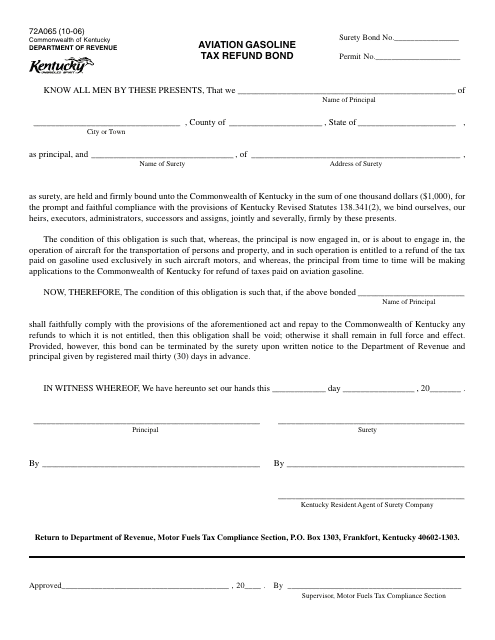

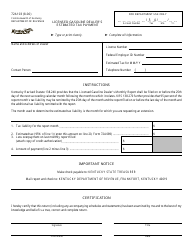

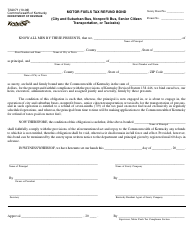

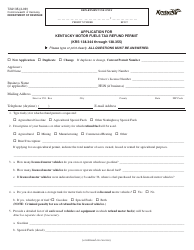

Form 72A065 Aviation Gasoline Tax Refund Bond - Kentucky

What Is Form 72A065?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A065?

A: Form 72A065 is the Aviation Gasoline Tax Refund Bond specific to the state of Kentucky.

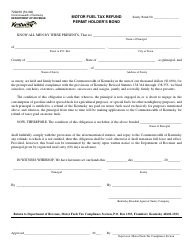

Q: What is the purpose of Form 72A065?

A: The purpose of Form 72A065 is to request a refund of aviation gasoline taxes in Kentucky.

Q: Who needs to file Form 72A065?

A: Anyone who wants to claim a refund of aviation gasoline taxes in Kentucky needs to file Form 72A065.

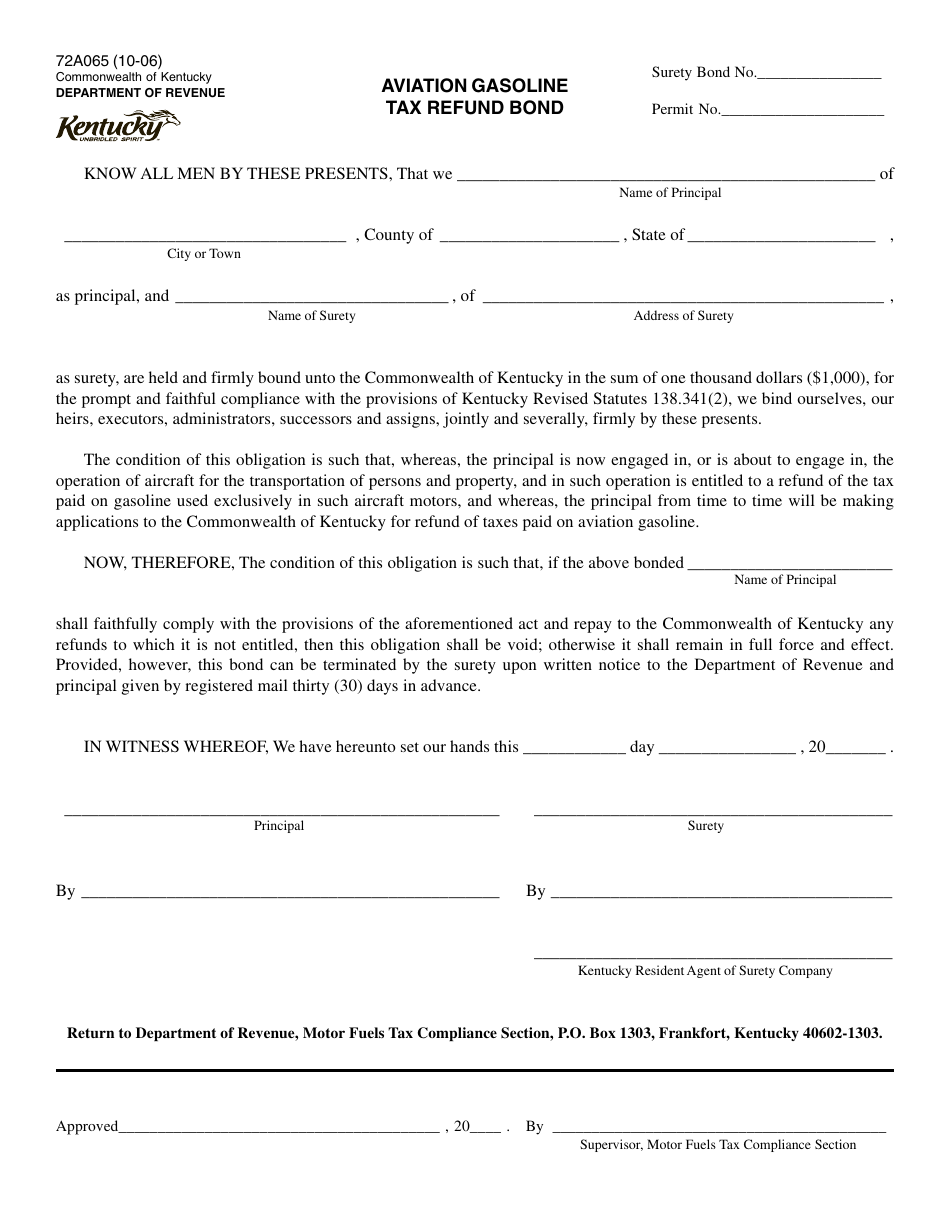

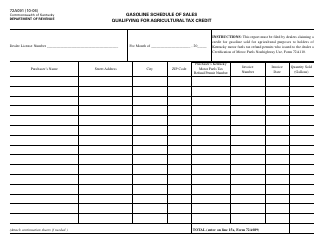

Q: What information is required on Form 72A065?

A: Form 72A065 requires information such as taxpayer identification, amount of aviation gasoline used, and supporting documentation.

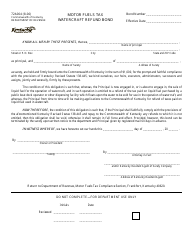

Q: When is Form 72A065 due?

A: Form 72A065 is due on a quarterly basis, with specific due dates mentioned on the form.

Q: How long does it take to process a refund request using Form 72A065?

A: The processing time for a refund request using Form 72A065 may vary, but it generally takes a few weeks to a few months.

Q: Can I e-file Form 72A065?

A: No, currently the Kentucky Department of Revenue does not offer the option to e-file Form 72A065. It must be filed by mail.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A065 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.