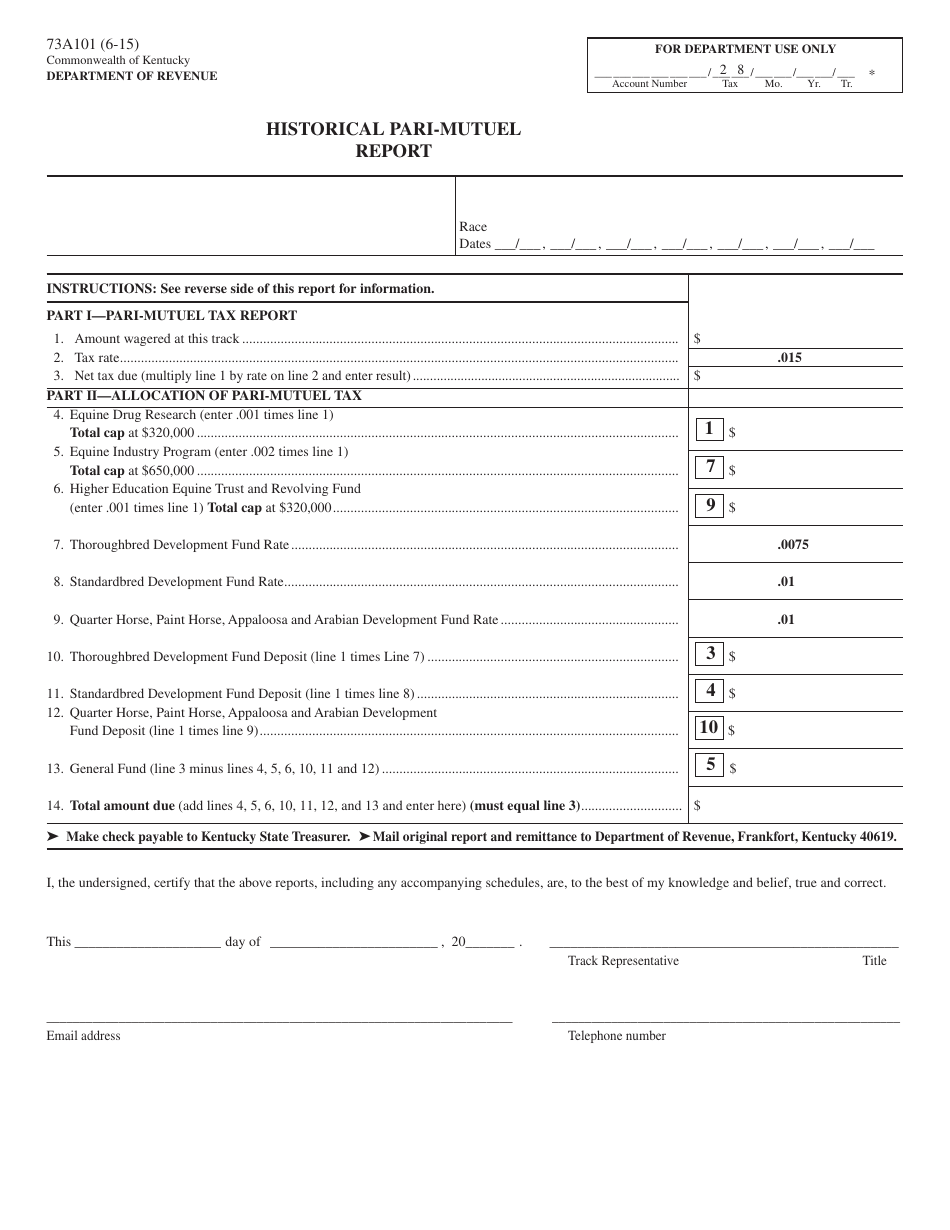

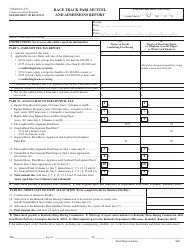

Form 73A101 Historical Pari-Mutuel Report - Kentucky

What Is Form 73A101?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 73A101?

A: Form 73A101 is a Historical Pari-Mutuel Report for Kentucky.

Q: What is a pari-mutuel report?

A: A pari-mutuel report provides information on the total amount of wagers and payouts for horse racing or other similar events.

Q: What is the purpose of Form 73A101?

A: The purpose of Form 73A101 is to document and report the historical pari-mutuel information for Kentucky.

Q: Who is required to fill out Form 73A101?

A: Entities involved in horse racing or similar events in Kentucky are required to fill out this form.

