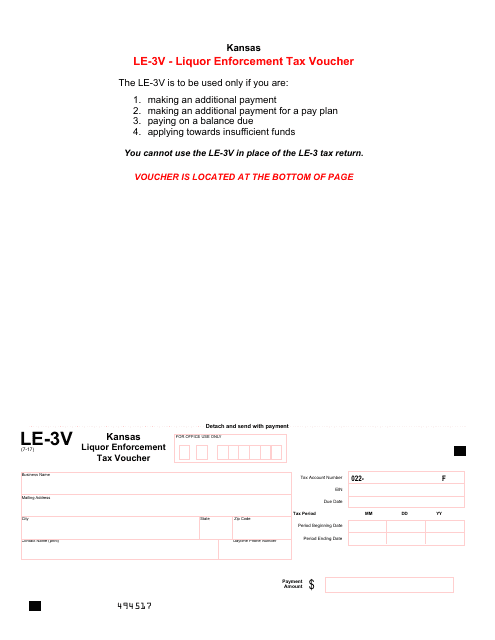

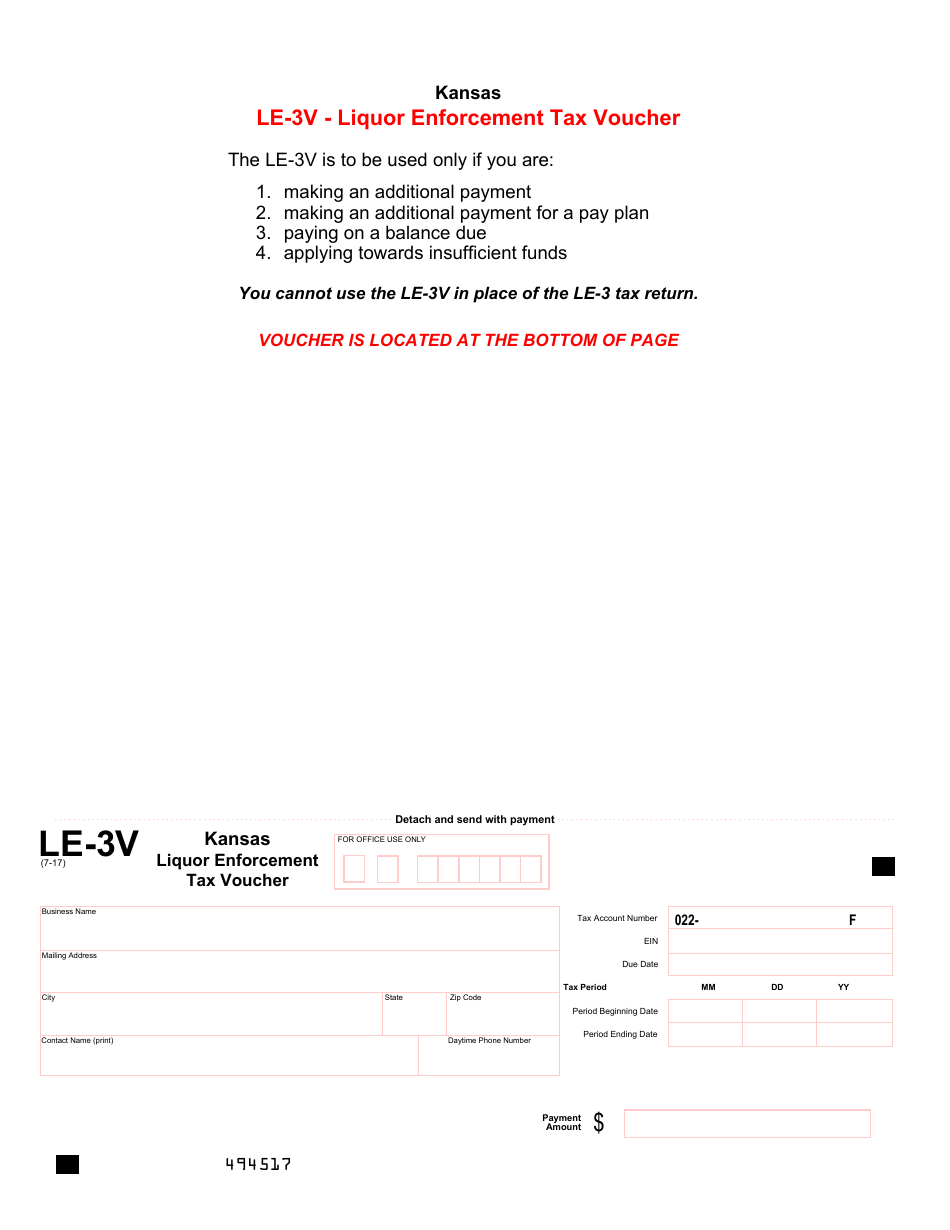

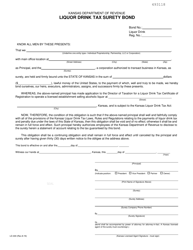

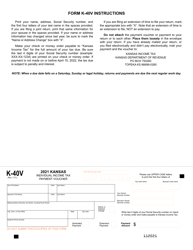

Form LE-3V Kansas Liquor Enforcement Tax Voucher - Kansas

What Is Form LE-3V?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is LE-3V?

A: LE-3V is a Kansas Liquor Enforcement Tax Voucher.

Q: What is the purpose of LE-3V?

A: LE-3V is used to report and pay liquor enforcement tax in Kansas.

Q: Who needs to file LE-3V?

A: Any business in Kansas that sells or distributes liquor needs to file LE-3V.

Q: When is LE-3V due?

A: LE-3V is due on the 25th day of the month following the reporting period.

Q: What happens if I don't file LE-3V?

A: Failure to file LE-3V or pay the liquor enforcement tax can result in penalties and interest.

Q: Are there any exemptions from the liquor enforcement tax?

A: Yes, there are certain exemptions. You should consult the Kansas Department of Revenue for more information.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LE-3V by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.