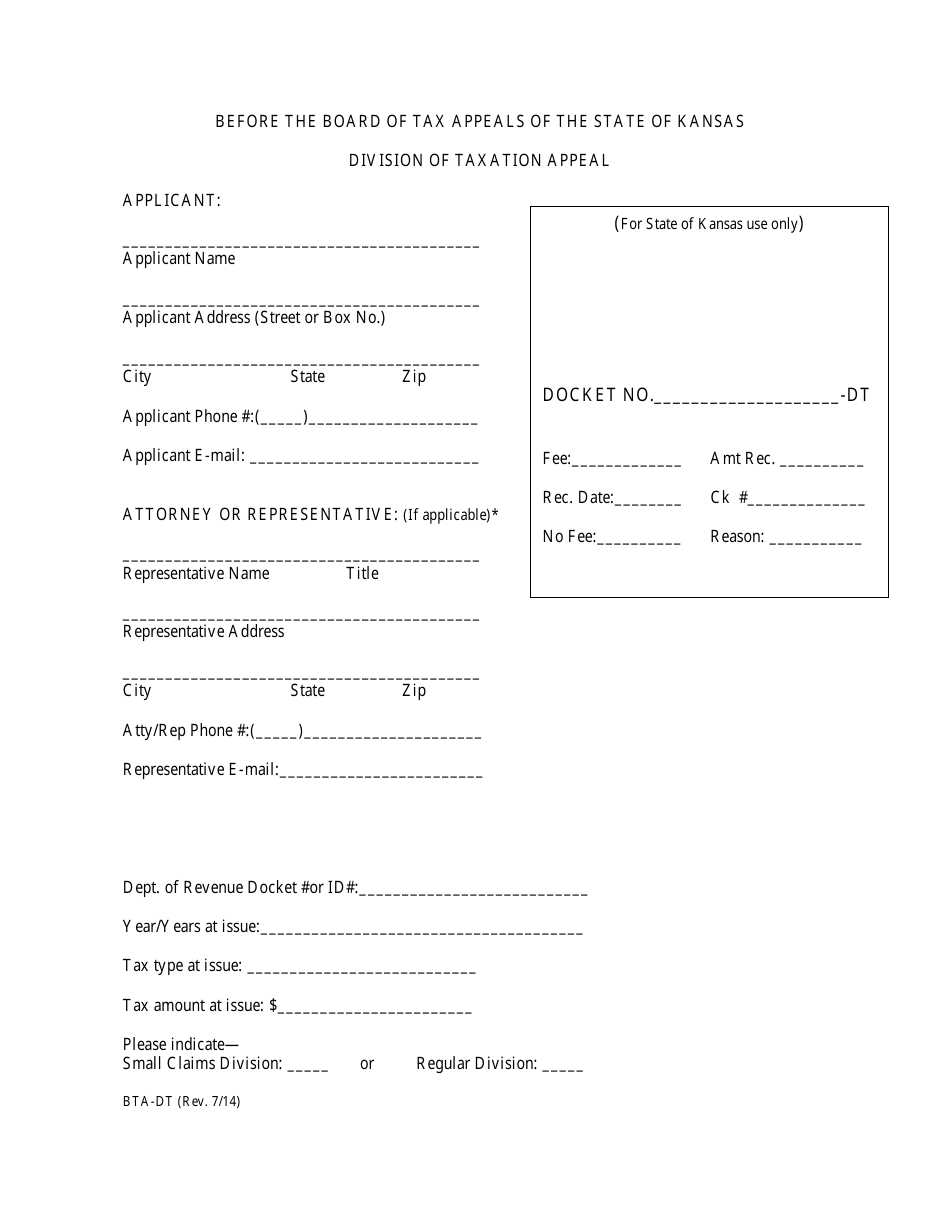

Form BTA-DT Division of Taxation Appeal - Kansas

What Is Form BTA-DT?

