Form BTA-IRBX Industrial Revenue Bond Exemption - Kansas

What Is Form BTA-IRBX?

This is a legal form that was released by the Kansas Board of Tax Appeals - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BTA-IRBX?

A: Form BTA-IRBX is a document related to Industrial Revenue Bond Exemption in Kansas.

Q: What is an Industrial Revenue Bond?

A: An Industrial Revenue Bond (IRB) is a type of bond issued by a government entity to finance the construction or expansion of a private business.

Q: What is the purpose of the Industrial Revenue Bond Exemption?

A: The purpose of the Industrial Revenue Bond Exemption is to provide tax incentives to businesses for certain qualifying projects.

Q: Who is eligible for the Industrial Revenue Bond Exemption in Kansas?

A: Businesses in Kansas that meet certain requirements are eligible for the Industrial Revenue Bond Exemption.

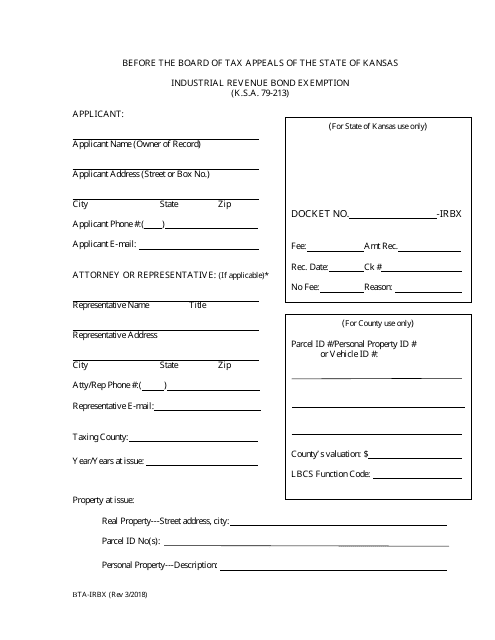

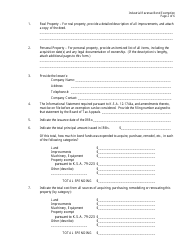

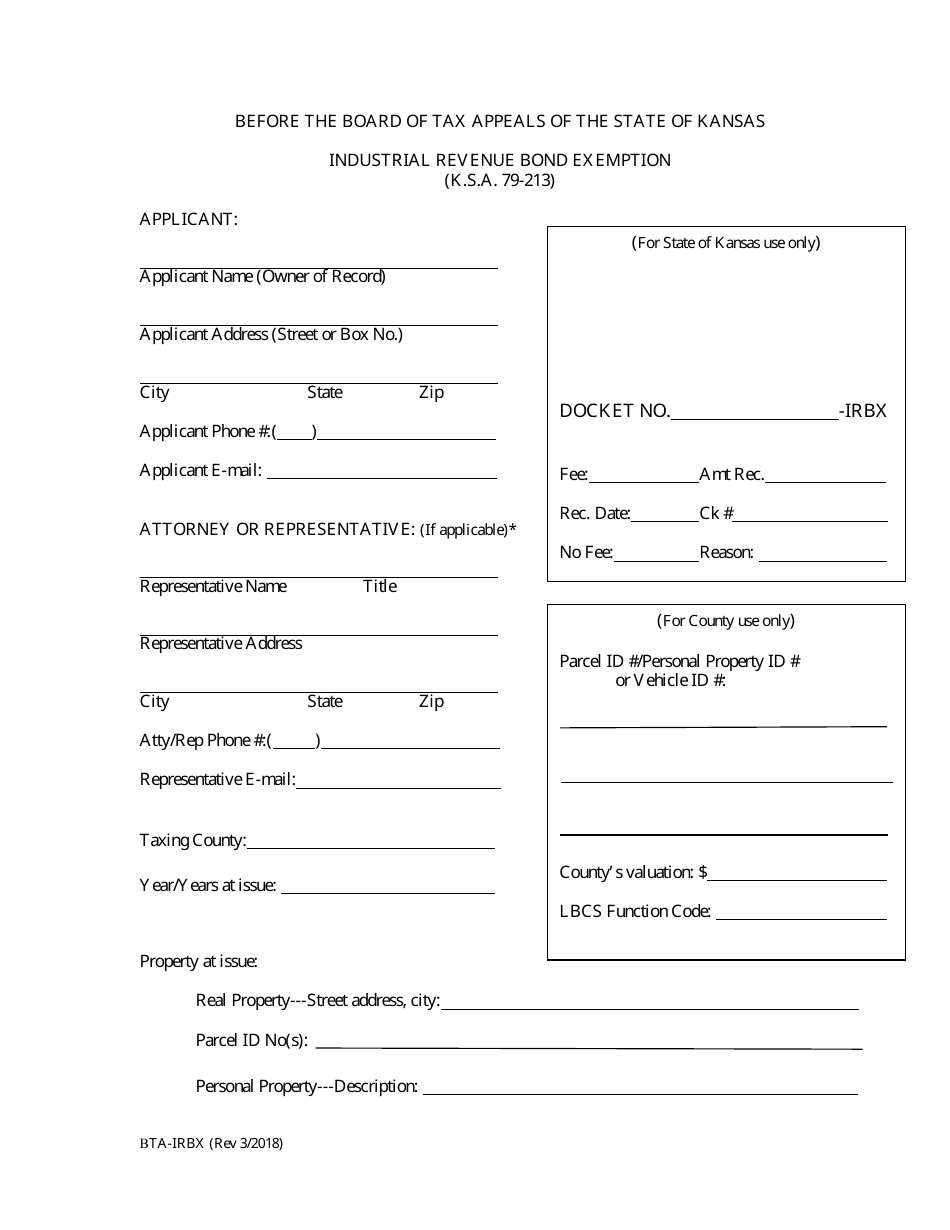

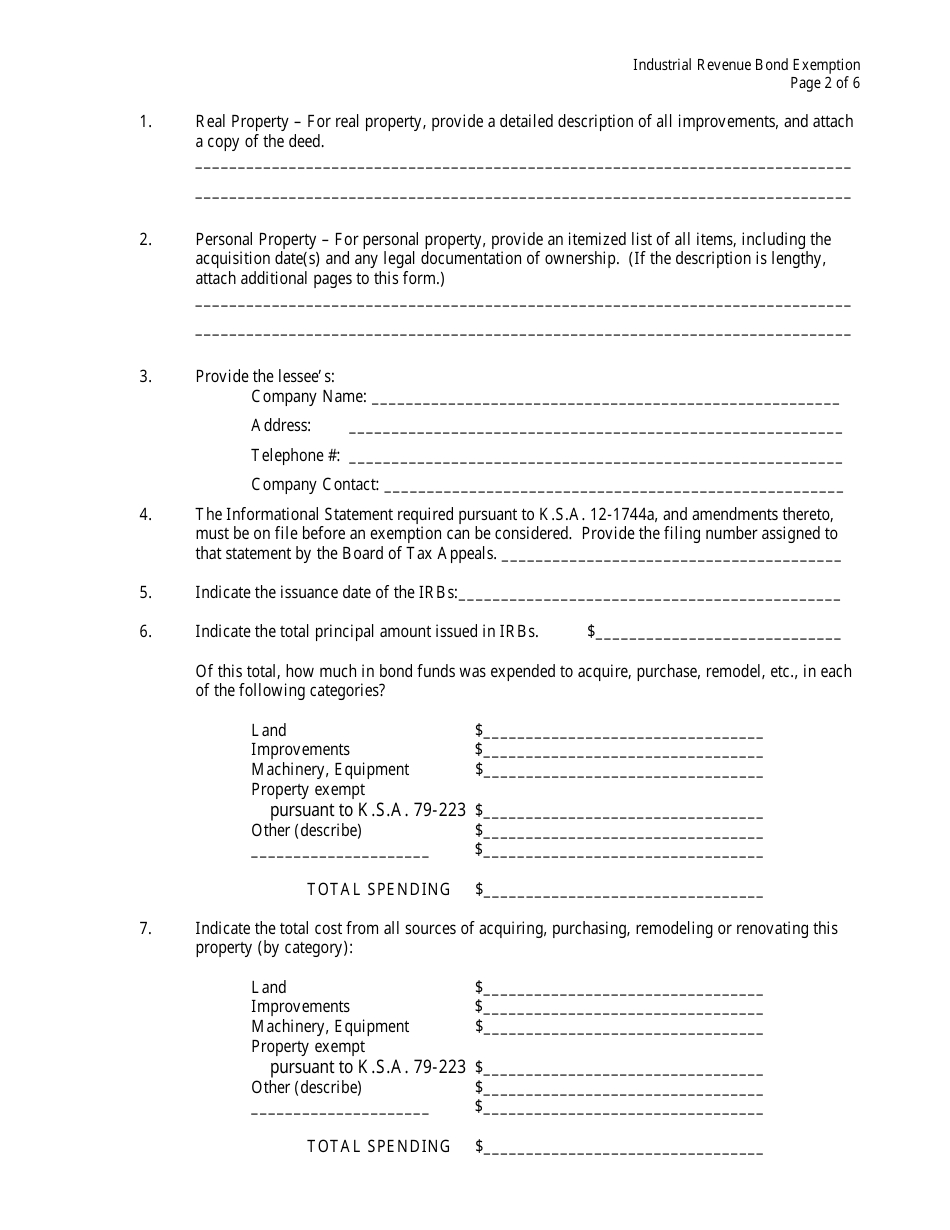

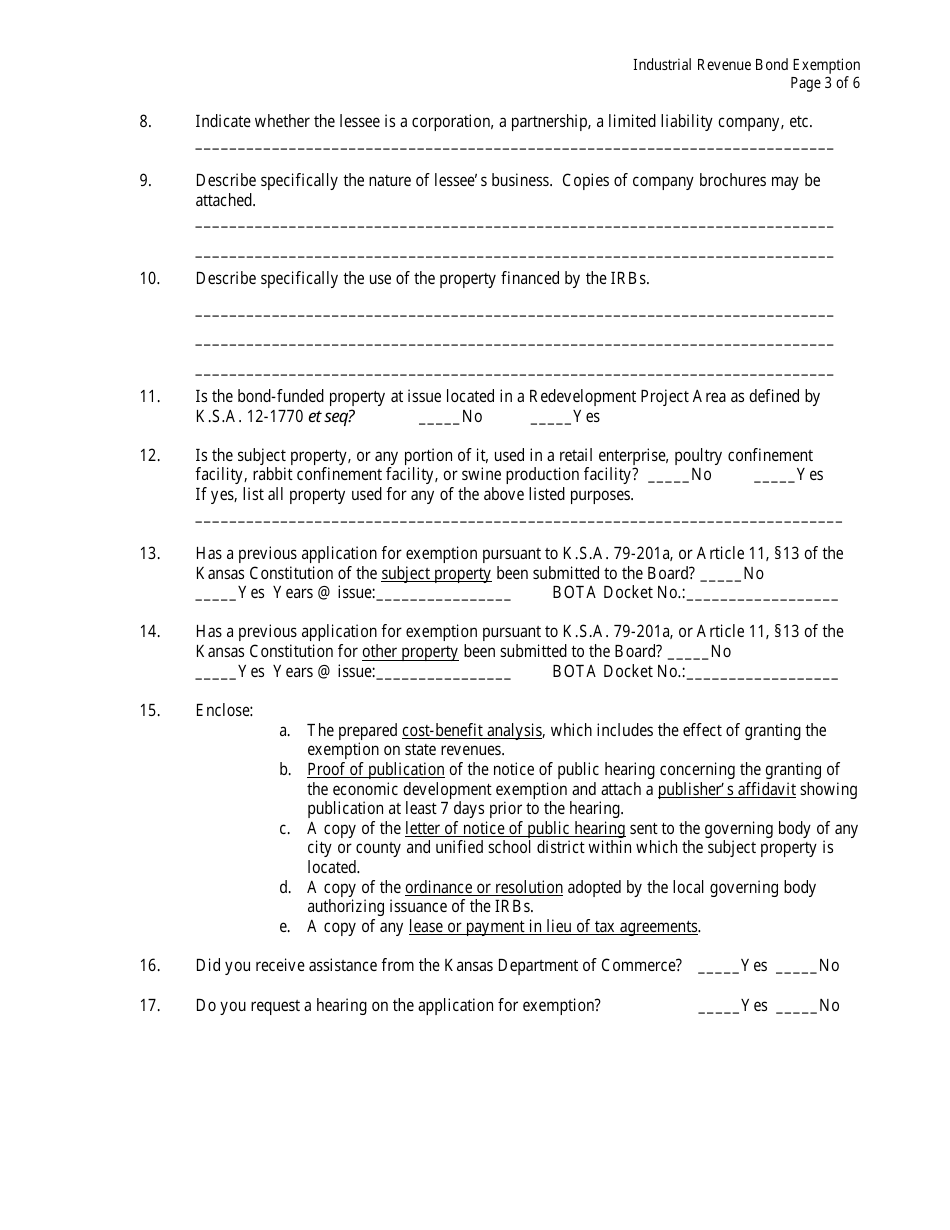

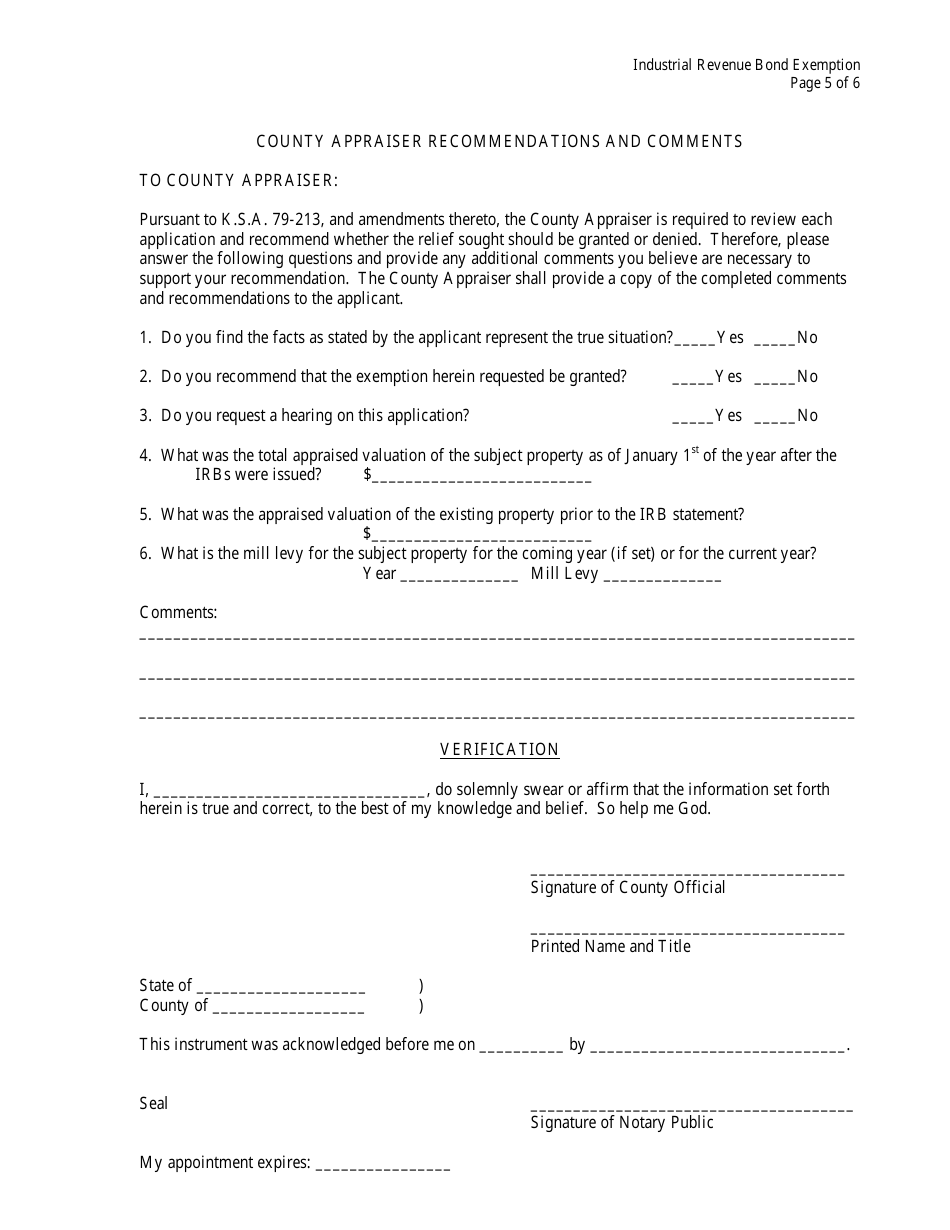

Q: What information is required on Form BTA-IRBX?

A: Form BTA-IRBX requires information about the business, the project, and the requested exemption.

Q: Is there a deadline for submitting Form BTA-IRBX?

A: Yes, there is a deadline for submitting Form BTA-IRBX. It is recommended to check with the Kansas Department of Revenue for the specific deadline.

Q: Are there any fees associated with Form BTA-IRBX?

A: There may be fees associated with submitting Form BTA-IRBX. It is recommended to check with the Kansas Department of Revenue for the current fee schedule.

Q: What happens after submitting Form BTA-IRBX?

A: After submitting Form BTA-IRBX, the Kansas Department of Revenue will review the application and determine if the business qualifies for the Industrial Revenue Bond Exemption.

Q: Is the Industrial Revenue Bond Exemption permanent?

A: No, the Industrial Revenue Bond Exemption is not usually permanent. It is typically granted for a specific period of time.

Q: Are there any restrictions on how the funds from an Industrial Revenue Bond can be used?

A: Yes, there may be restrictions on how the funds from an Industrial Revenue Bond can be used. These restrictions are typically specified in the bond agreement.

Q: Can I apply for the Industrial Revenue Bond Exemption if my business is located outside of Kansas?

A: No, the Industrial Revenue Bond Exemption is only available for businesses located in Kansas.

Q: What are the benefits of the Industrial Revenue Bond Exemption?

A: The benefits of the Industrial Revenue Bond Exemption include potential tax savings and the ability to finance qualifying projects at a lower interest rate.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Kansas Board of Tax Appeals;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BTA-IRBX by clicking the link below or browse more documents and templates provided by the Kansas Board of Tax Appeals.