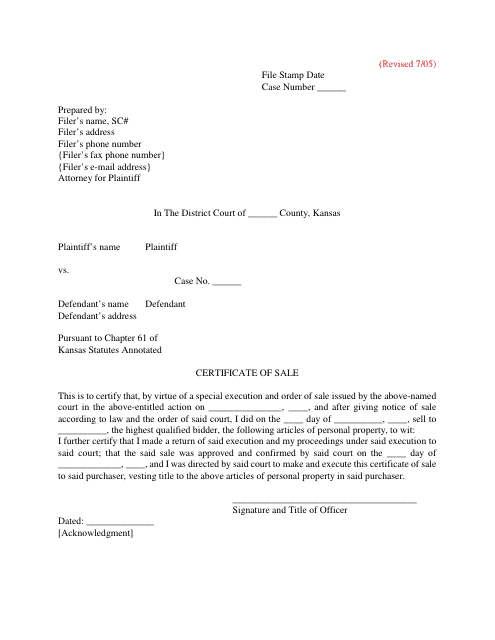

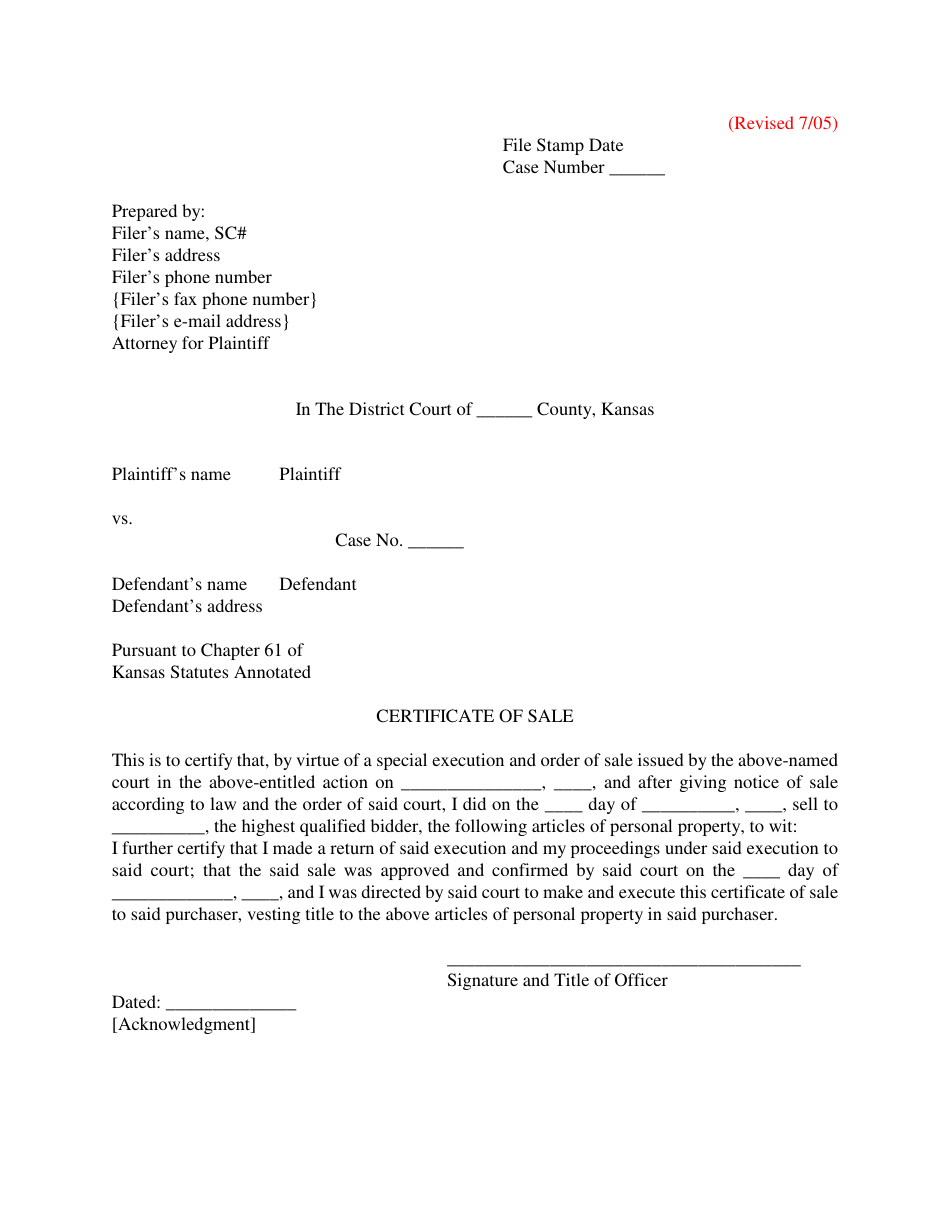

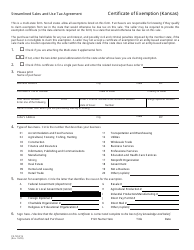

Certificate of Sale - Kansas

Certificate of Sale is a legal document that was released by the Kansas District Courts - a government authority operating within Kansas.

FAQ

Q: What is a Certificate of Sale?

A: A Certificate of Sale is a document that provides proof of the successful sale of a property at a public auction or tax sale.

Q: When is a Certificate of Sale issued in Kansas?

A: A Certificate of Sale is issued in Kansas after a property is sold at a tax sale due to unpaid property taxes.

Q: What is the purpose of a Certificate of Sale?

A: The purpose of a Certificate of Sale is to transfer ownership of a property from the delinquent taxpayer to the winning bidder at the tax sale.

Q: Can I redeem or repurchase a property after a Certificate of Sale is issued?

A: In Kansas, the property owner has a redemption period after the Certificate of Sale is issued, during which they have the right to repurchase the property by paying the delinquent taxes and related costs.

Q: What happens if the property is not redeemed during the redemption period?

A: If the property is not redeemed during the redemption period, the winning bidder can apply for a tax deed to obtain full ownership rights of the property.

Form Details:

- Released on July 1, 2005;

- The latest edition currently provided by the Kansas District Courts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kansas District Courts.