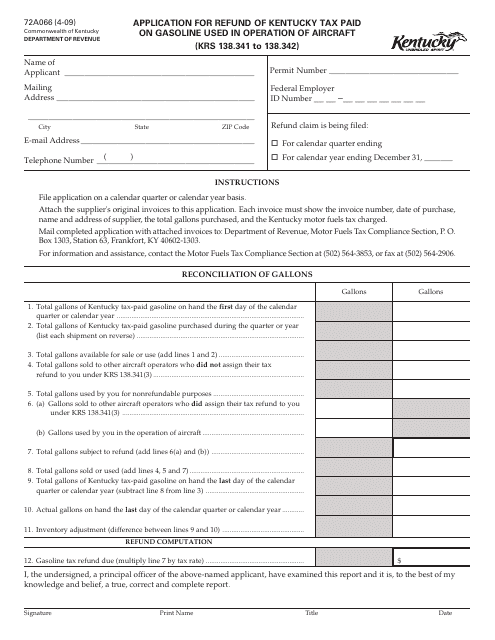

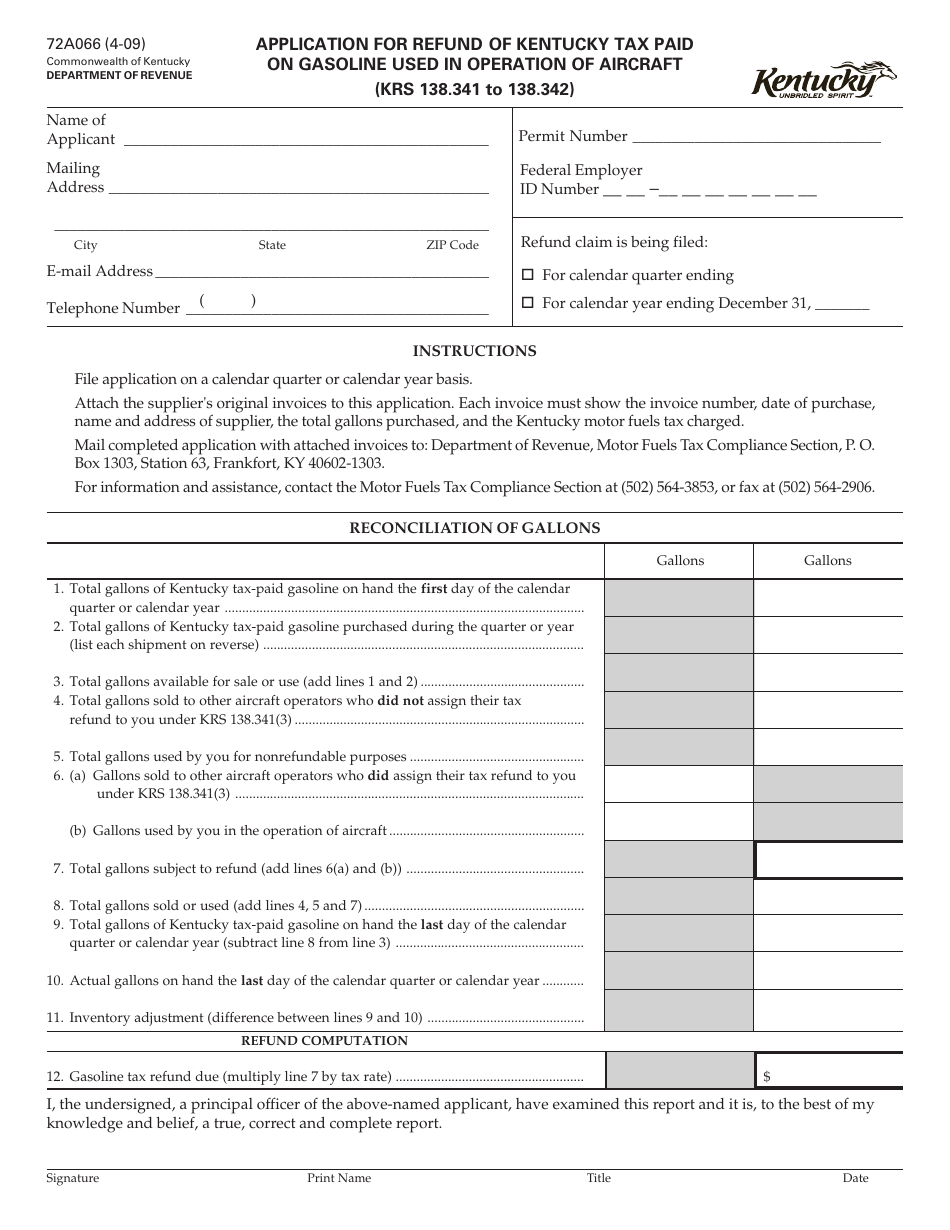

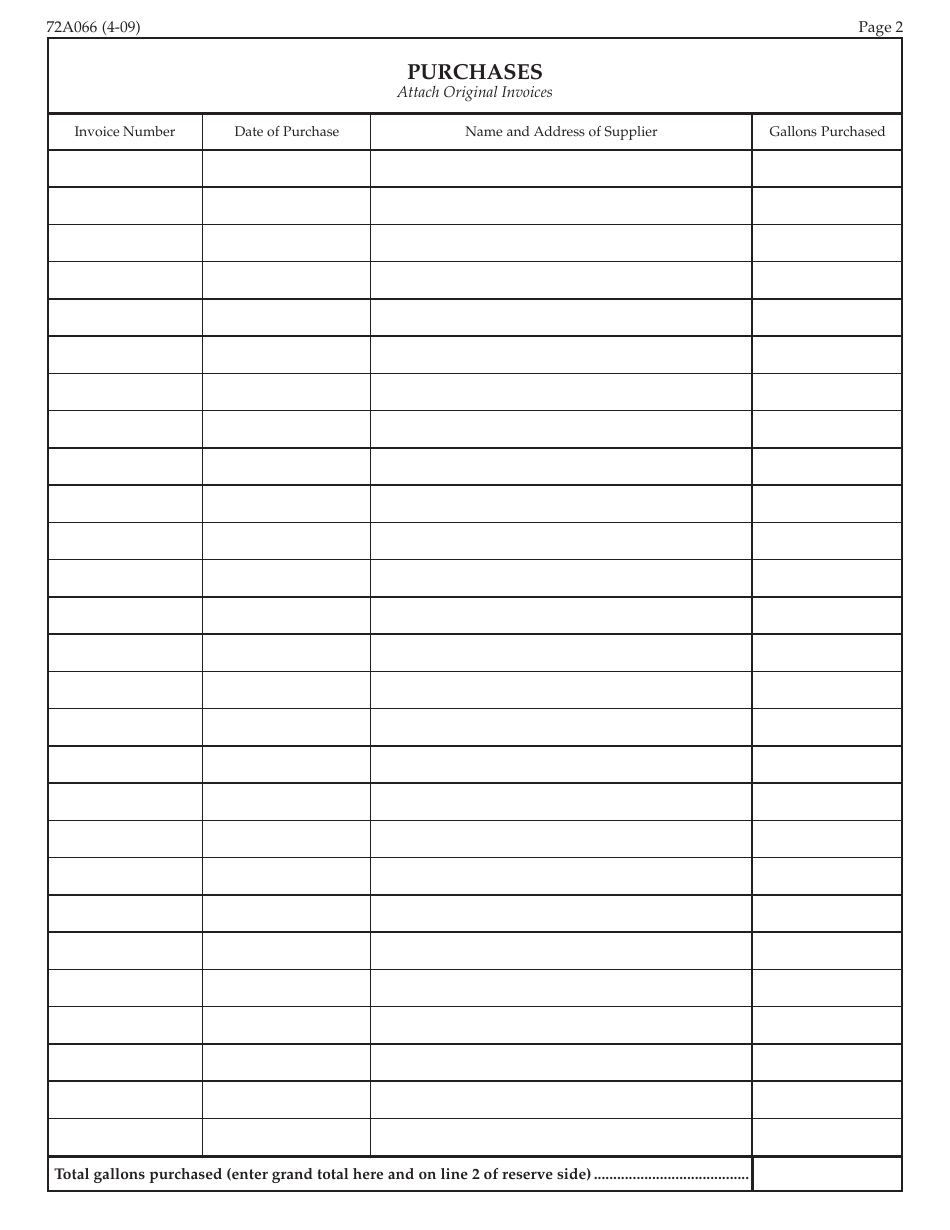

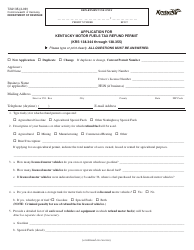

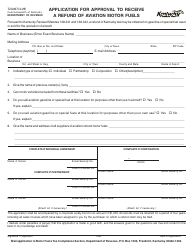

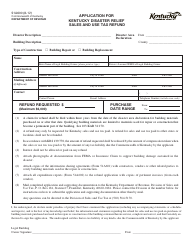

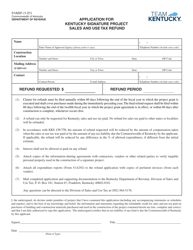

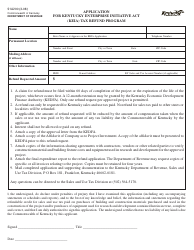

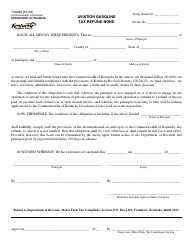

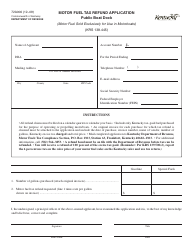

Form 72A066 Application for Refund of Kentucky Tax Paid on Gasoline Used in Operation of Aircraft - Kentucky

What Is Form 72A066?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A066?

A: Form 72A066 is the Application for Refund of Kentucky Tax Paid on Gasoline Used in Operation of Aircraft in Kentucky.

Q: Who can use Form 72A066?

A: This form can be used by individuals and businesses who have paid Kentucky tax on gasoline used in the operation of aircraft.

Q: What is the purpose of Form 72A066?

A: The purpose of this form is to request a refund of the Kentucky tax paid on gasoline used in the operation of aircraft.

Q: How to complete Form 72A066?

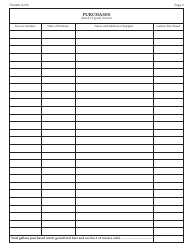

A: You will need to provide information about the aircraft, the amount of gasoline used, and the amount of Kentucky tax paid. You must also attach supporting documentation.

Form Details:

- Released on April 1, 2009;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A066 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.