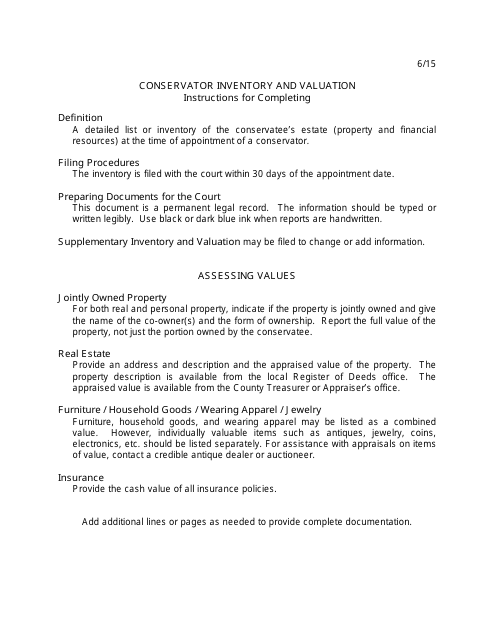

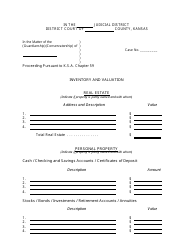

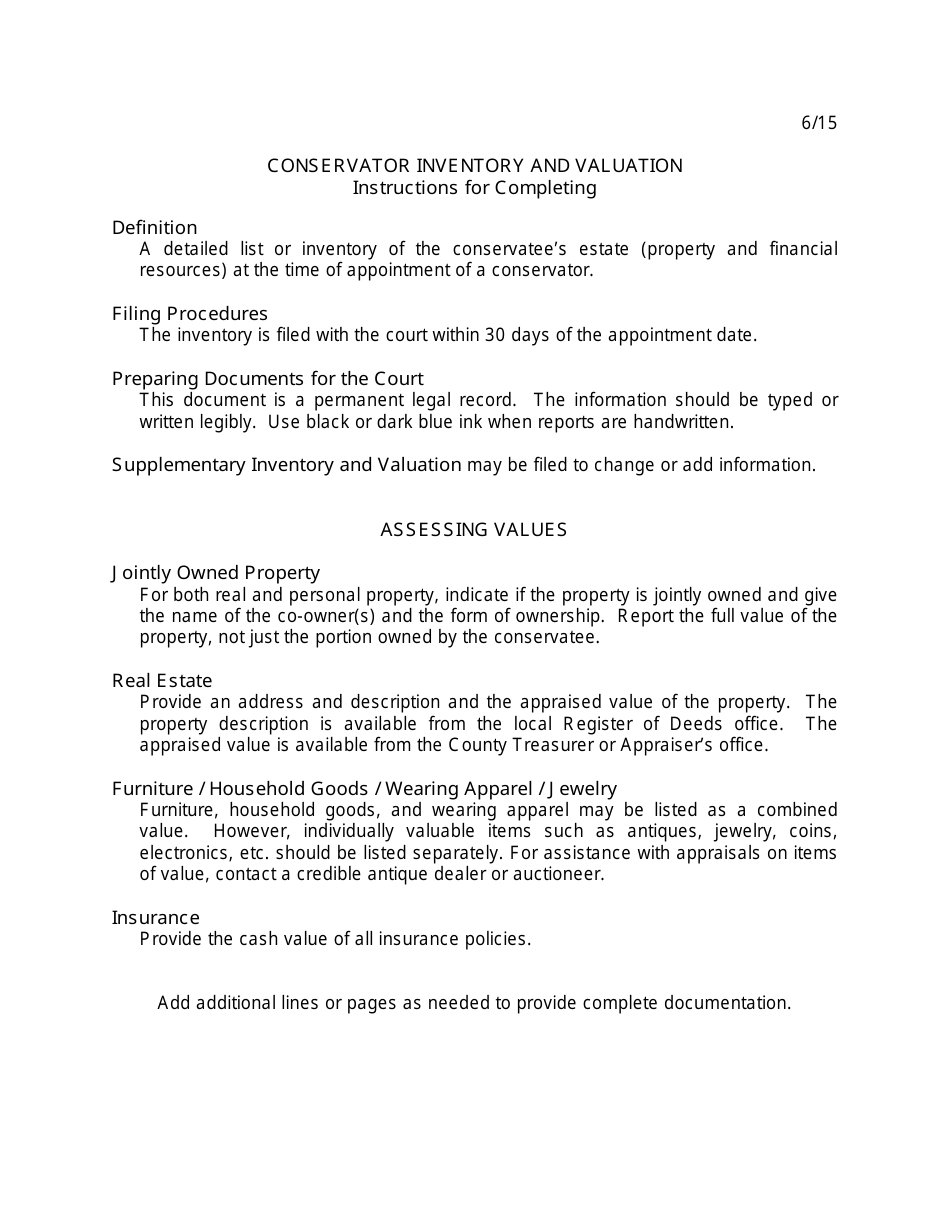

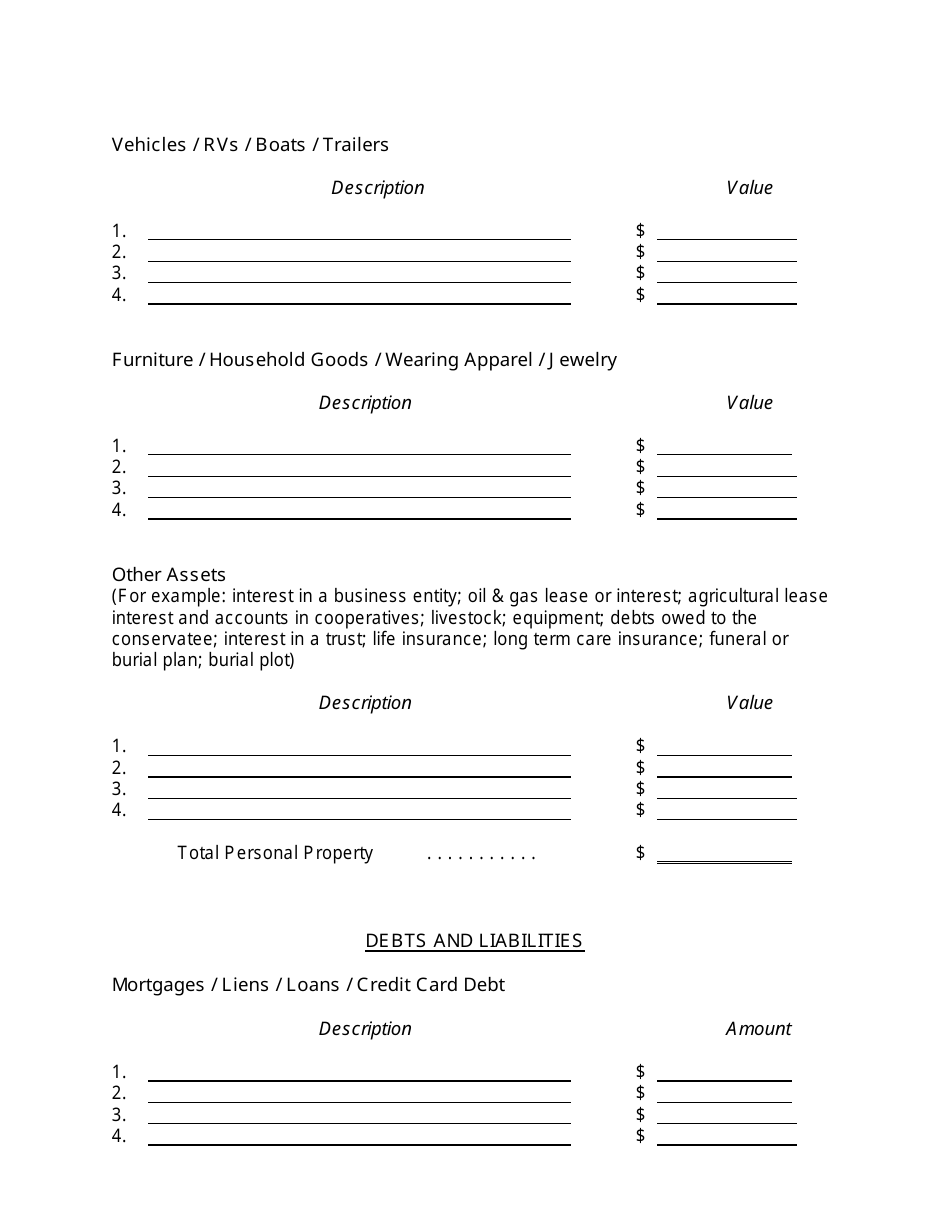

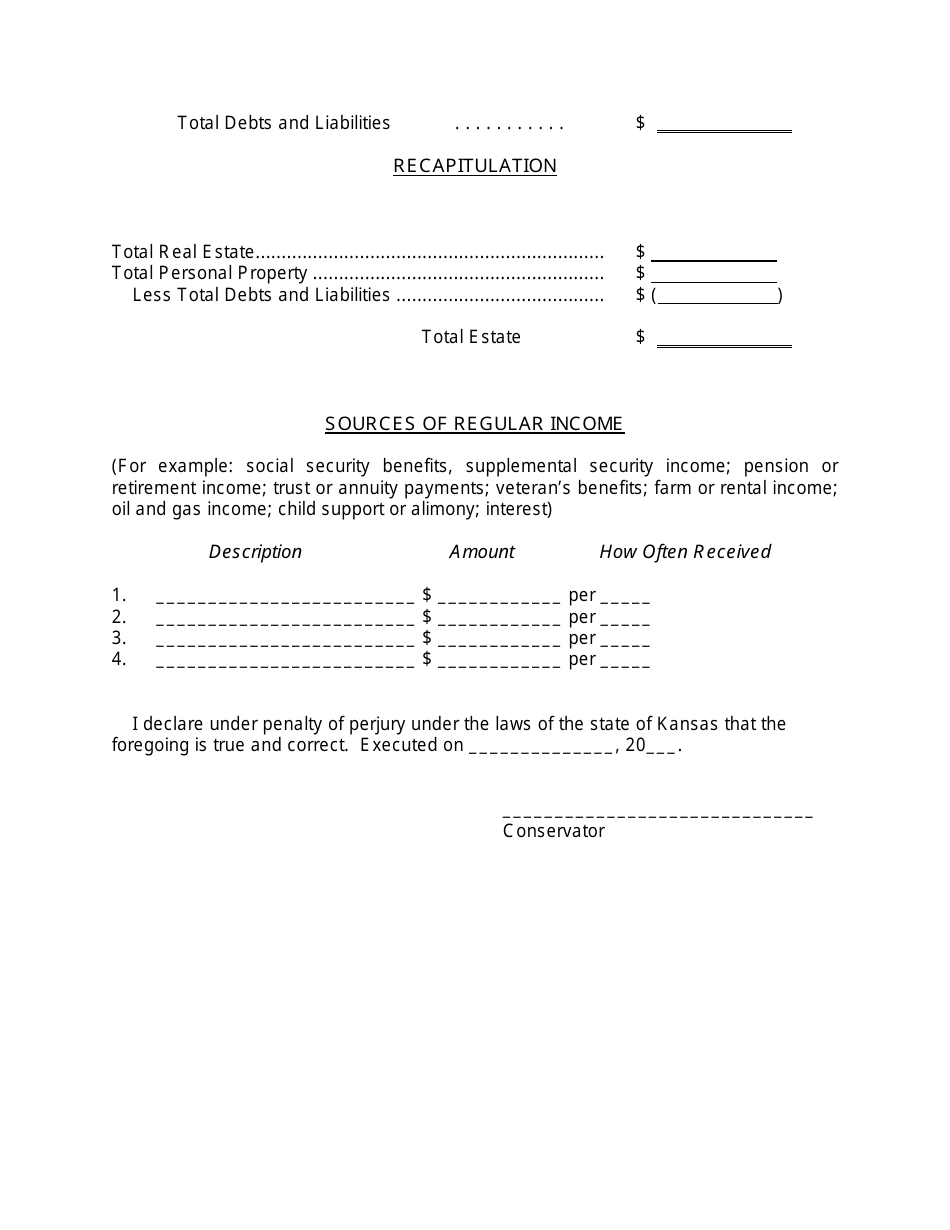

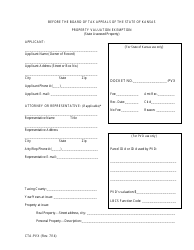

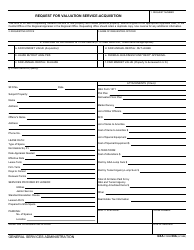

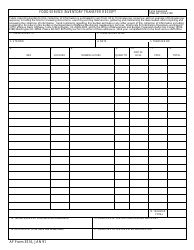

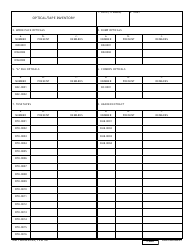

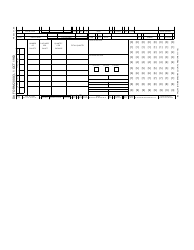

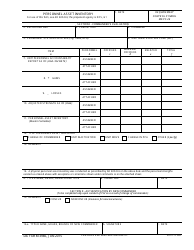

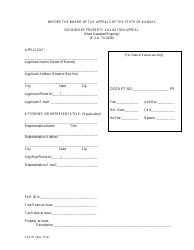

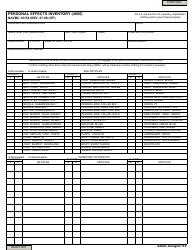

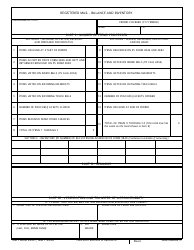

Inventory and Valuation - Kansas

