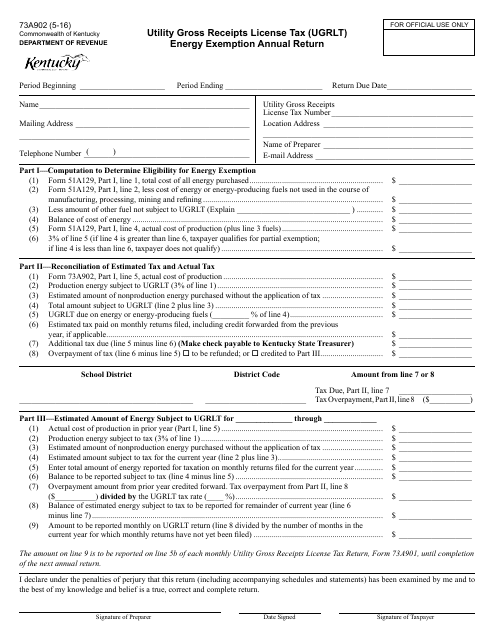

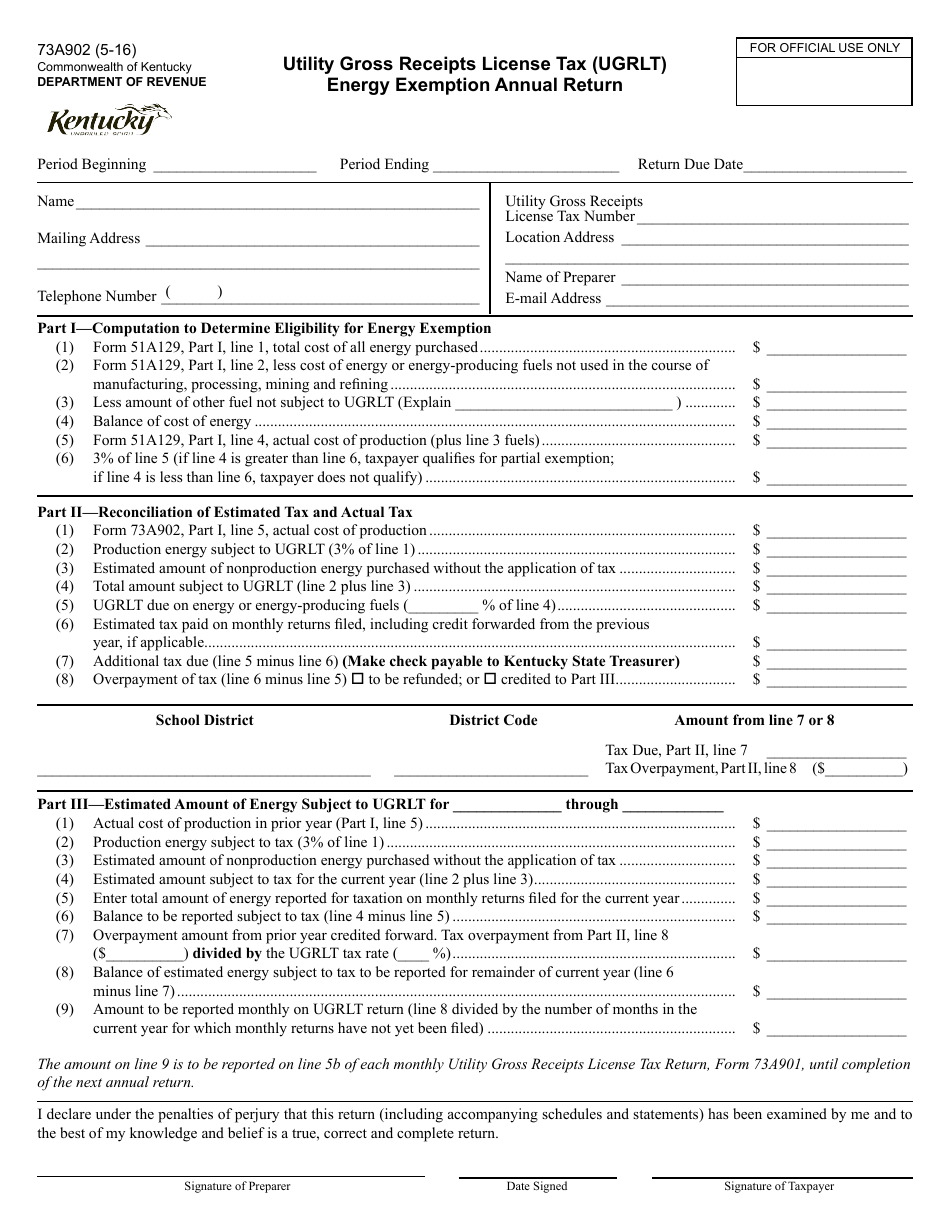

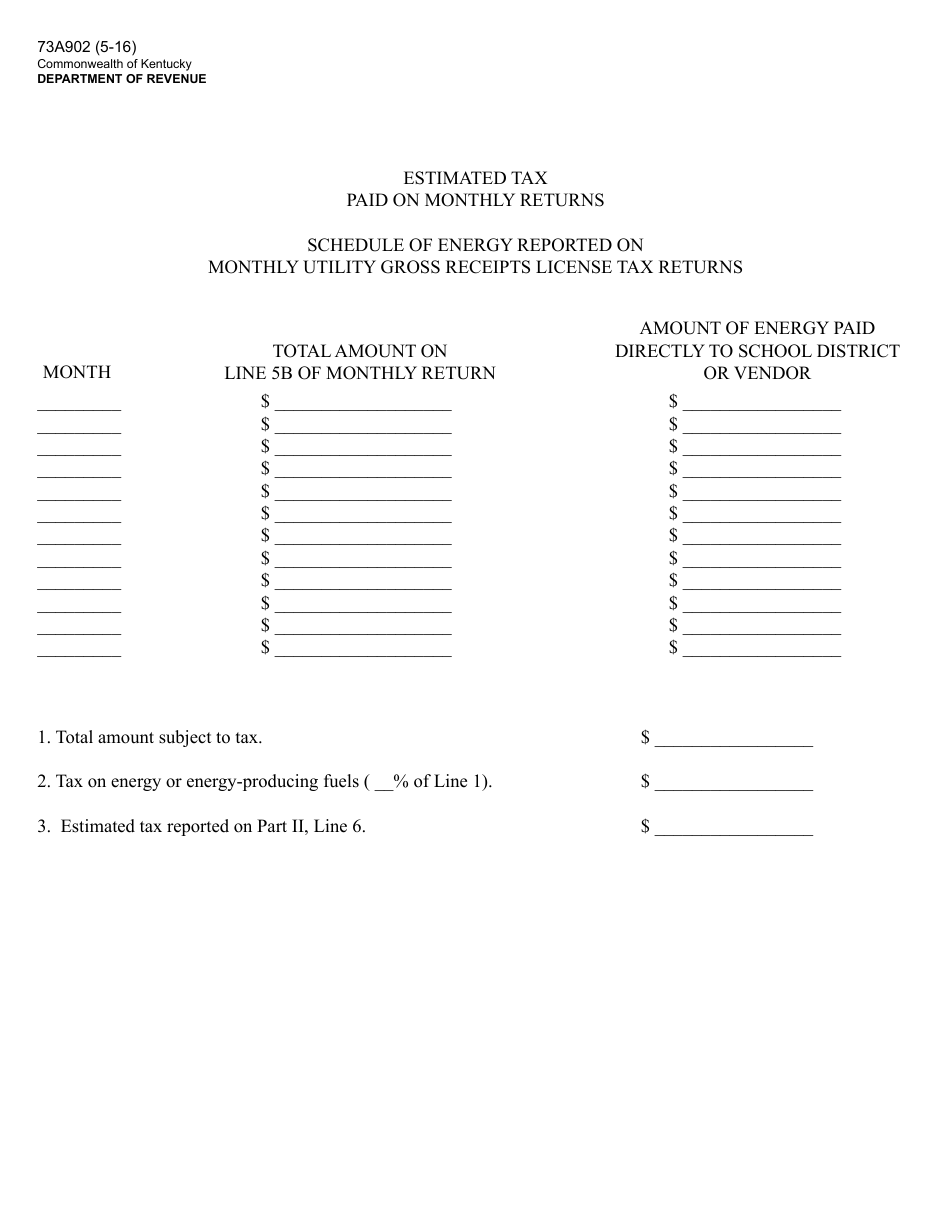

Form 73A902 Utility Gross Receipts License Tax (Ugrlt) Energy Exemption Annual Return - Kentucky

What Is Form 73A902?

