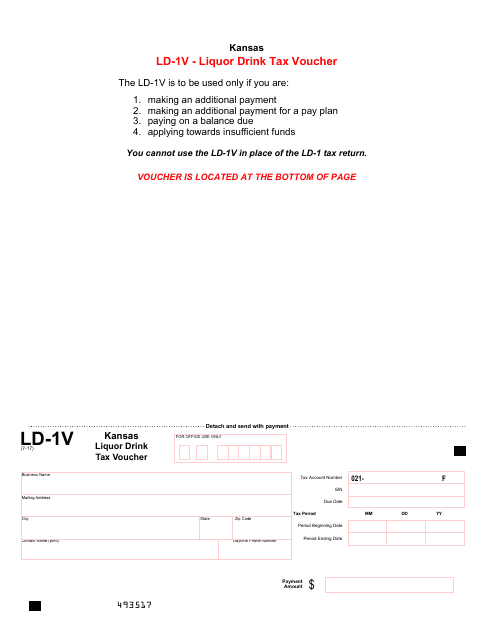

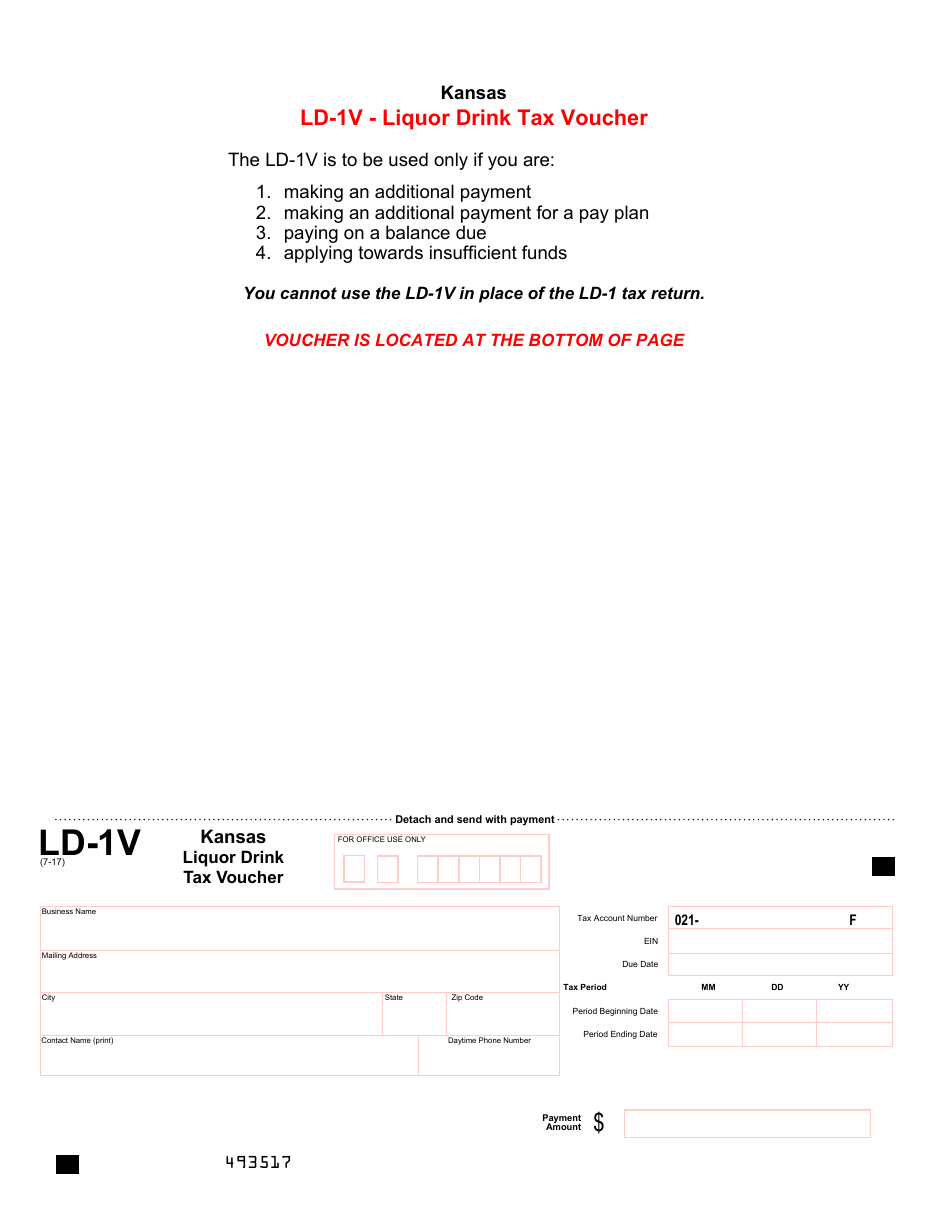

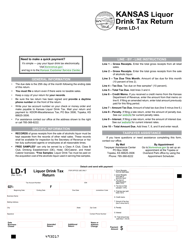

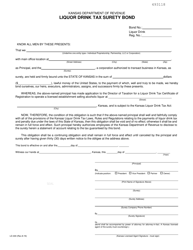

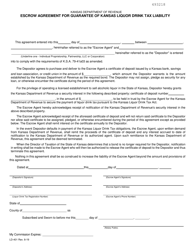

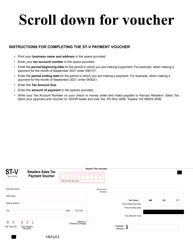

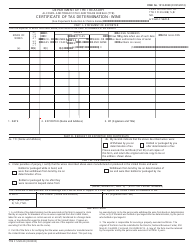

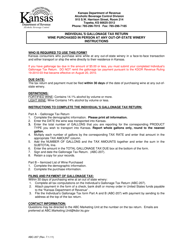

Form LD-1V Kansas Liquor Drink Tax Voucher - Kansas

What Is Form LD-1V?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

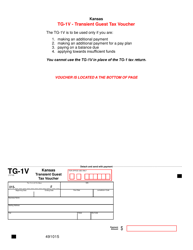

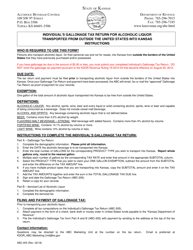

Q: What is LD-1V?

A: LD-1V is the form used in Kansas to report and remit liquor drink tax.

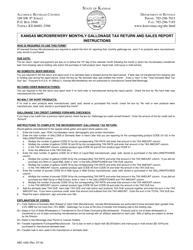

Q: What is the Kansas liquor drink tax?

A: The Kansas liquor drink tax is a tax imposed on the sale of alcoholic beverages in Kansas.

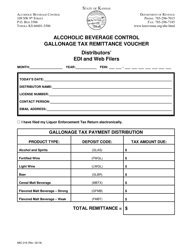

Q: Who needs to file form LD-1V?