Inventory and Valuation is a legal document that was released by the Kansas District Courts - a government authority operating within Kansas.

FAQ

Q: What is inventory valuation?

A: Inventory valuation is the process of assigning a monetary value to a company's inventory.

Q: Why is inventory valuation important?

A: Inventory valuation is important for financial reporting and determining the profitability of a business.

Q: How is inventory normally valued?

A: Inventory is normally valued at cost, which can include the cost of buying or producing the items.

Q: What methods are commonly used for inventory valuation?

A: Common methods for inventory valuation include FIFO (first-in, first-out), LIFO (last-in, first-out), and weighted average.

Q: What is the impact of inventory valuation method on financial statements?

A: The inventory valuation method can impact a company's financial statements, such as the balance sheet and income statement.

Q: What is FIFO?

A: FIFO stands for first-in, first-out, and it is a method of valuing inventory where items purchased first are sold or used first.

Q: What is LIFO?

A: LIFO stands for last-in, first-out, and it is a method of valuing inventory where the most recently purchased items are sold or used first.

Q: What is weighted average?

A: Weighted average is a method of valuing inventory that takes into account the average cost of all items in inventory.

Q: What other factors can affect inventory valuation?

A: Other factors that can affect inventory valuation include obsolescence, damage, and changes in market prices.

Q: How can inventory valuation impact taxes?

A: Inventory valuation method can impact taxes, as different methods can result in different cost of goods sold and taxable income.

Form Details:

- Released on June 1, 2015;

- The latest edition currently provided by the Kansas District Courts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kansas District Courts.