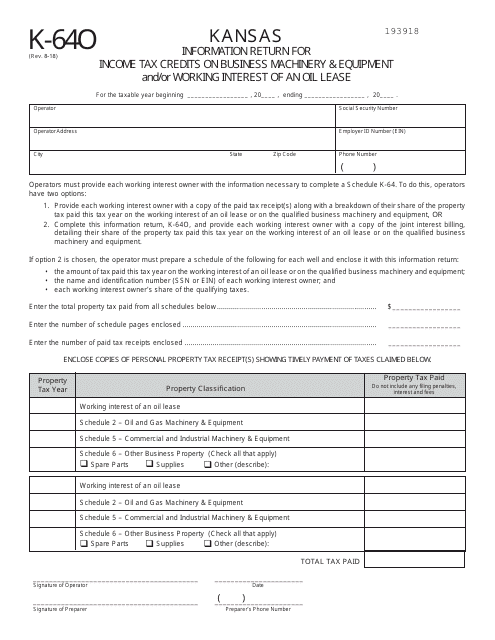

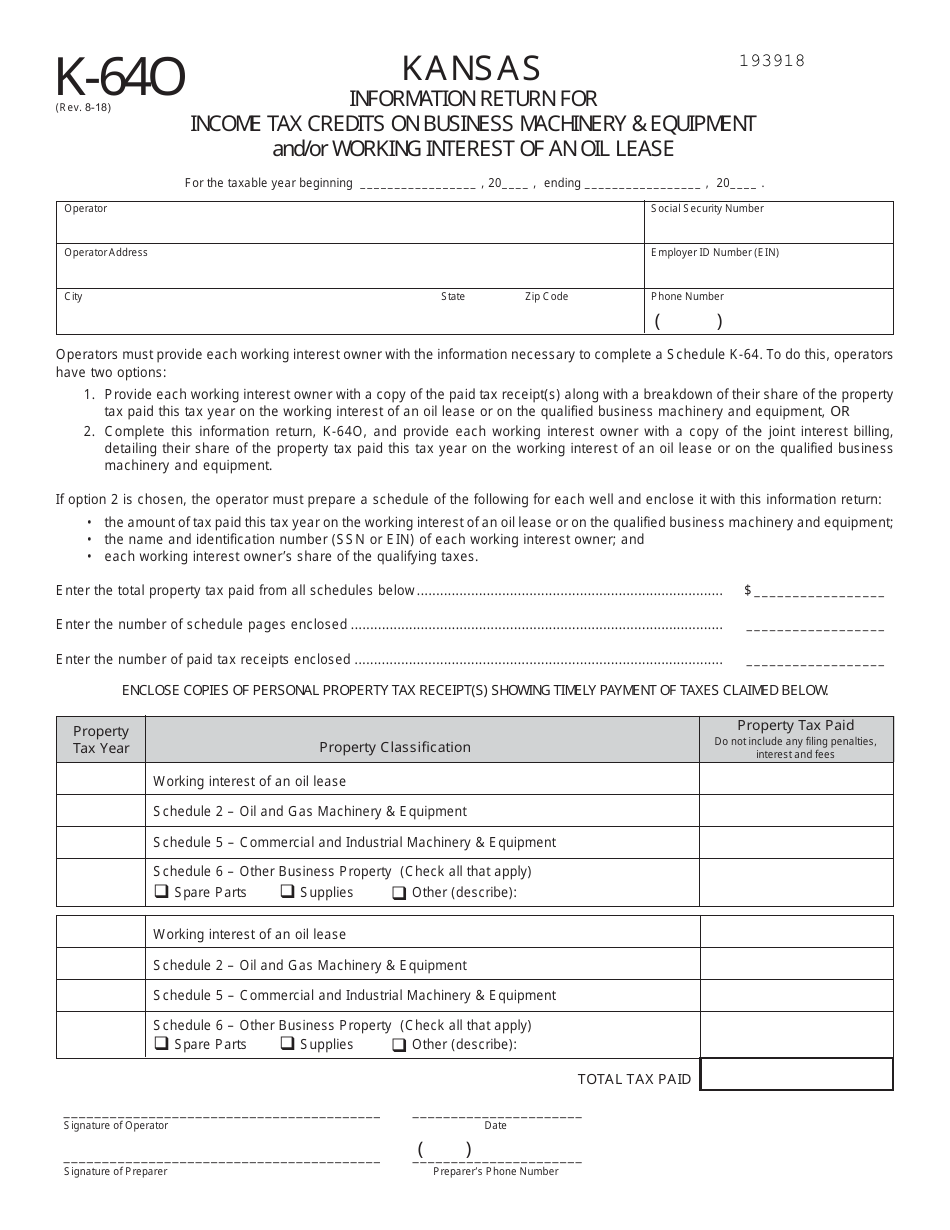

Form K-64O Information Return for Income Tax Credits on Business Machinery & Equipment and / or Working Interest of an Oil Lease - Kansas

What Is Form K-64O?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-64O?

A: Form K-64O is an information return for reporting income tax credits on business machinery & equipment and/or working interest of an oil lease in Kansas.

Q: Who should file Form K-64O?

A: Individuals or businesses who have income tax credits related to business machinery & equipment and/or working interest of an oil lease in Kansas should file Form K-64O.

Q: What is the purpose of filing Form K-64O?

A: The purpose of filing Form K-64O is to report and claim income tax credits related to business machinery & equipment and/or working interest of an oil lease in Kansas.

Q: What information is required to complete Form K-64O?

A: To complete Form K-64O, you will need to provide information about your business machinery & equipment and/or working interest of an oil lease, as well as any income tax credits associated with them.

Q: When is the deadline for filing Form K-64O?

A: The deadline for filing Form K-64O is generally April 15th of the following year. However, it is recommended to check the specific deadline each year, as it may vary.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form K-64O by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.