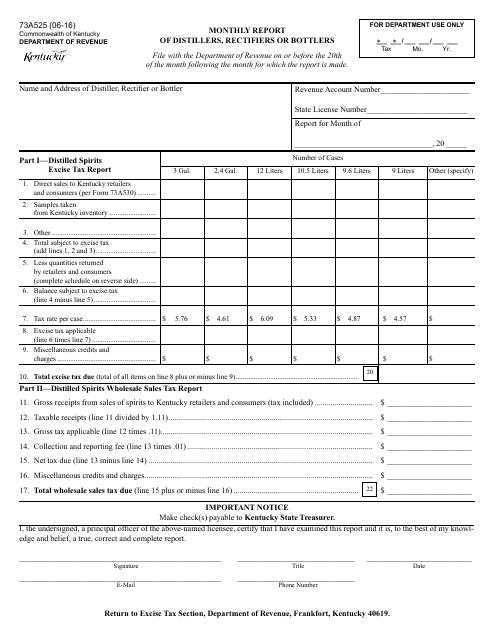

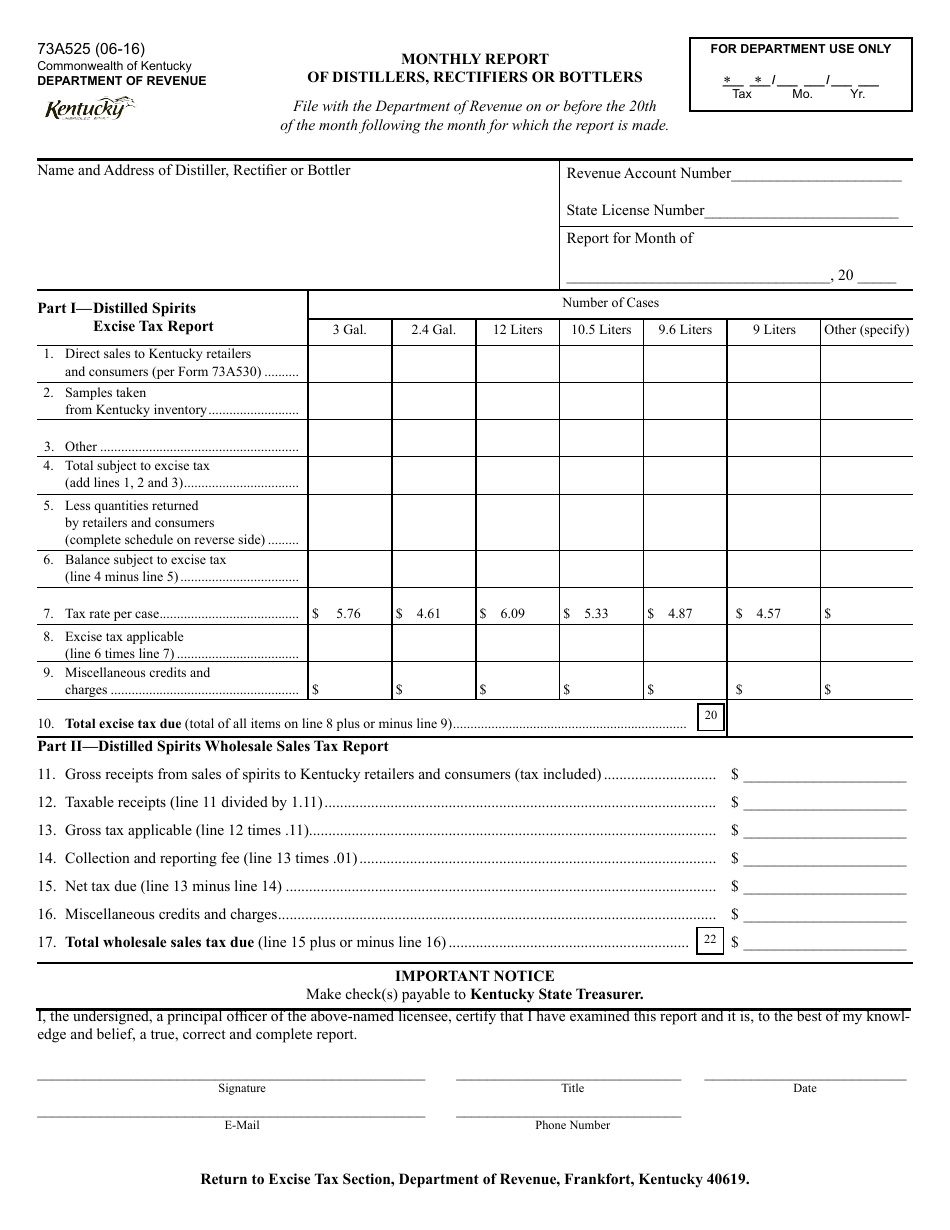

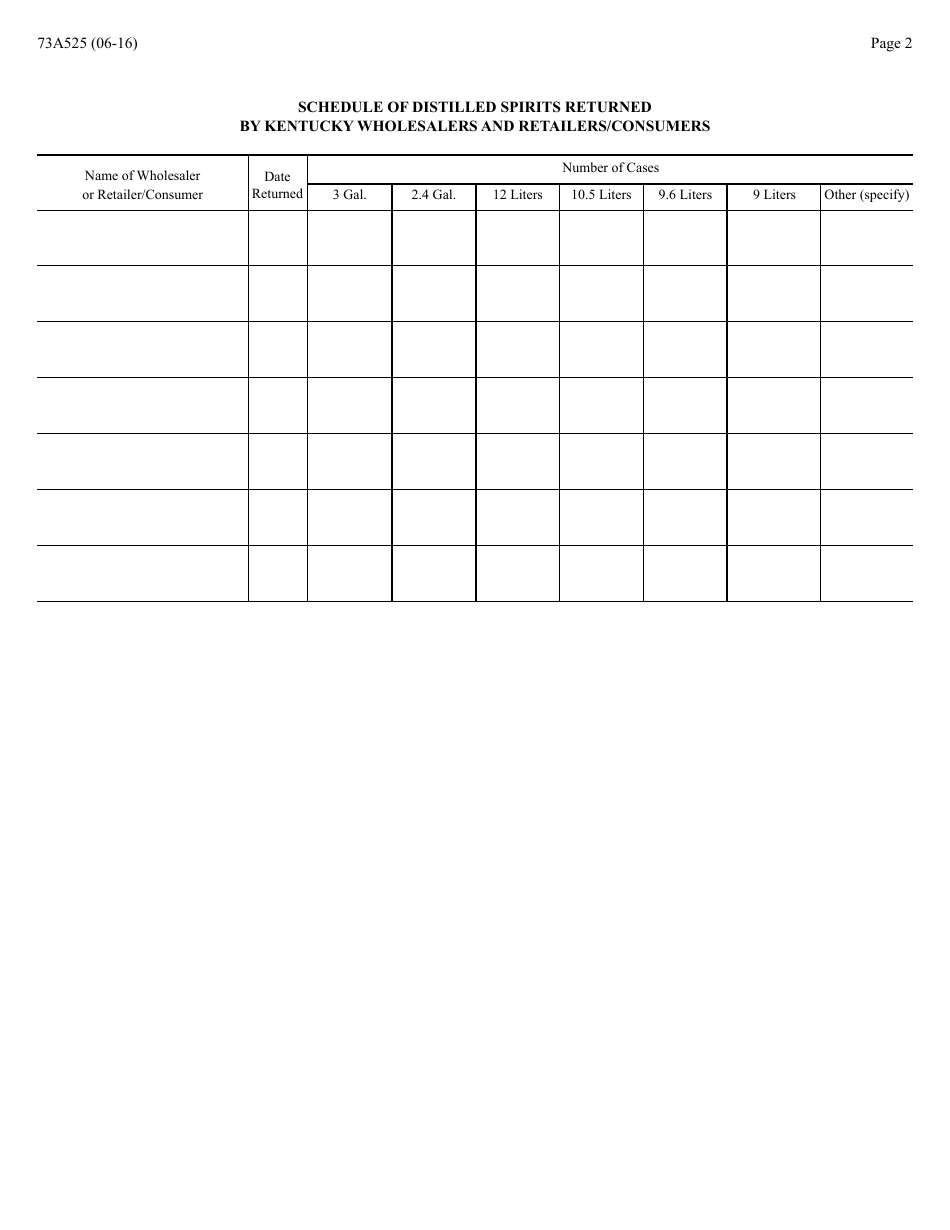

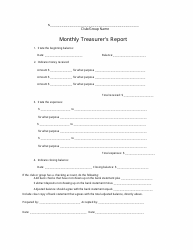

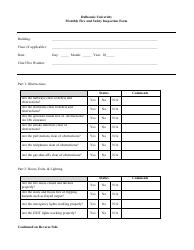

Form 73A525 Monthly Report of Distillers, Rectifiers or Bottlers - Kentucky

What Is Form 73A525?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 73A525?

A: Form 73A525 is a monthly report specifically for distillers, rectifiers, or bottlers in Kentucky.

Q: Who needs to file Form 73A525?

A: Distillers, rectifiers, or bottlers in Kentucky need to file Form 73A525.

Q: What is the purpose of Form 73A525?

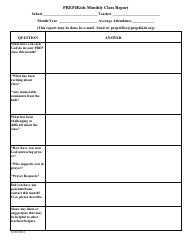

A: The purpose of Form 73A525 is to report the activities and production of distillers, rectifiers, or bottlers in Kentucky on a monthly basis.