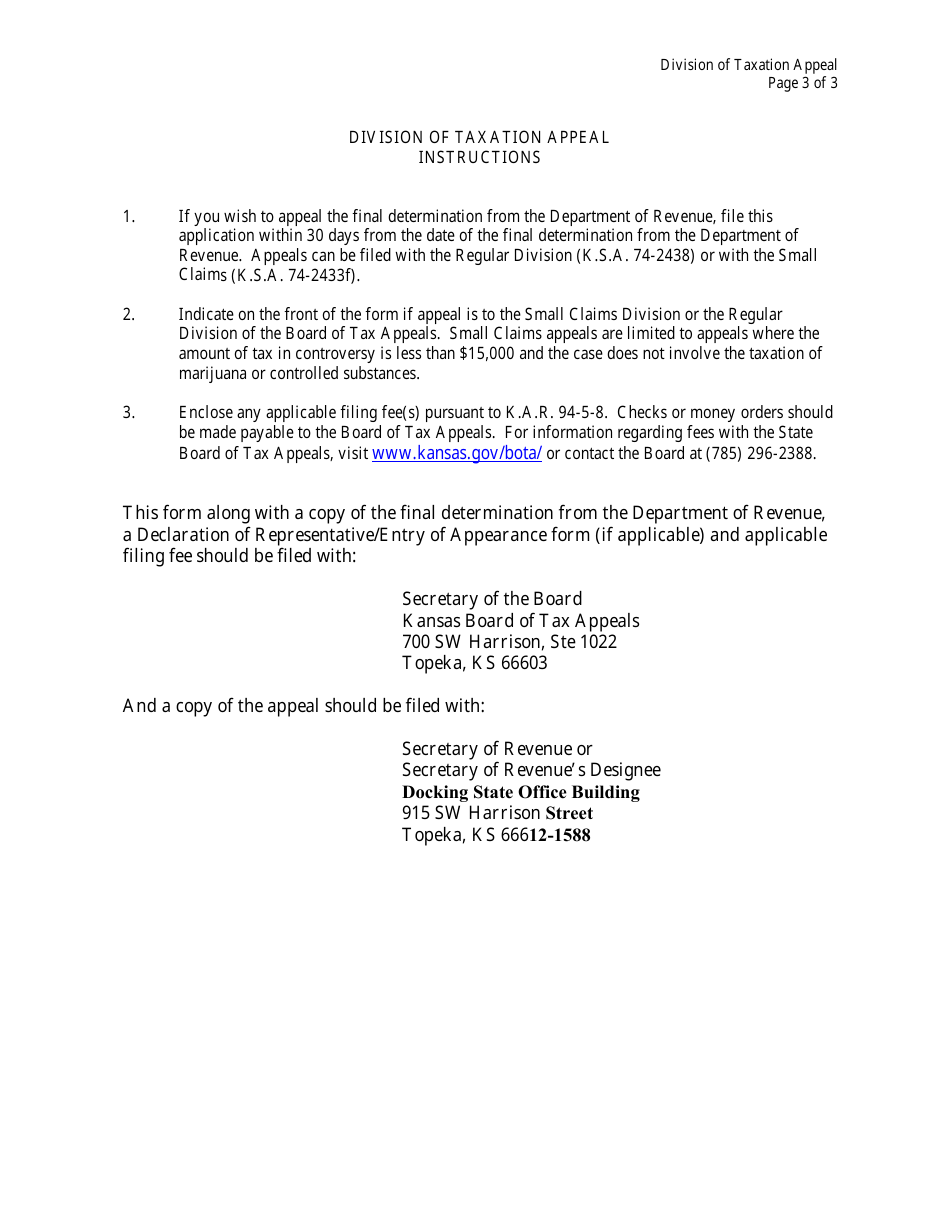

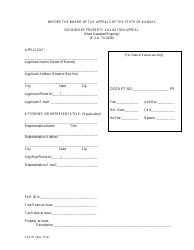

This is a legal form that was released by the Kansas Board of Tax Appeals - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BTA-DT Division of Taxation Appeal?

A: BTA-DT Division of Taxation Appeal is a form used to appeal a tax decision in the state of Kansas.

Q: Who can use the BTA-DT Division of Taxation Appeal form?

A: Any taxpayer who wants to challenge a tax decision in Kansas can use the BTA-DT Division of Taxation Appeal form.

Q: What is the purpose of the BTA-DT Division of Taxation Appeal form?

A: The purpose of the BTA-DT Division of Taxation Appeal form is to request a review of a tax decision by the Board of Tax Appeals in Kansas.

Q: Is there a deadline to submit the BTA-DT Division of Taxation Appeal form?

A: Yes, you must submit the BTA-DT Division of Taxation Appeal form within 30 days after the notice of the tax decision.

Q: Do I need to pay a fee to file the BTA-DT Division of Taxation Appeal form?

A: Yes, there is a filing fee required to submit the BTA-DT Division of Taxation Appeal form. The fee amount can be found on the form itself.

Q: What should I include with the BTA-DT Division of Taxation Appeal form?

