This version of the form is not currently in use and is provided for reference only. Download this version of

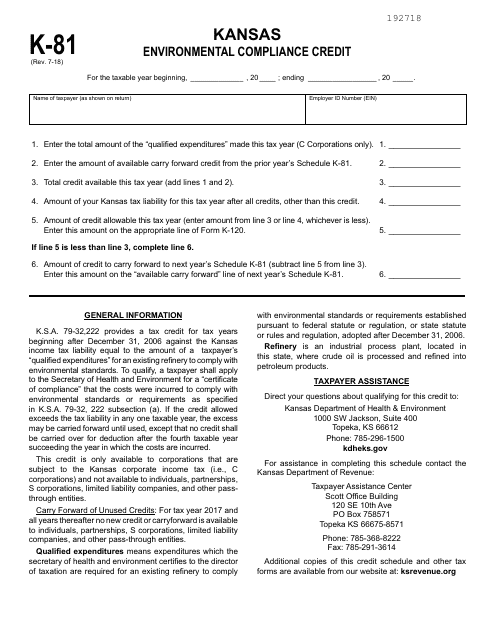

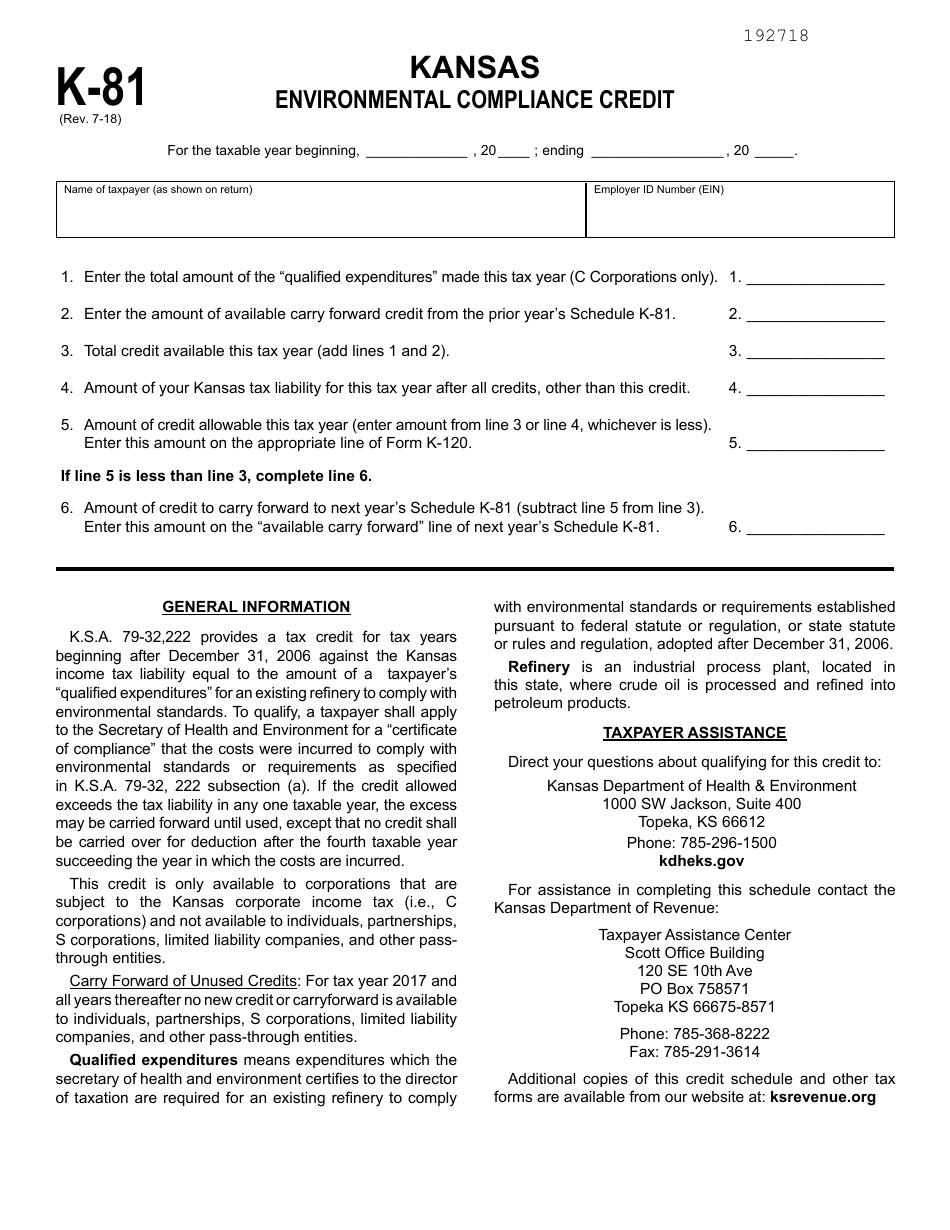

Schedule K-81

for the current year.

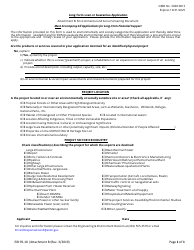

Schedule K-81 Kansas Environmental Compliance Credit - Kansas

What Is Schedule K-81?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-81?

A: Schedule K-81 is a form used in Kansas to claim the Environmental Compliance Credit.

Q: What is the Environmental Compliance Credit?

A: The Environmental Compliance Credit is a tax credit in Kansas that rewards businesses for implementing and maintaining environmentally friendly practices.

Q: Who can claim the Environmental Compliance Credit?

A: Businesses operating in Kansas that have implemented environmentally friendly practices can claim the Environmental Compliance Credit.

Q: How do I claim the Environmental Compliance Credit?

A: To claim the Environmental Compliance Credit, you must complete and submit Schedule K-81 with your Kansas tax return.

Q: What kind of practices qualify for the Environmental Compliance Credit?

A: Practices that improve air and water quality, reduce waste and emissions, and promote energy efficiency and conservation may qualify for the Environmental Compliance Credit.

Q: Is there a limit to the amount of credit that can be claimed?

A: Yes, there is a limit to the amount of credit that can be claimed. The maximum credit allowed is $25,000 per taxpayer.

Q: Are there any other requirements to claim the Environmental Compliance Credit?

A: Yes, there are certain requirements that must be met to claim the Environmental Compliance Credit, such as obtaining a certification from the Kansas Department of Health and Environment.

Q: Can the Environmental Compliance Credit be carried forward or refunded?

A: No, the Environmental Compliance Credit cannot be carried forward or refunded. It can only be used to offset Kansas income tax liability.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-81 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.