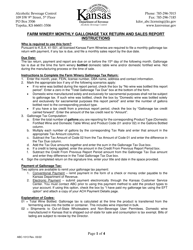

This version of the form is not currently in use and is provided for reference only. Download this version of

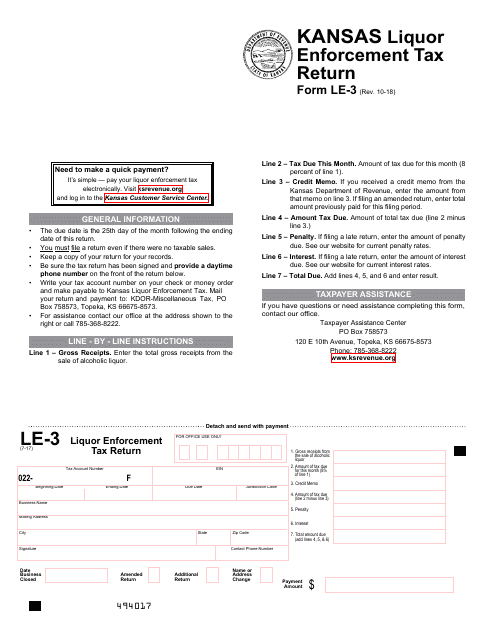

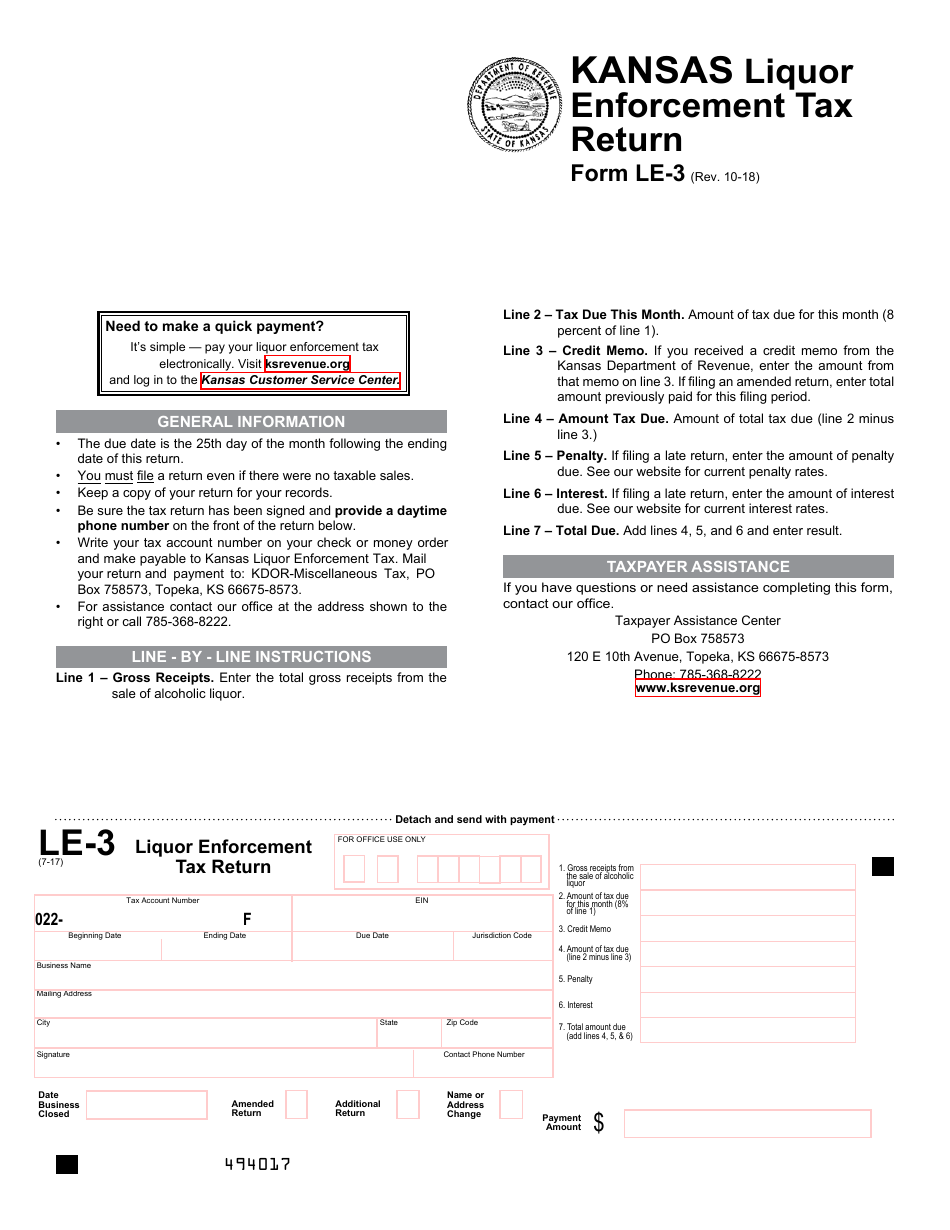

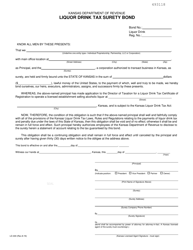

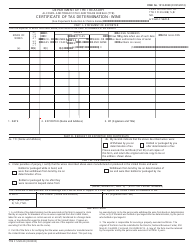

Form LE-3

for the current year.

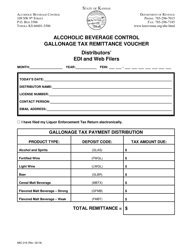

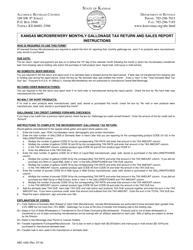

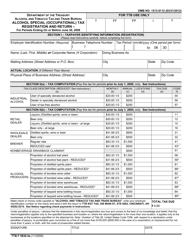

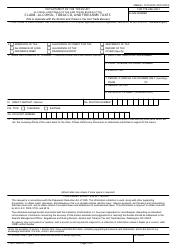

Form LE-3 Kansas Liquor Enforcement Tax Return - Kansas

What Is Form LE-3?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

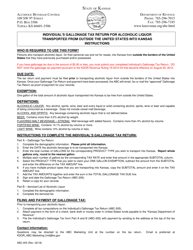

Q: What is the Form LE-3?

A: Form LE-3 is the Kansas Liquor Enforcement Tax Return.

Q: Who needs to file the Form LE-3?

A: Any business or individual engaged in the sale of liquor in Kansas needs to file the Form LE-3.

Q: What is the purpose of the Form LE-3?

A: The purpose of the Form LE-3 is to report and pay the liquor enforcement tax owed to the state of Kansas.

Q: When is the due date for filing the Form LE-3?

A: The Form LE-3 is due on or before the 25th day of the month following the end of the reporting period.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LE-3 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.