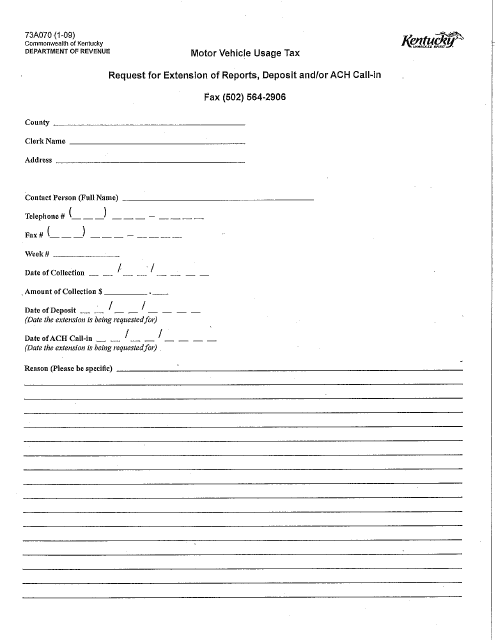

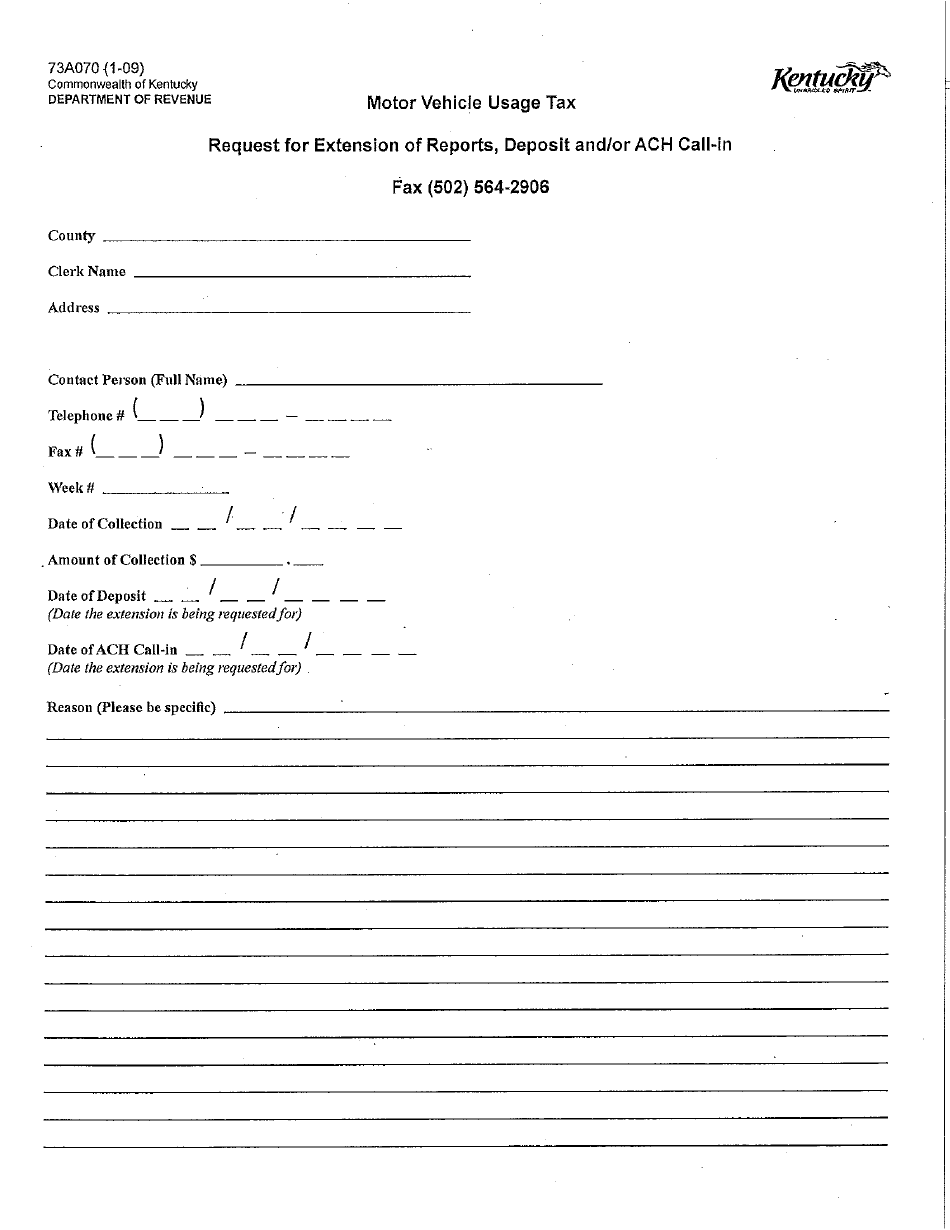

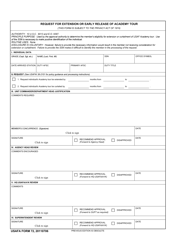

Form 73A070 Request for Extension of Reports, Deposit and / or ACH Call-In - Kentucky

What Is Form 73A070?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 73A070?

A: Form 73A070 is the Request for Extension of Reports, Deposit and/or ACH Call-In form for Kentucky.

Q: What is the purpose of Form 73A070?

A: The purpose of Form 73A070 is to request an extension for submitting reports, making deposits, and/or calling in ACH payments in Kentucky.

Q: Who needs to fill out Form 73A070?

A: Anyone who needs an extension for filing reports, making deposits, and/or calling in ACH payments in Kentucky needs to fill out Form 73A070.

Q: Can I request an extension for multiple types of reports and payments on one Form 73A070?

A: Yes, you can request an extension for multiple types of reports and payments on one Form 73A070.

Q: What information do I need to provide on Form 73A070?

A: You will need to provide your contact information, your taxpayer identification number, the type of report/payment you are requesting an extension for, the reason for the extension, and the requested extension date on Form 73A070.

Form Details:

- Released on January 1, 2009;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 73A070 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.