Q: What information is included in Form 73A101?

A: Form 73A101 includes details about the total handle (amount wagered), the pari-mutuel tax withheld, and the purses paid out.

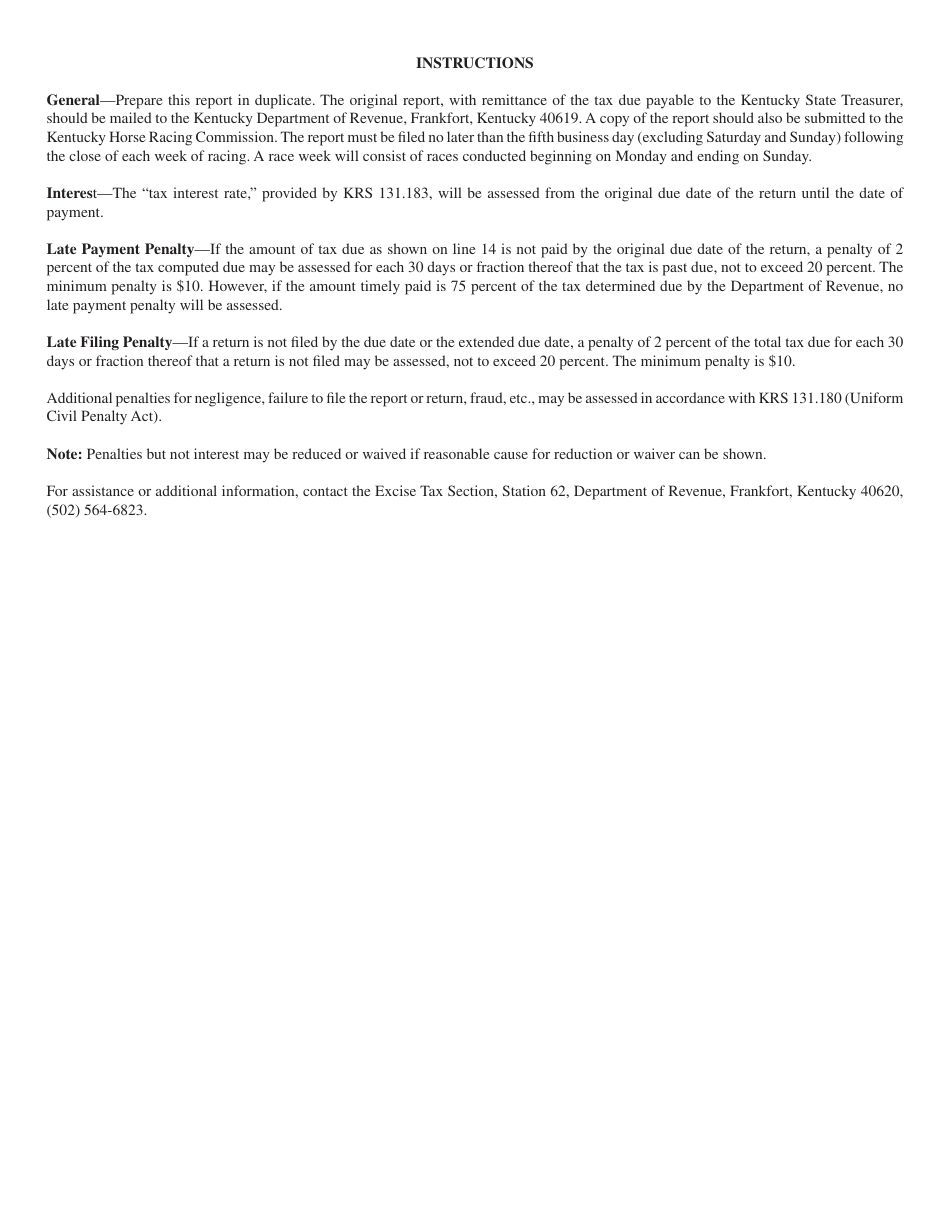

Q: When is Form 73A101 due?

A: The specific due date for Form 73A101 may vary, but it is generally required to be submitted on a monthly basis.

Q: Are there any penalties for not filing Form 73A101?

A: Failure to file Form 73A101 or filing it late may result in penalties or fines imposed by the Kentucky Horse Racing Commission.

Q: Can individuals access the information in Form 73A101?

A: Form 73A101 is primarily for regulatory and reporting purposes, so it may not be readily accessible to the general public.

Form Details:

- Released on June 1, 2015;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 73A101 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.