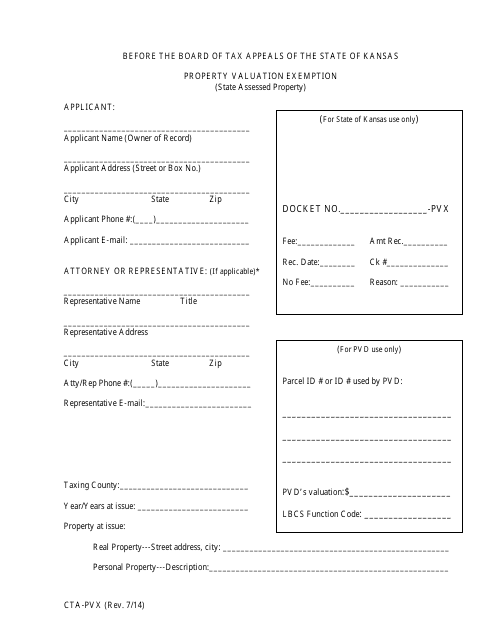

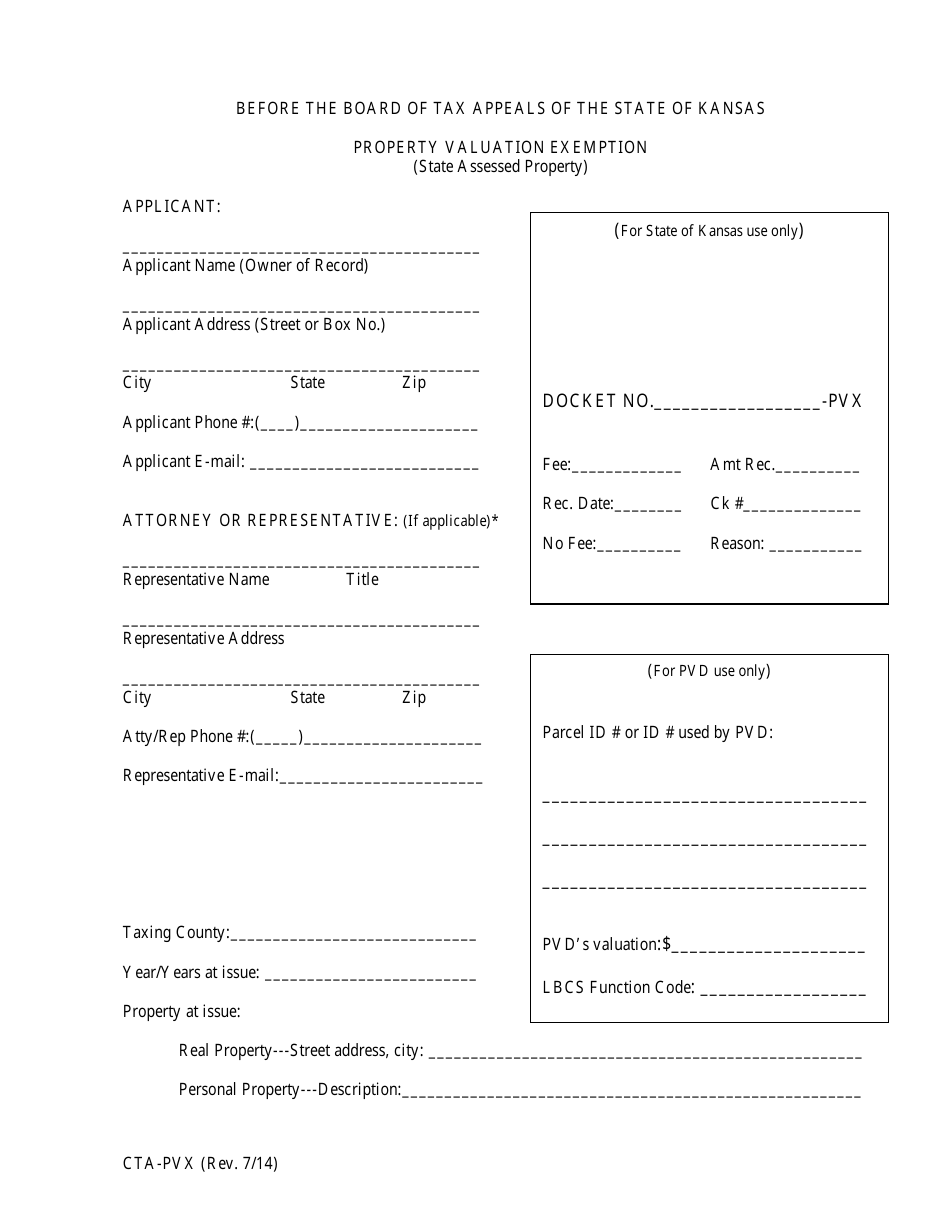

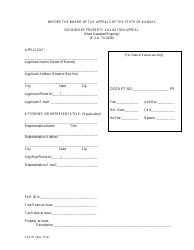

Form CTA-PVX Property Valuation Exemption - Kansas

What Is Form CTA-PVX?

