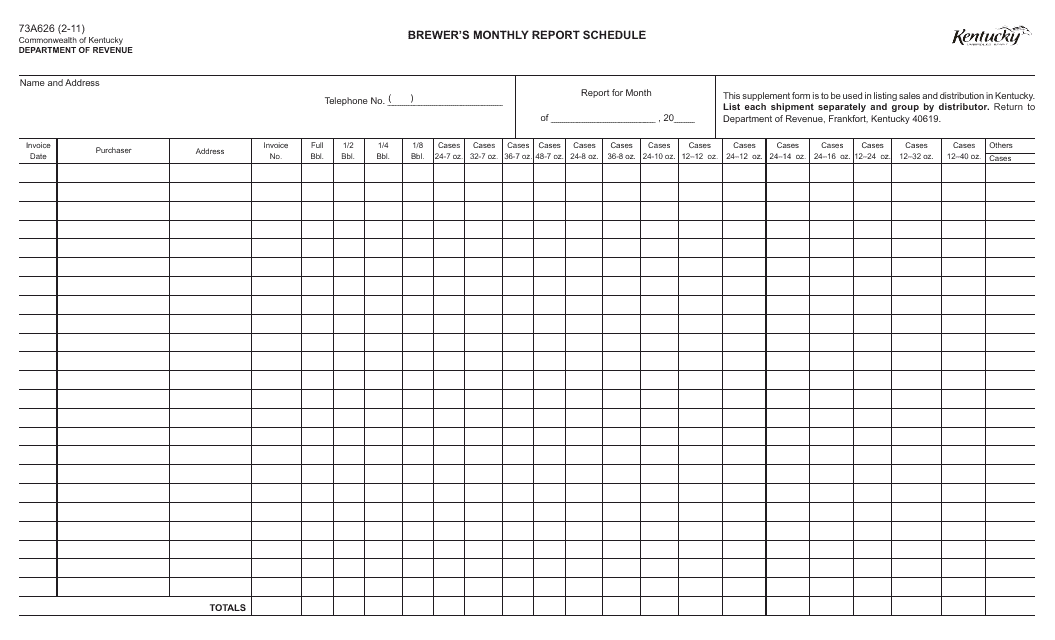

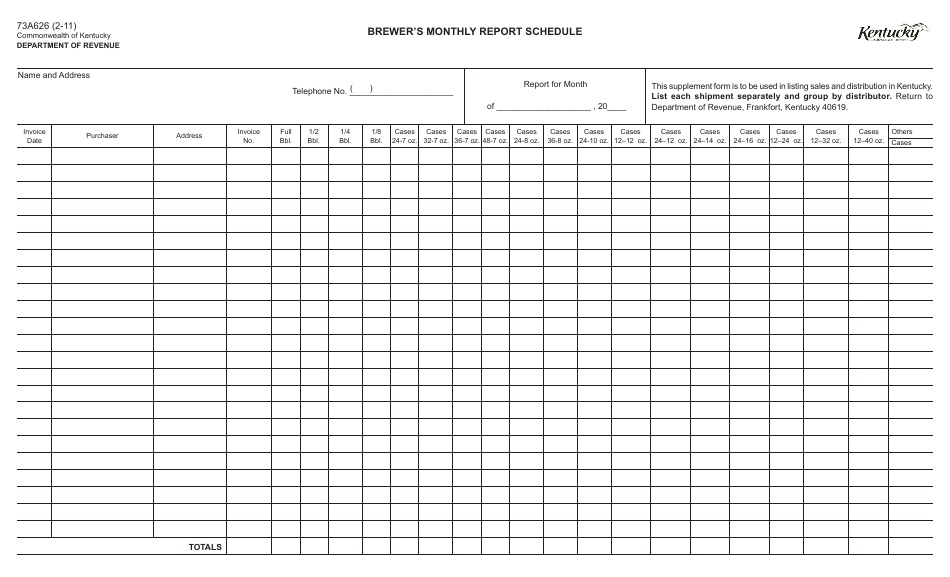

Form 73A626 Brewer's Monthly Report Schedule - Kentucky

What Is Form 73A626?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 73A626?

A: Form 73A626 is the Brewer's Monthly Report Schedule used in Kentucky.

Q: Who needs to file Form 73A626?

A: Brewers in Kentucky need to file Form 73A626.

Q: What is the purpose of Form 73A626?

A: Form 73A626 is used to report monthly beer production and sales for brewers in Kentucky.

Q: When is Form 73A626 due?

A: Form 73A626 is typically due on the 10th day of the following month.

Q: Are there any penalties for not filing Form 73A626?

A: Yes, failure to file Form 73A626 or filing it late may result in penalties and/or interest charges.

Q: Is Form 73A626 specific to Kentucky?

A: Yes, Form 73A626 is specific to brewers in Kentucky and is not used in other states.

Q: Are there any additional requirements for brewers in Kentucky?

A: Yes, brewers in Kentucky are also required to obtain appropriate licenses and pay taxes on their beer production and sales.

Form Details:

- Released on February 1, 2011;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 73A626 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.