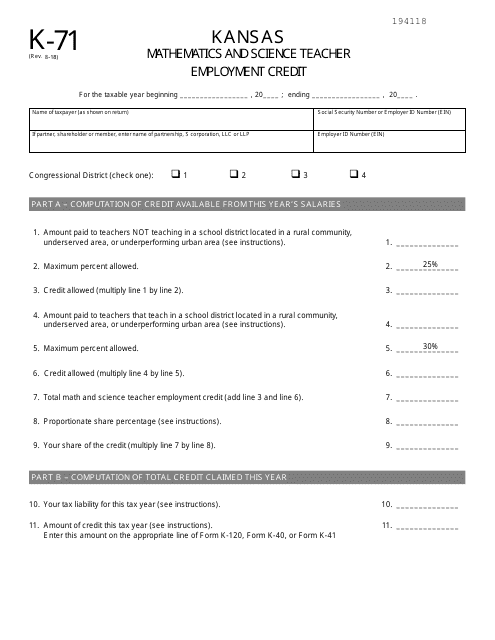

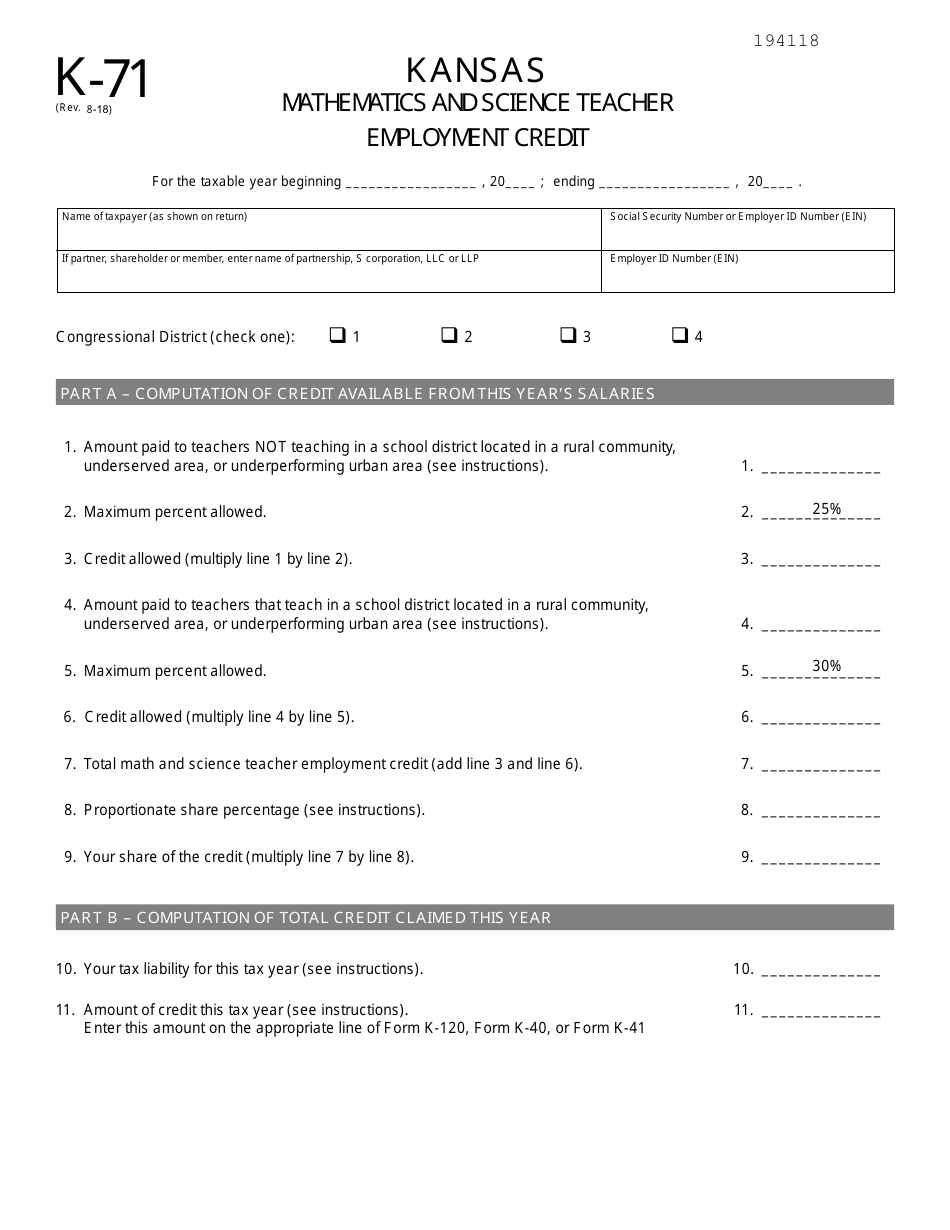

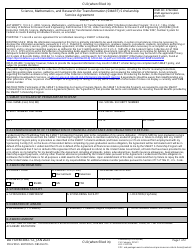

Form K-71 Mathematics and Science Teacher Employment Credit - Kansas

What Is Form K-71?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-71?

A: Form K-71 is a form used in Kansas to claim the Mathematics and Science Teacher Employment Credit.

