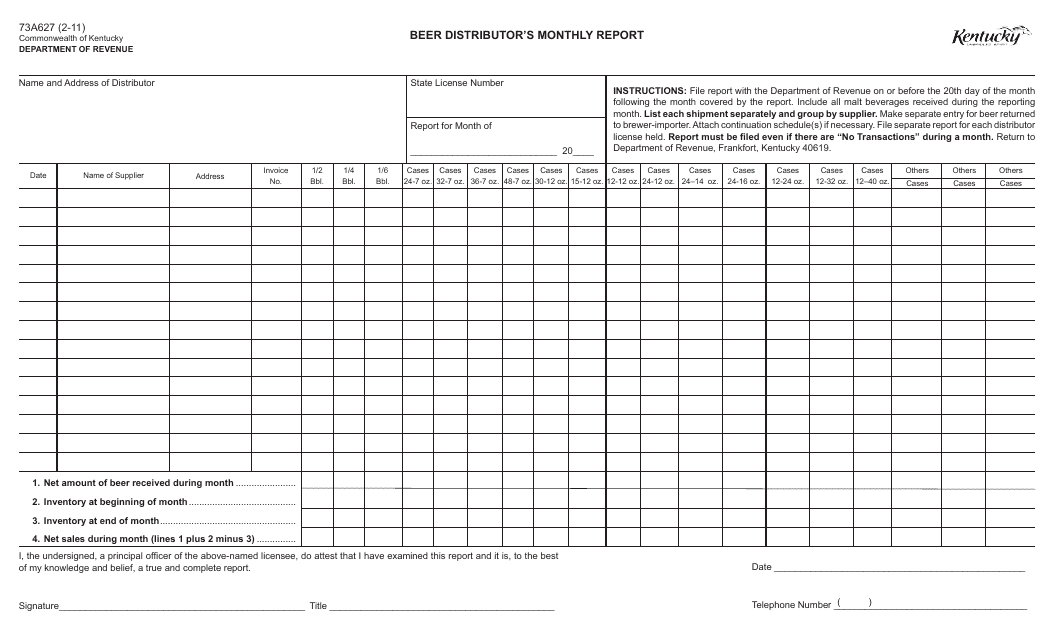

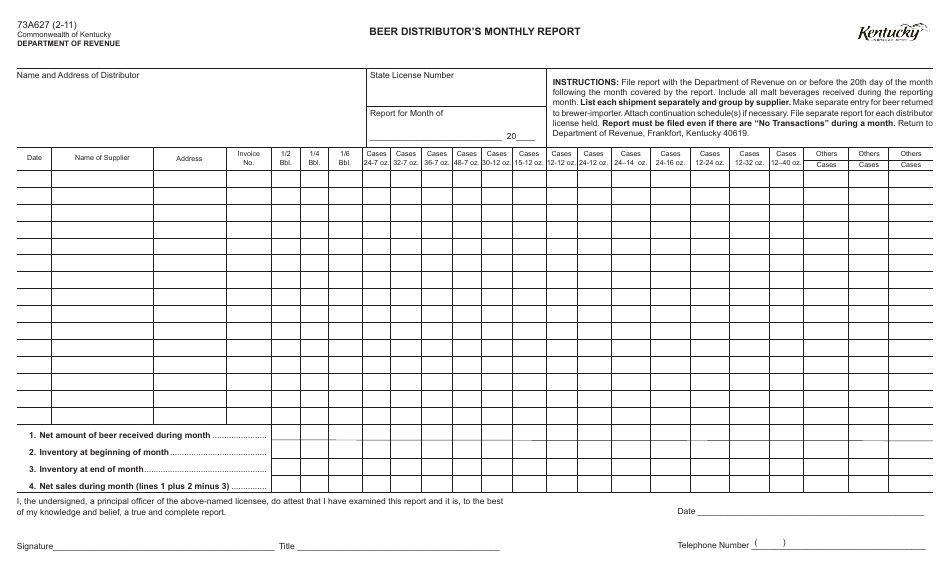

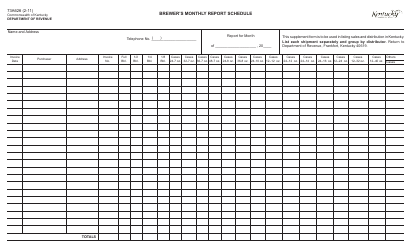

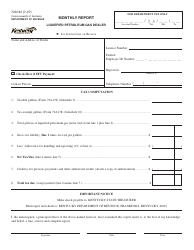

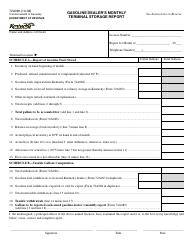

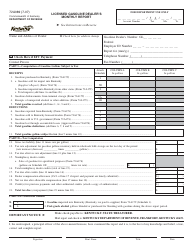

Form 73A627 Beer Distributor's Monthly Report - Kentucky

What Is Form 73A627?

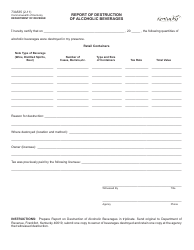

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 73A627?

A: Form 73A627 is the Beer Distributor's Monthly Report in Kentucky.

Q: Who needs to complete Form 73A627?

A: Beer distributors in Kentucky need to complete Form 73A627.

Q: What information is required on Form 73A627?

A: Form 73A627 requires information related to beer sales and distributions, including quantities sold and taxes due.

Q: How often should Form 73A627 be filed?

A: Form 73A627 should be filed monthly.

Q: What happens if Form 73A627 is not filed?

A: Failure to file Form 73A627 may result in penalties and fines for beer distributors in Kentucky.

Q: Are there any additional requirements for beer distributors in Kentucky?

A: Yes, beer distributors in Kentucky may have additional reporting and licensing requirements to comply with state regulations.

Form Details:

- Released on February 1, 2011;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 73A627 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.