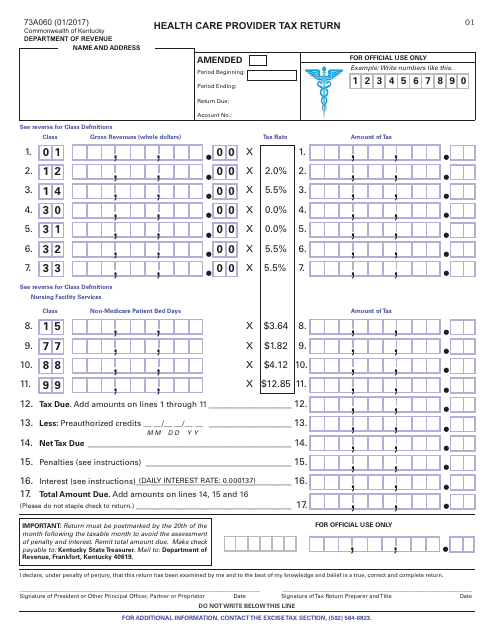

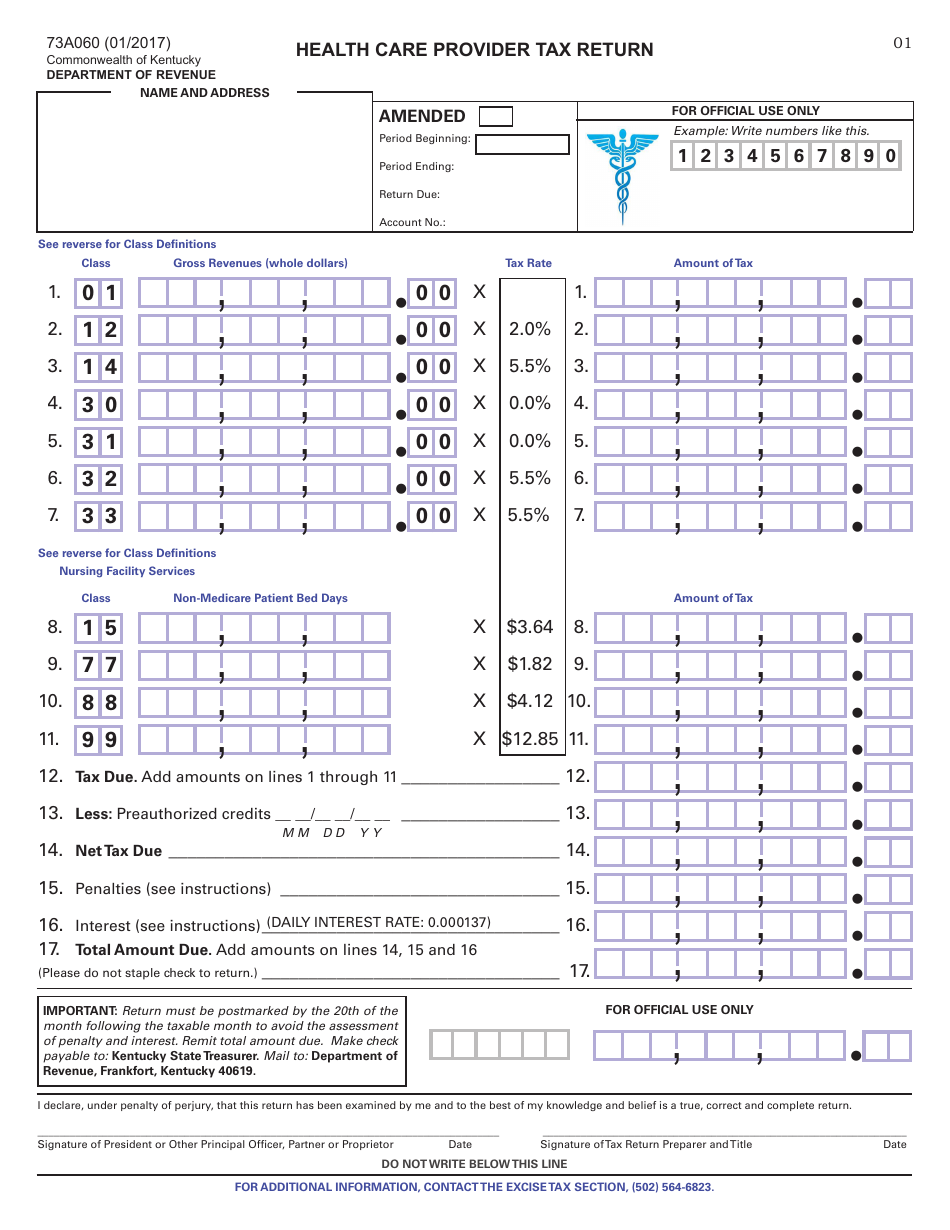

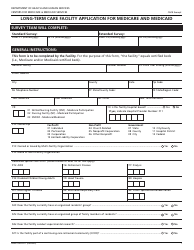

Form 73A060 Health Care Provider Tax Return - Kentucky

What Is Form 73A060?

