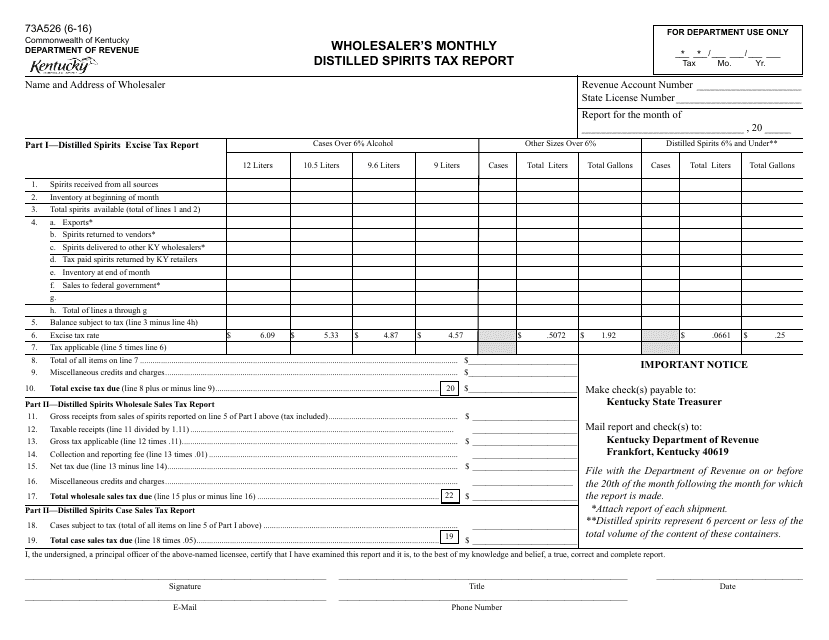

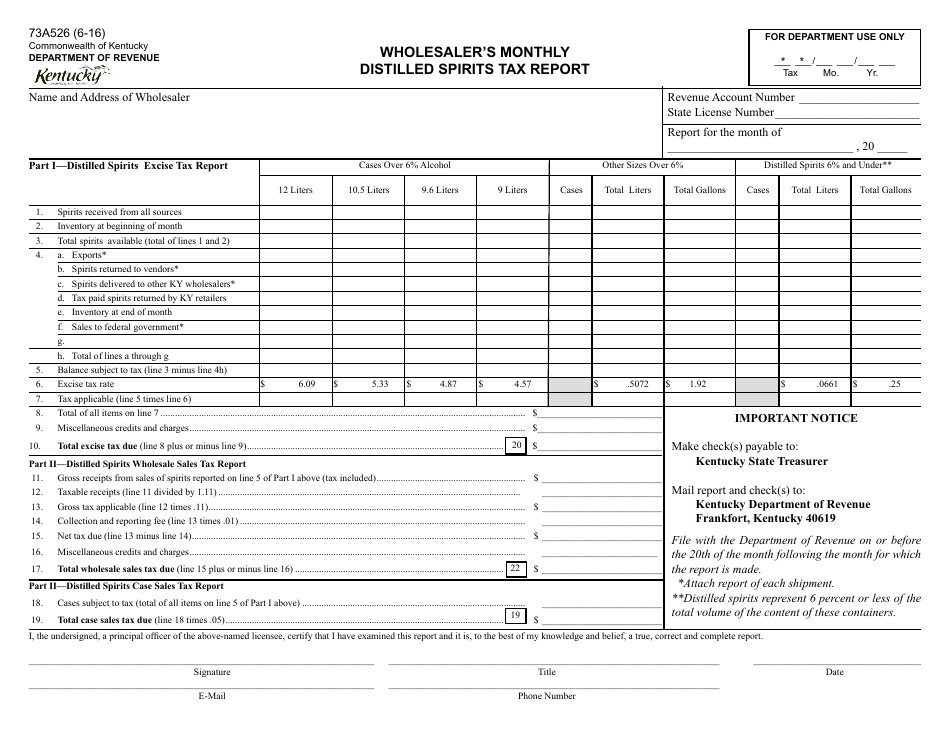

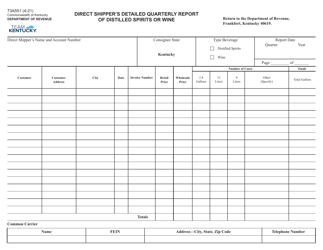

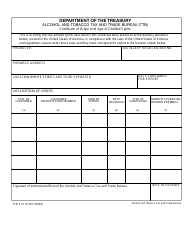

Form 73A526 Wholesaler's Monthly Distilled Spirits Tax Report - Kentucky

What Is Form 73A526?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 73A526?

A: Form 73A526 is the Wholesaler's Monthly Distilled SpiritsTax Report in Kentucky.

Q: Who needs to file Form 73A526?

A: Wholesalers of distilled spirits in Kentucky need to file Form 73A526.

Q: What is the purpose of Form 73A526?

A: The purpose of Form 73A526 is to report and pay the monthly distilled spirits tax in Kentucky.

Q: When is Form 73A526 due?

A: Form 73A526 is due on the 20th day of the month following the reporting period.

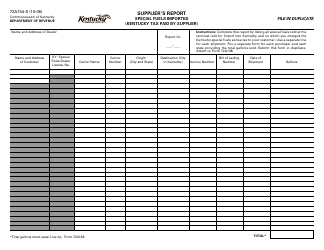

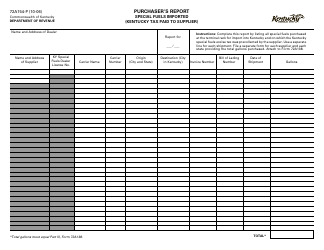

Q: What information do I need to complete Form 73A526?

A: You will need to provide information about your distilled spirits sales and calculate the tax owed.

Q: Are there any penalties for late filing of Form 73A526?

A: Yes, there can be penalties for late filing or non-payment of the distilled spirits tax.

Q: Is Form 73A526 specific to Kentucky?

A: Yes, Form 73A526 is specific to the state of Kentucky.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 73A526 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.