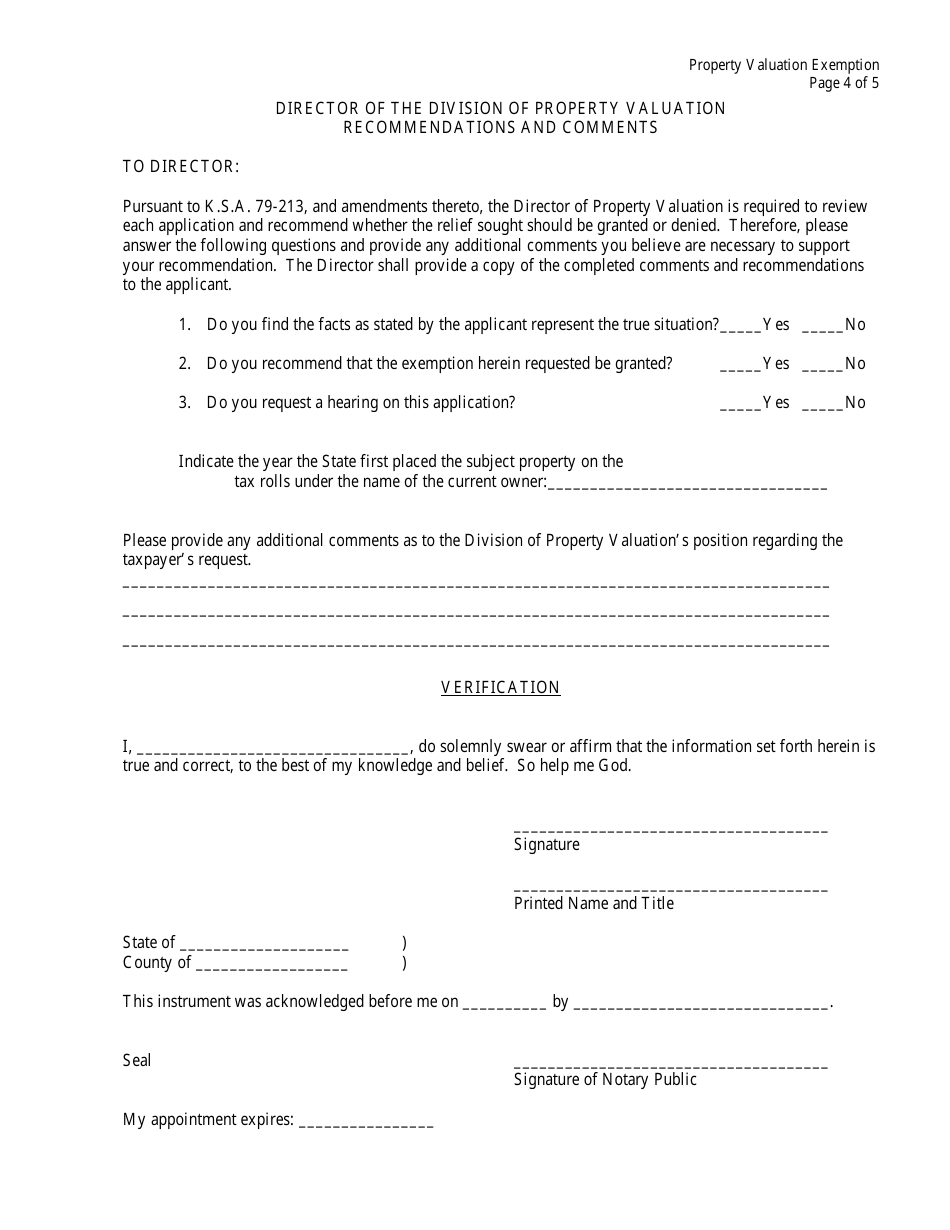

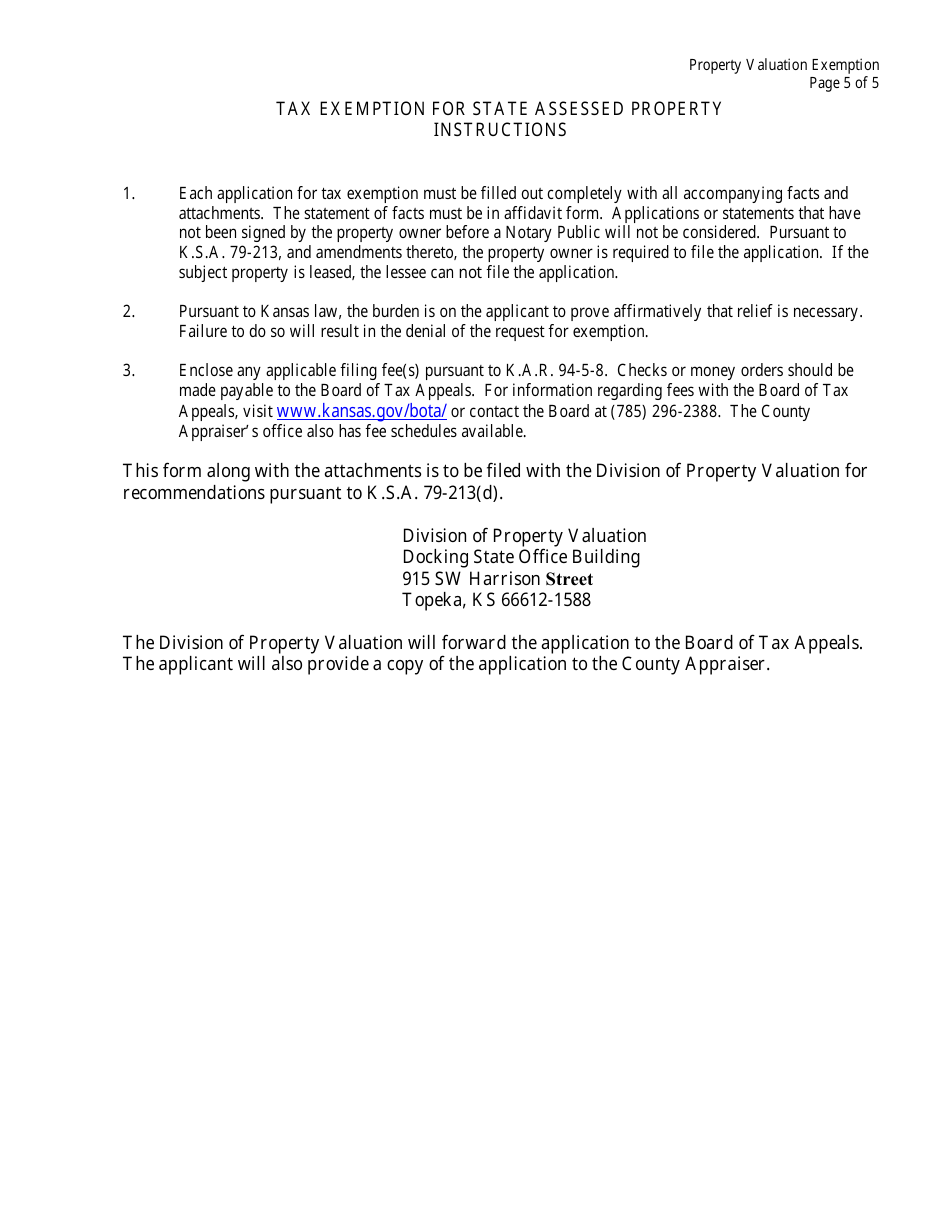

This is a legal form that was released by the Kansas Board of Tax Appeals - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

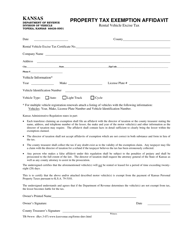

Q: What is the CTA-PVX Property Valuation Exemption?

A: The CTA-PVX Property Valuation Exemption is a program in Kansas that allows eligible properties to be exempt from certain property taxes.

Q: Who is eligible for the CTA-PVX Property Valuation Exemption?

A: Properties that are used for business, commercial, industrial, or residential purposes may be eligible for the CTA-PVX Property Valuation Exemption. There are specific criteria that must be met.