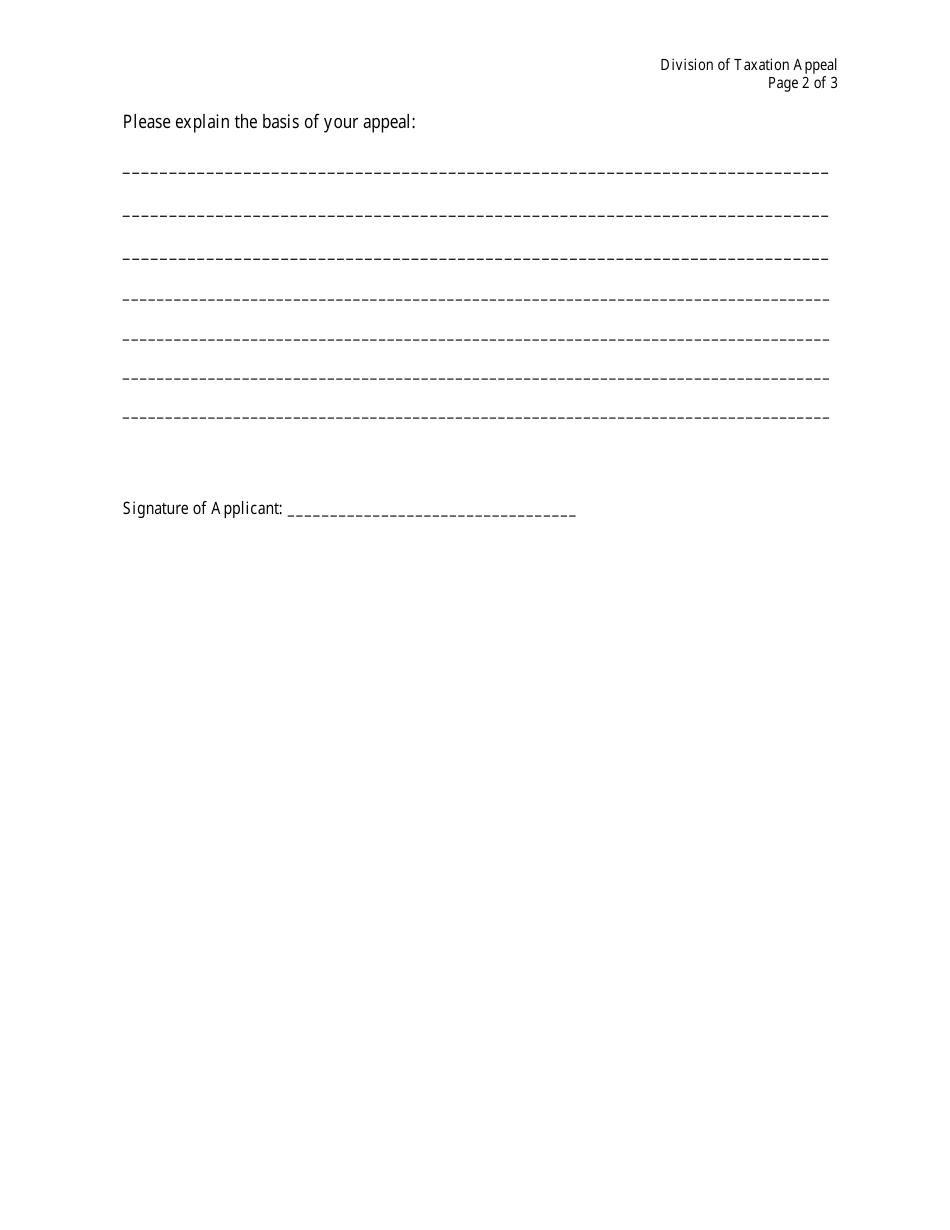

A: You should include any supporting documentation or evidence related to your tax dispute, as well as a copy of the notice of the tax decision.

Q: How long does it take to get a decision on the BTA-DT Division of Taxation Appeal?

A: The timeline for a decision on the BTA-DT Division of Taxation Appeal can vary depending on the complexity of the case. It is best to contact the Board of Tax Appeals for an estimated timeframe.

Q: Can I appeal the decision made by the Board of Tax Appeals?

A: Yes, you can appeal the decision made by the Board of Tax Appeals through the Kansas court system.

Form Details:

- Released on July 1, 2014;

- The latest edition provided by the Kansas Board of Tax Appeals;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BTA-DT by clicking the link below or browse more documents and templates provided by the Kansas Board of Tax Appeals.