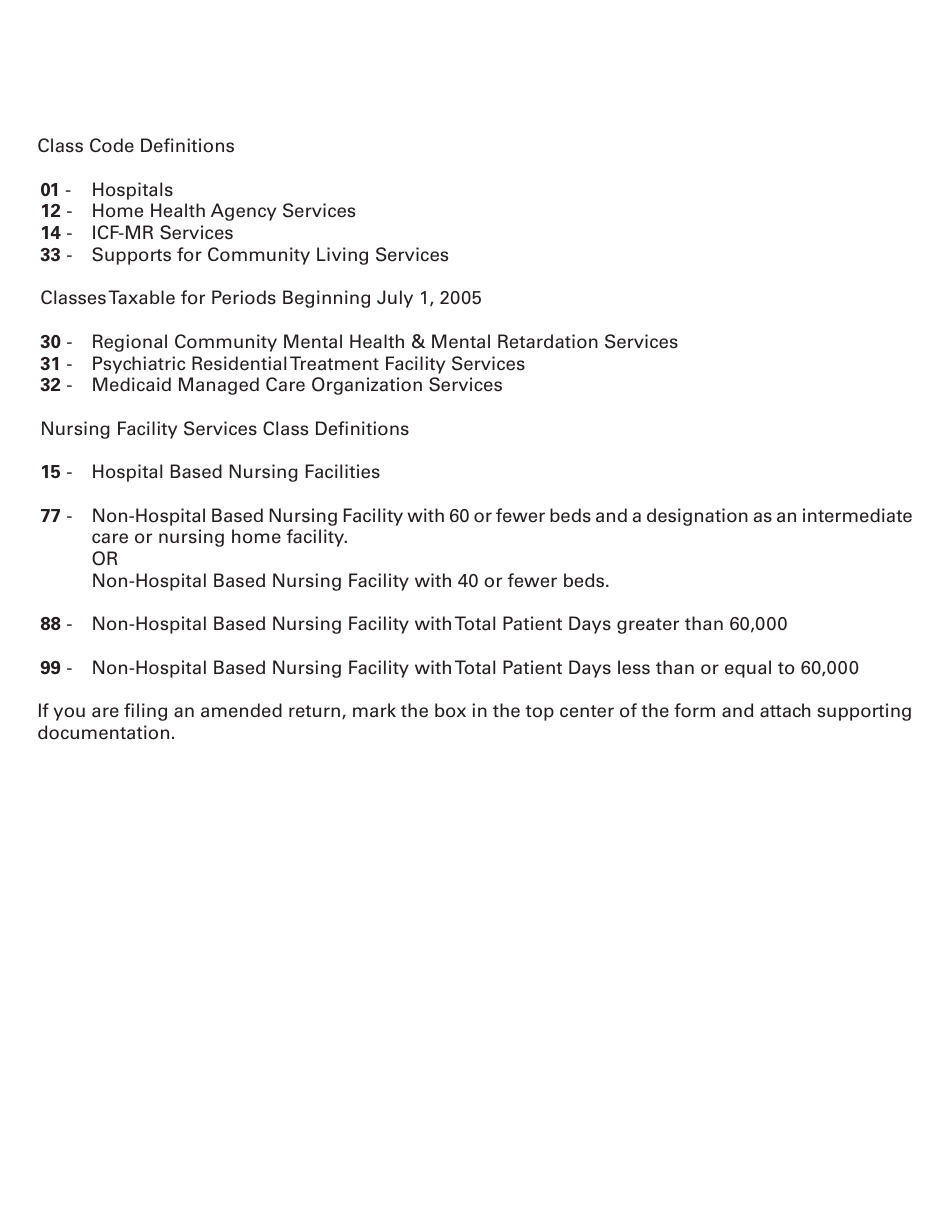

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 73A060?

A: Form 73A060 is the Health Care Provider Tax Return specific to the state of Kentucky.

Q: Who needs to file Form 73A060?

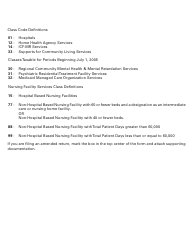

A: Health care providers in Kentucky who are subject to the provider tax need to file Form 73A060.

Q: What is the purpose of Form 73A060?

A: The purpose of Form 73A060 is to report and remit the provider tax imposed on health care providers in Kentucky.

Q: How often do I need to file Form 73A060?

A: Form 73A060 is filed quarterly, meaning it needs to be filed four times a year.

Q: What information is required on Form 73A060?

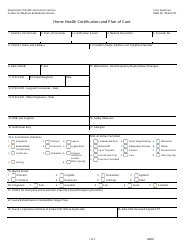

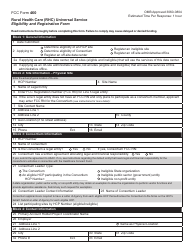

A: Form 73A060 requires the health care provider's identification information, total patient service revenue, and the calculation of the provider tax liability.

Q: Are there any penalties for not filing Form 73A060?

A: Yes, there are penalties for not filing Form 73A060, including potential fines and interest on the unpaid provider tax.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 73A060 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.