A: Anyone who sells alcoholic beverages in Kansas is required to file form LD-1V and remit the liquor drink tax.

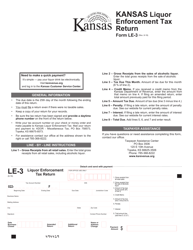

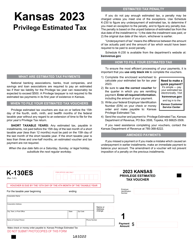

Q: How often do I need to file form LD-1V?

A: Form LD-1V must be filed and the tax must be remitted on a monthly basis.

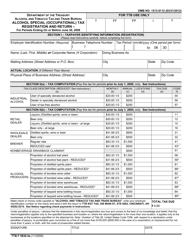

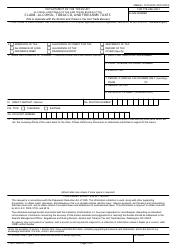

Q: What information is required on form LD-1V?

A: Form LD-1V requires information such as the total sales of alcoholic beverages, the amount of liquor drink tax due, and the retailer's license number.

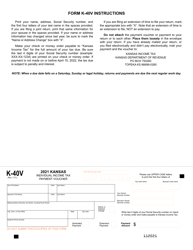

Q: What happens if I fail to file form LD-1V or pay the liquor drink tax?

A: Failure to file form LD-1V or pay the liquor drink tax can result in penalties and interest being assessed by the Kansas Department of Revenue.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LD-1V by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.