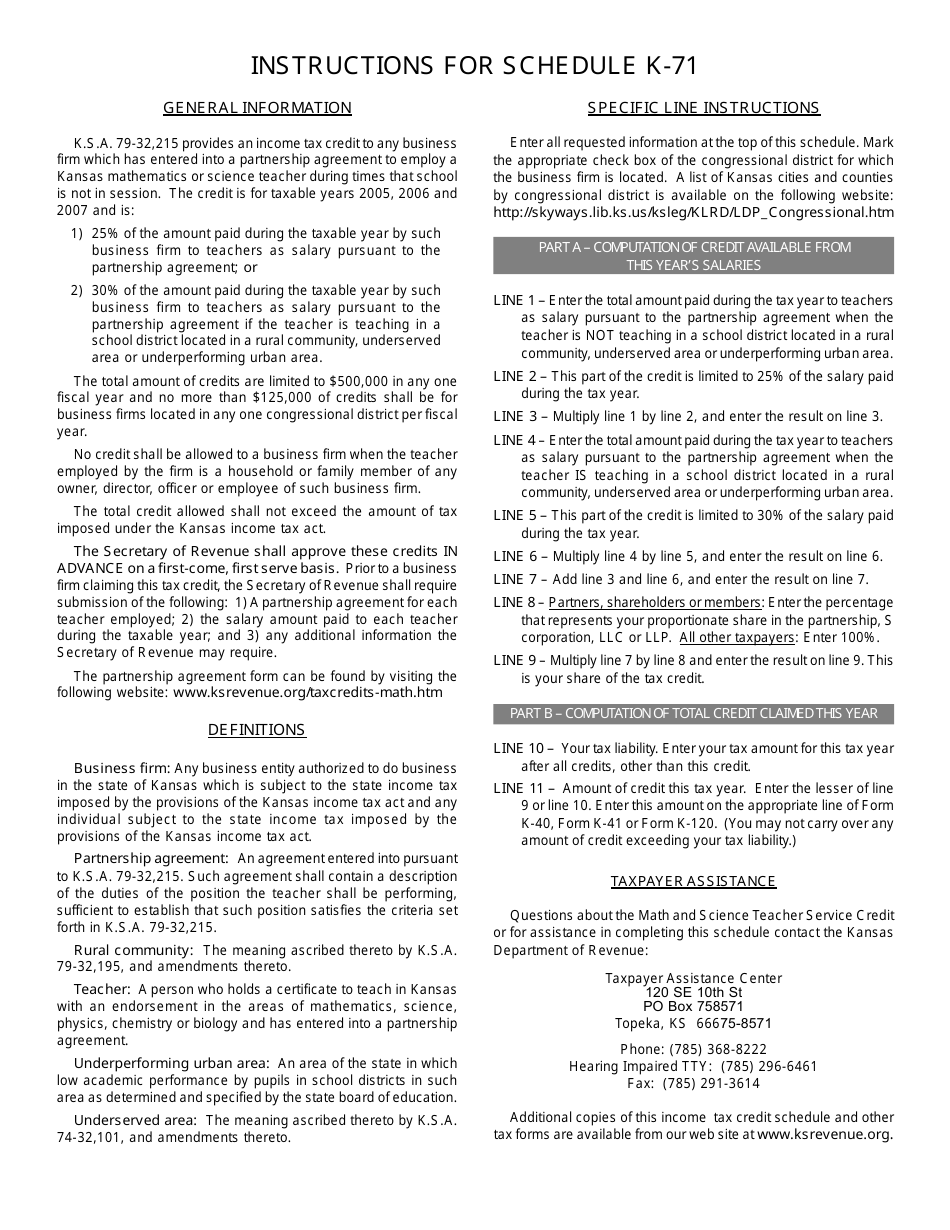

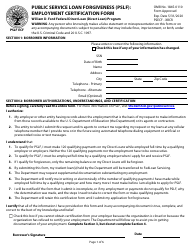

Q: What is the Mathematics and Science Teacher Employment Credit?

A: The Mathematics and Science Teacher Employment Credit is a tax credit available to Kansas residents who are certified mathematics or science teachers.

Q: Who is eligible for the Mathematics and Science Teacher Employment Credit?

A: Kansas residents who are certified mathematics or science teachers in a public or accredited private school are eligible for the credit.

Q: How much is the Mathematics and Science Teacher Employment Credit?

A: The credit is $500 for each year the taxpayer is employed as a certified mathematics or science teacher.

Q: How do I claim the Mathematics and Science Teacher Employment Credit?

A: To claim the credit, you need to complete and file Form K-71 with your Kansas state tax return.

Q: Are there any limitations or restrictions for the Mathematics and Science Teacher Employment Credit?

A: Yes, there are limitations and restrictions for the credit. For example, the credit cannot exceed the taxpayer's tax liability and there is a maximum credit limit per taxpayer.

Q: When is the deadline to file Form K-71?

A: The deadline to file Form K-71 is the same as the deadline for filing your Kansas state tax return, which is typically April 15th.

Q: Can I claim the Mathematics and Science Teacher Employment Credit if I teach in a private school?

A: Yes, you can claim the credit if you are a certified mathematics or science teacher in an accredited private school.

Q: Can I claim the Mathematics and Science Teacher Employment Credit if I teach in a homeschool setting?

A: No, the credit is only available for certified mathematics or science teachers in public or accredited private schools.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form K-71 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.