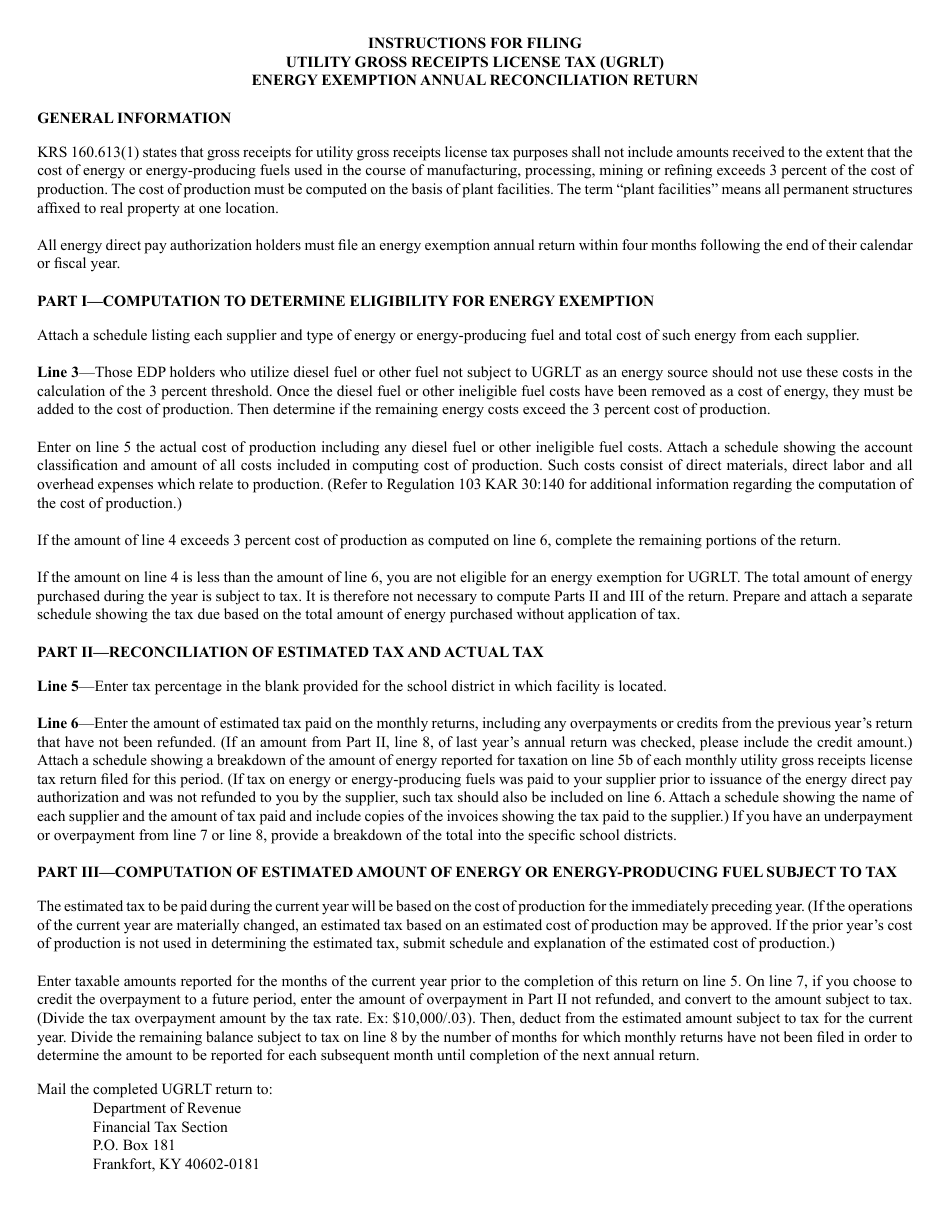

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 73A902?

A: Form 73A902 is the Utility Gross ReceiptsLicense Tax (UGRLT) Energy Exemption Annual Return for Kentucky.

Q: What is the purpose of Form 73A902?

A: The purpose of Form 73A902 is to report and claim an exemption from the Utility Gross Receipts License Tax for energy usage.

Q: Who needs to file Form 73A902?

A: Businesses in Kentucky that qualify for an exemption from the Utility Gross Receipts License Tax for energy usage need to file Form 73A902.

Q: When should Form 73A902 be filed?

A: Form 73A902 should be filed annually by the due date specified by the Kentucky Department of Revenue.

Q: Are there any penalties for not filing Form 73A902?

A: Yes, there may be penalties for failure to file Form 73A902 or for filing late.

Q: Is Form 73A902 specific to Kentucky?

A: Yes, Form 73A902 is specific to Kentucky and is used to report and claim an exemption from the Utility Gross Receipts License Tax for energy usage in the state.

Q: Are there any fees or costs associated with filing Form 73A902?

A: There may be fees or costs associated with filing Form 73A902, depending on the specific situation and the requirements of the Kentucky Department of Revenue.

Q: Can I get help with filing Form 73A902?

A: Yes, the Kentucky Department of Revenue provides assistance and resources for businesses that need help with filing Form 73A902.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 73A902 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.