This version of the form is not currently in use and is provided for reference only. Download this version of

Form DC-1

for the current year.

Form DC-1 Environmental Surcharge and Solvent Fee Return - Kansas

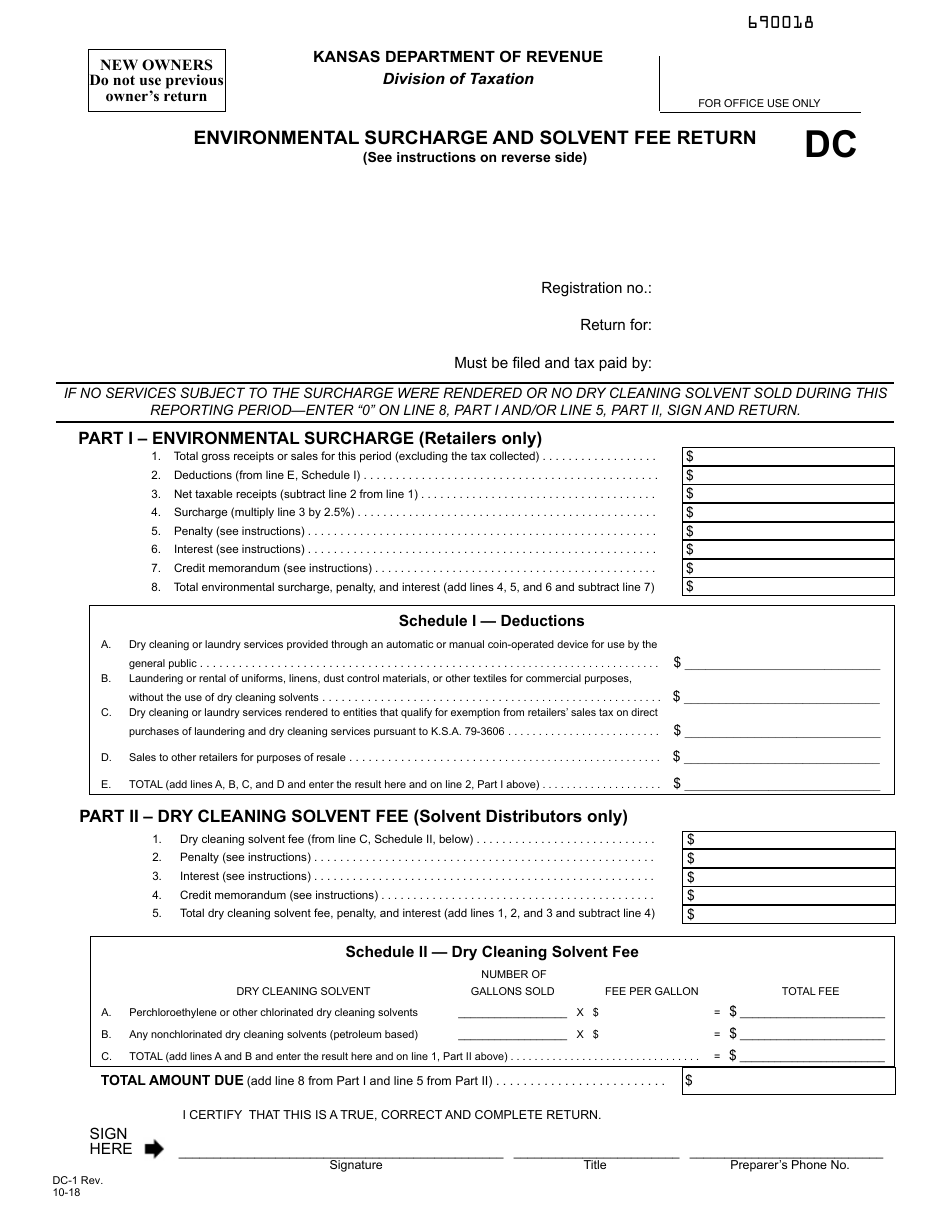

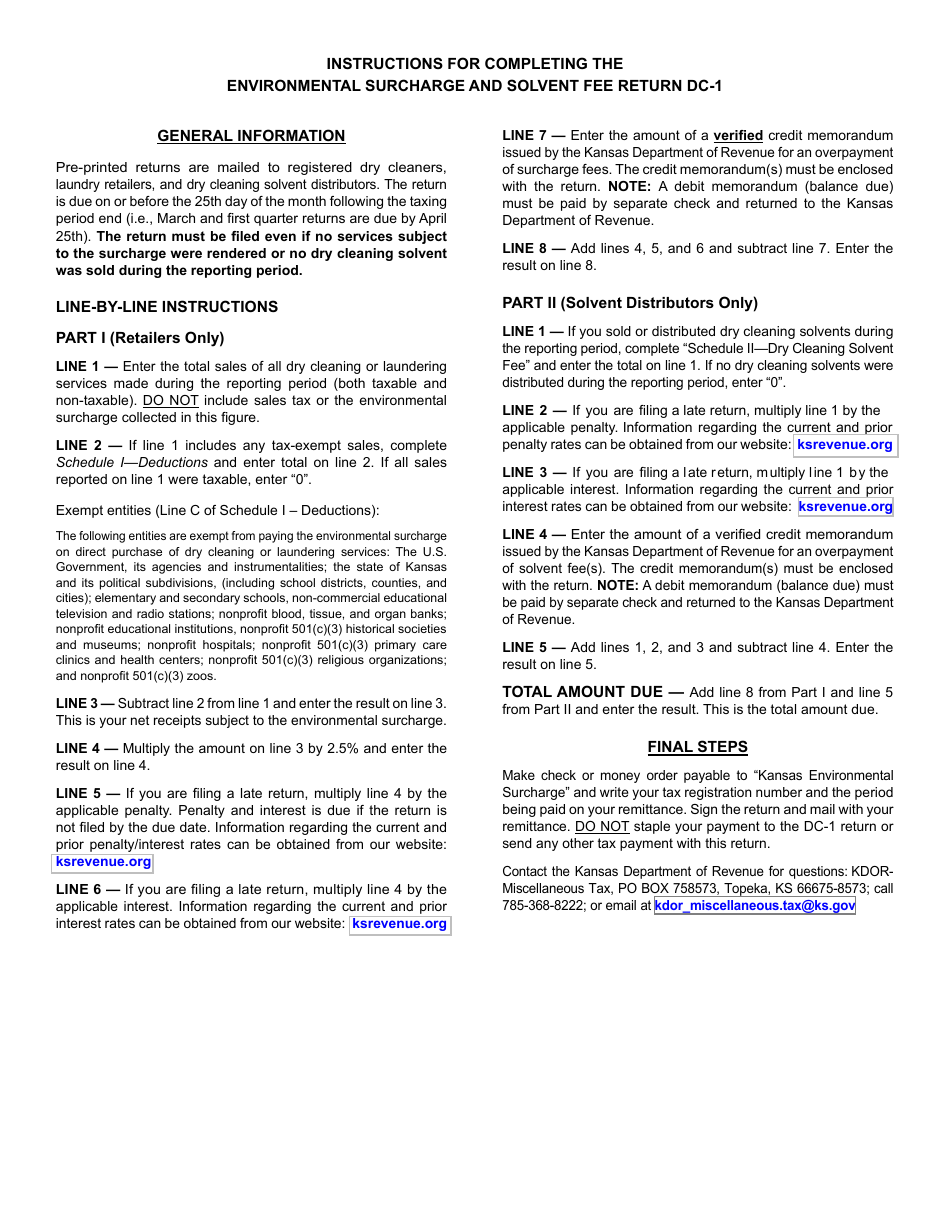

What Is Form DC-1?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DC-1?

A: Form DC-1 is the Environmental Surcharge and Solvent Fee Return for businesses in Kansas.

Q: What is the purpose of Form DC-1?

A: The purpose of Form DC-1 is to report and remit the environmental surcharge and solvent fee.

Q: Who needs to file Form DC-1?

A: Businesses in Kansas that generate or distribute certain solvents are required to file Form DC-1.

Q: What are environmental surcharge and solvent fees?

A: Environmental surcharge and solvent fees are fees imposed on businesses that generate or distribute certain solvents as part of an environmental protection program.

Q: When is Form DC-1 due?

A: Form DC-1 is due on a monthly basis, with returns and payments due by the 20th day of the month following the reporting period.

Q: Are there any penalties for not filing or paying Form DC-1?

A: Yes, there are penalties for late filing or payment of Form DC-1, including interest charges and additional fees.

Q: Is Form DC-1 only for businesses in Kansas?

A: Yes, Form DC-1 is specifically for businesses that operate in the state of Kansas.

Q: What should I do if I have questions about Form DC-1?

A: If you have questions about Form DC-1, you should contact the Kansas Department of Revenue for assistance.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DC-1 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.