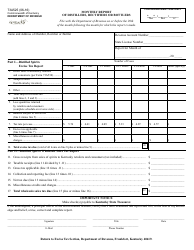

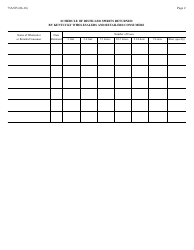

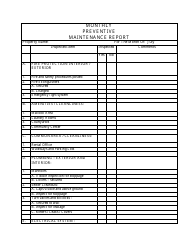

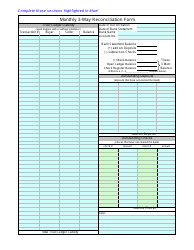

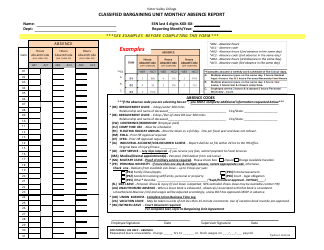

Q: What information needs to be included in Form 73A525?

A: Form 73A525 requires distillers, rectifiers, or bottlers to provide information such as the quantity and type of alcoholic beverages produced or sold, storage capacity, and inventory.

Q: What is the deadline for filing Form 73A525?

A: The deadline for filing Form 73A525 is typically the 15th day of the following month.

Q: Is Form 73A525 specific to Kentucky?

A: Yes, Form 73A525 is specific to distillers, rectifiers, or bottlers in Kentucky.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 73A525 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.