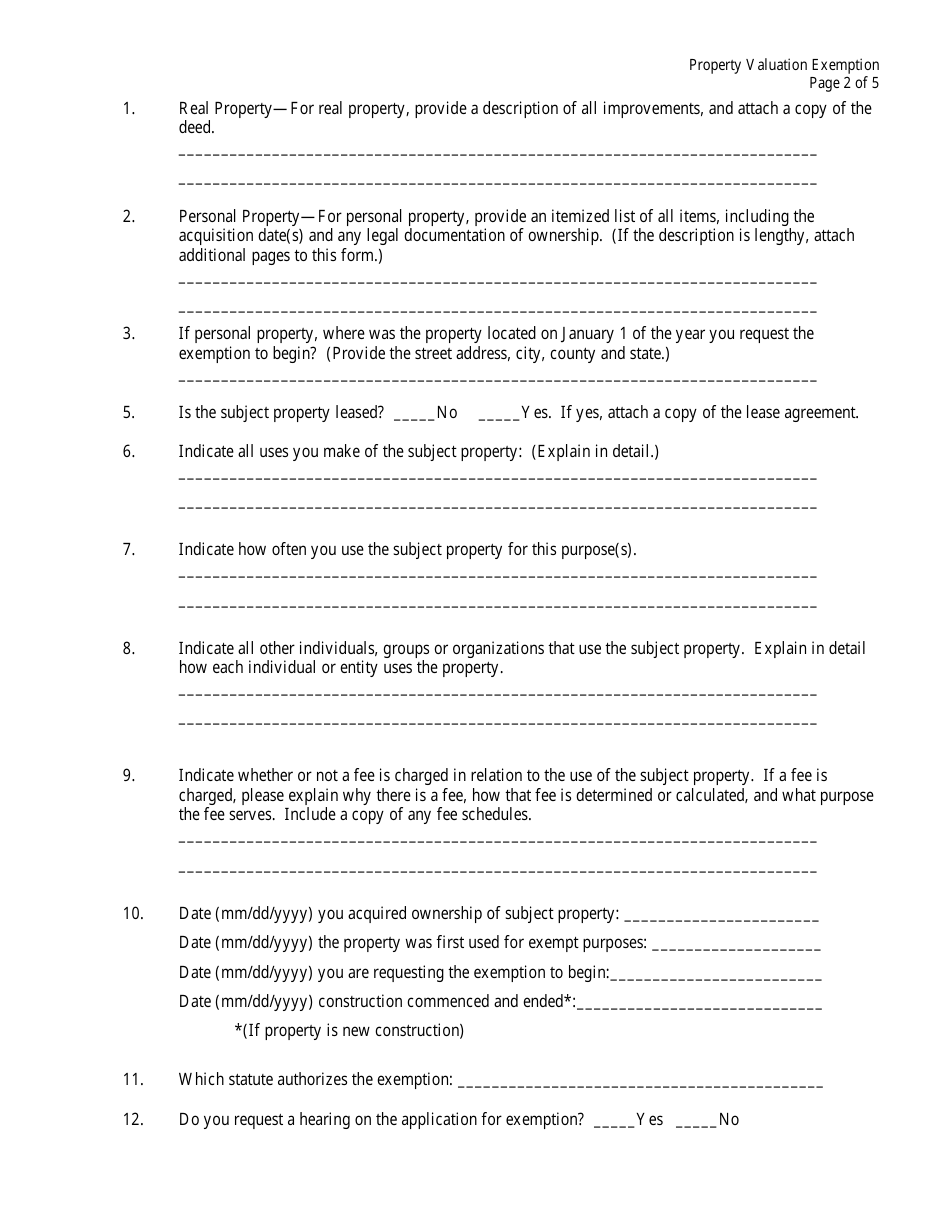

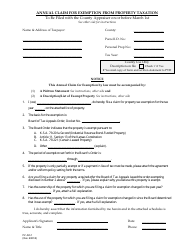

Q: How do I apply for the CTA-PVX Property Valuation Exemption?

A: To apply for the CTA-PVX Property Valuation Exemption, you will need to complete the application form and submit it to the county appraiser's office where the property is located.

Q: What are the benefits of the CTA-PVX Property Valuation Exemption?

A: The main benefit of the CTA-PVX Property Valuation Exemption is that it can reduce the amount of property taxes that eligible properties have to pay.

Q: Are there any limitations or restrictions for the CTA-PVX Property Valuation Exemption?

A: There may be limitations or restrictions on the CTA-PVX Property Valuation Exemption, such as a maximum exemption amount or a time limit on the exemption.

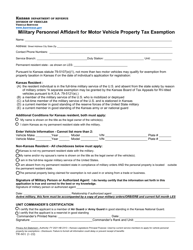

Form Details:

- Released on July 1, 2014;

- The latest edition provided by the Kansas Board of Tax Appeals;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CTA-PVX by clicking the link below or browse more documents and templates provided by the Kansas Board of Tax Appeals.