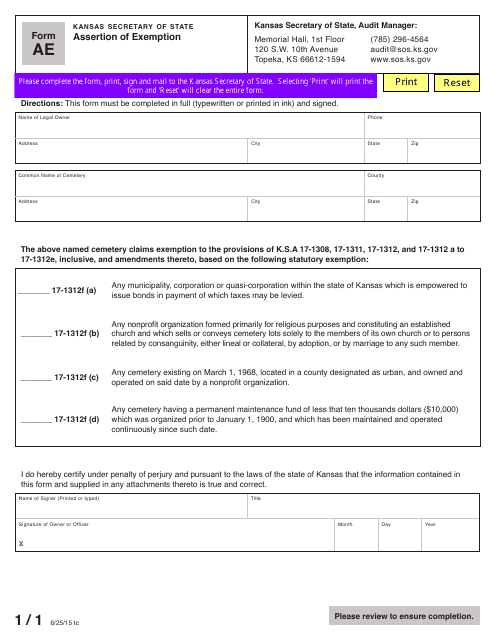

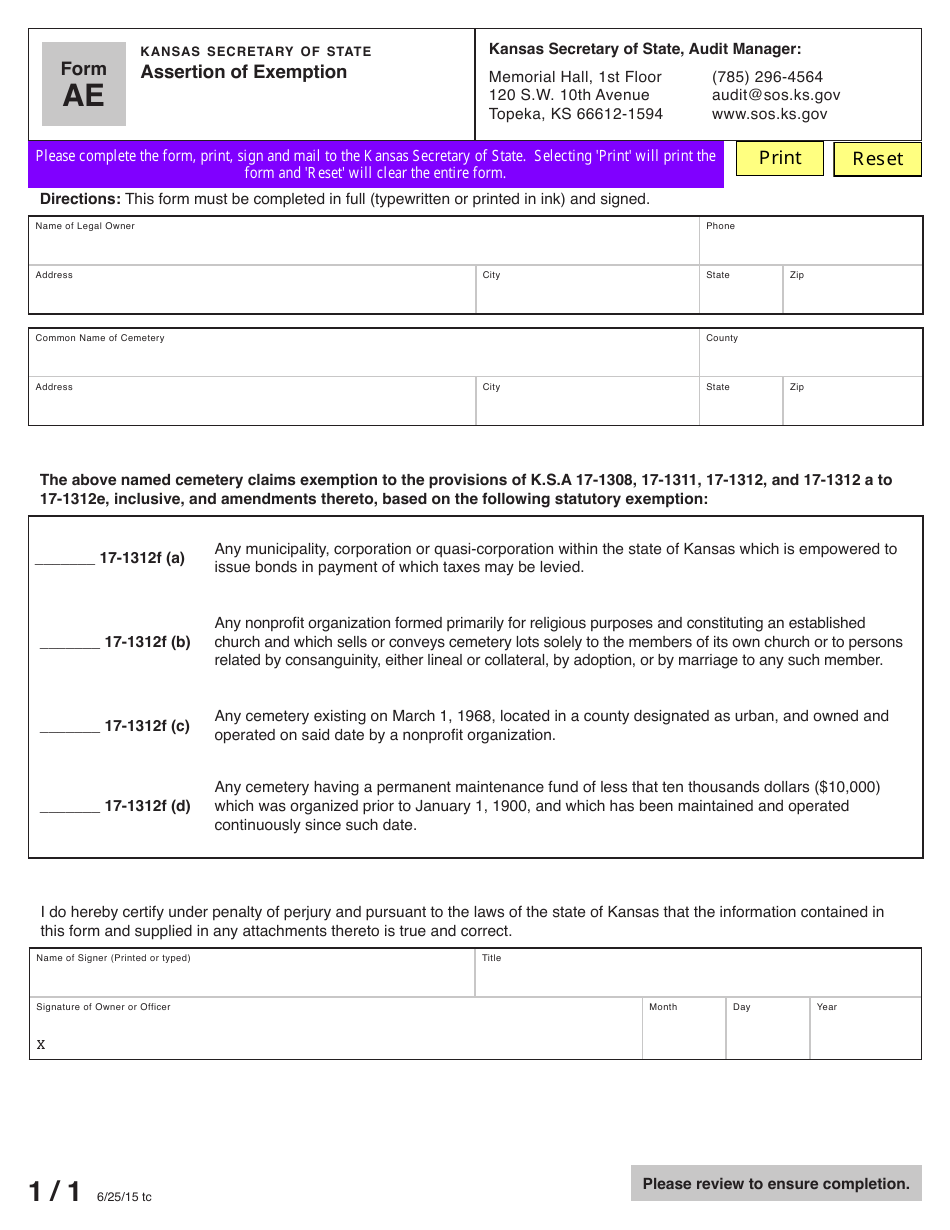

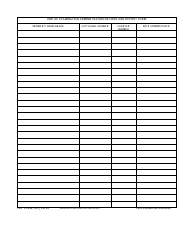

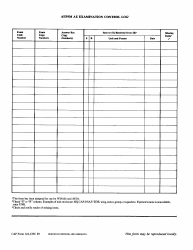

Form AE Assertion of Exemption - Kansas

What Is Form AE?

This is a legal form that was released by the Kansas Secretary of State - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form AE Assertion of Exemption?

A: Form AE Assertion of Exemption is a document filed in Kansas to claim an exemption from certain taxes.

Q: Who can file a Form AE Assertion of Exemption in Kansas?

A: Individuals or organizations who believe they are exempt from certain taxes in Kansas can file a Form AE Assertion of Exemption.

Q: What taxes can be exempted using Form AE Assertion of Exemption?

A: Form AE Assertion of Exemption can be used to claim exemption from various taxes in Kansas, such as sales tax, fuel tax, and property tax.

Q: What is the purpose of filing a Form AE Assertion of Exemption?

A: The purpose of filing a Form AE Assertion of Exemption is to provide proof of exemption from certain taxes in Kansas.

Q: Are there any fees associated with filing a Form AE Assertion of Exemption?

A: There are no fees associated with filing a Form AE Assertion of Exemption in Kansas.

Form Details:

- Released on June 25, 2015;

- The latest edition provided by the Kansas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AE by clicking the link below or browse more documents and templates provided by the Kansas Secretary of State.