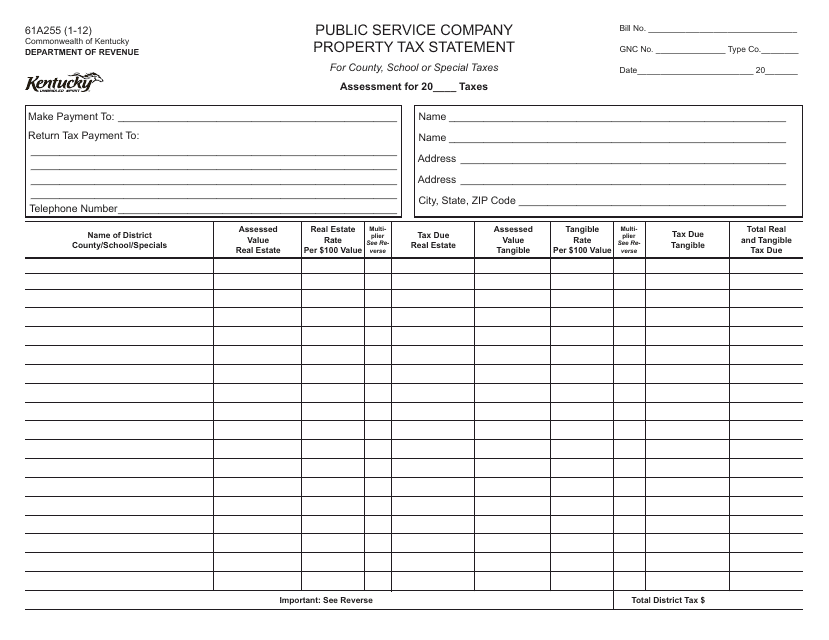

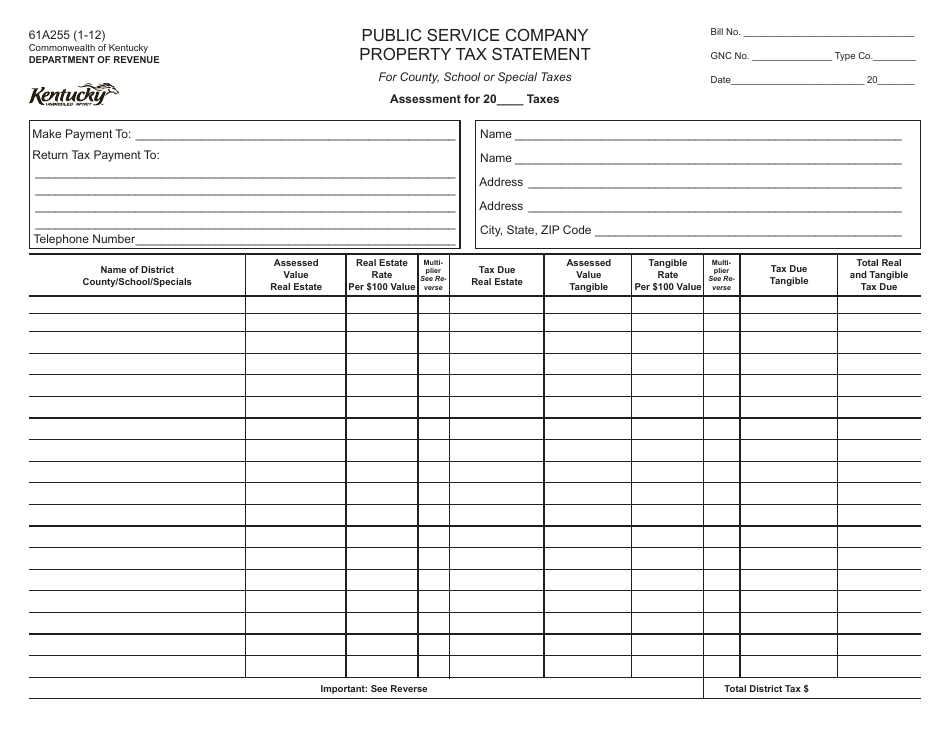

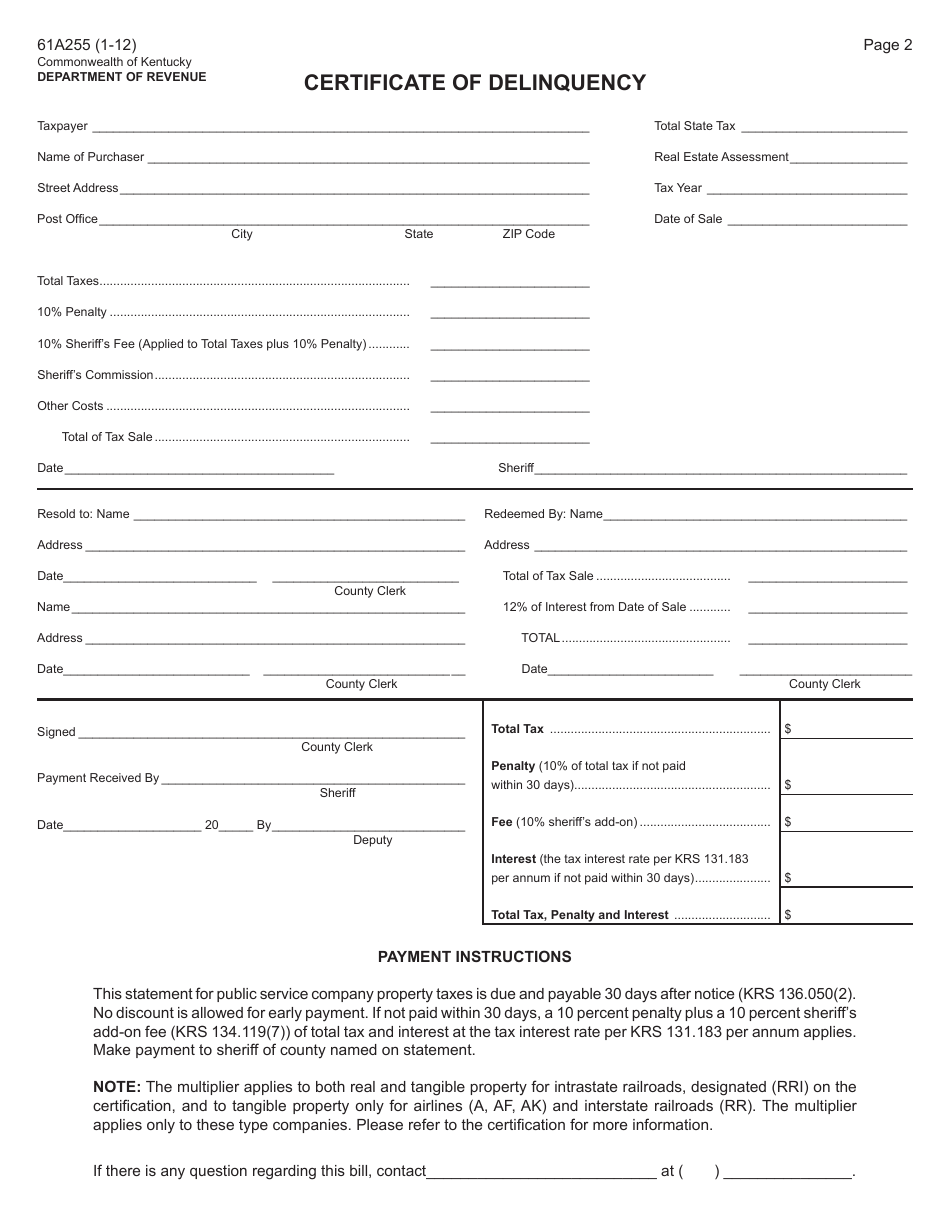

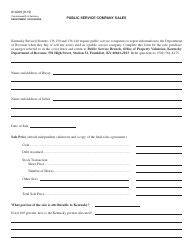

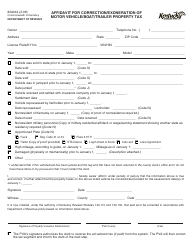

Form 61A255 Public Service Company Property Tax Statement - Kentucky

What Is Form 61A255?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 61A255?

A: Form 61A255 is the Public Service CompanyProperty Tax Statement for Kentucky.

Q: Who needs to file Form 61A255?

A: Public service companies in Kentucky that own property subject to property tax need to file Form 61A255.

Q: What is the purpose of Form 61A255?

A: Form 61A255 is used to report the value of public service company property for property tax assessment purposes.

Q: When is Form 61A255 due?

A: Form 61A255 is due annually on May 15th.

Q: Is there a penalty for late filing of Form 61A255?

A: Yes, there is a penalty for late filing of Form 61A255. The penalty amount varies depending on the number of days past the due date.

Form Details:

- Released on January 1, 2012;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 61A255 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.