This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule K-33

for the current year.

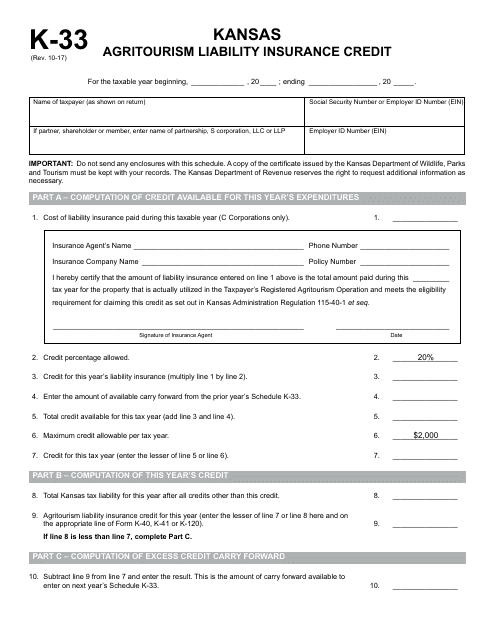

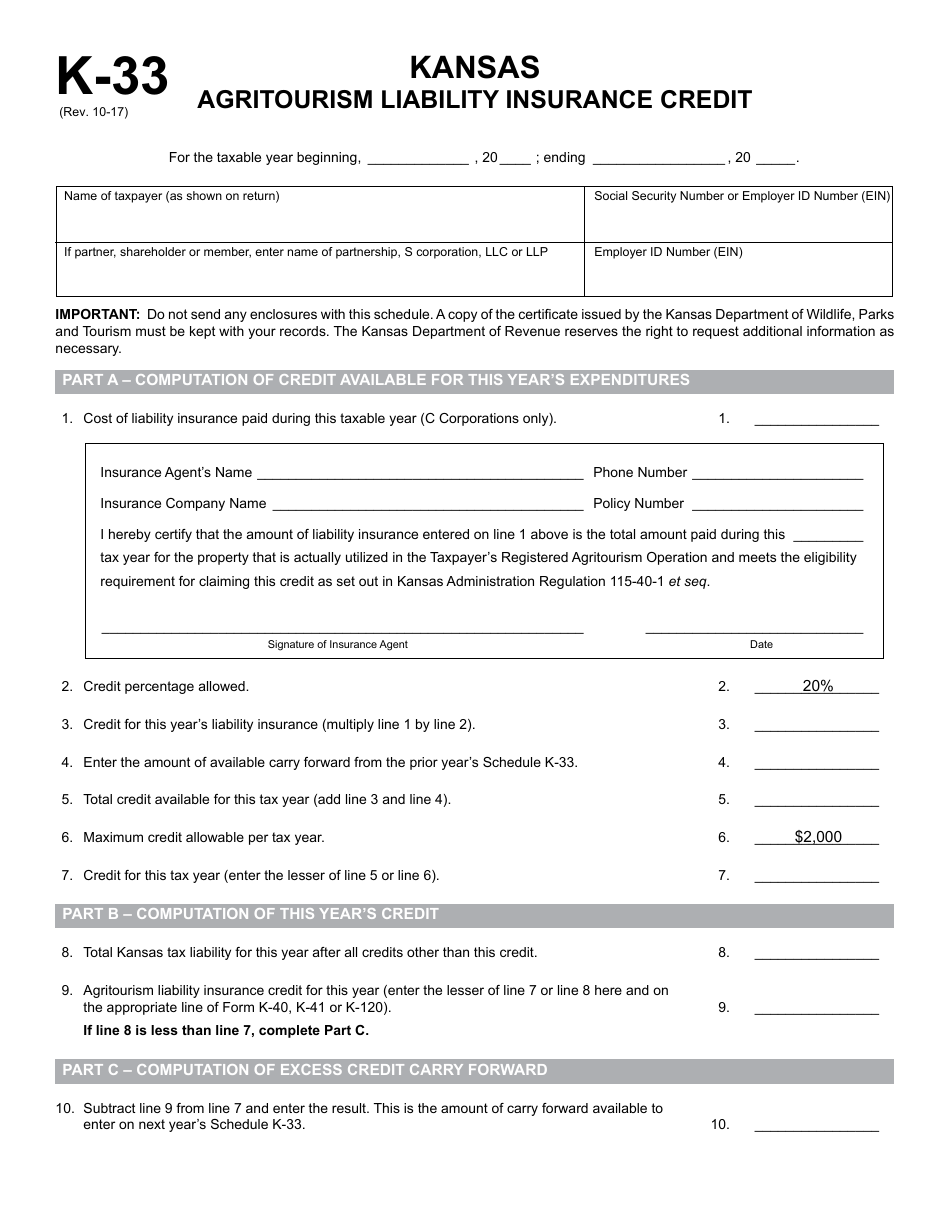

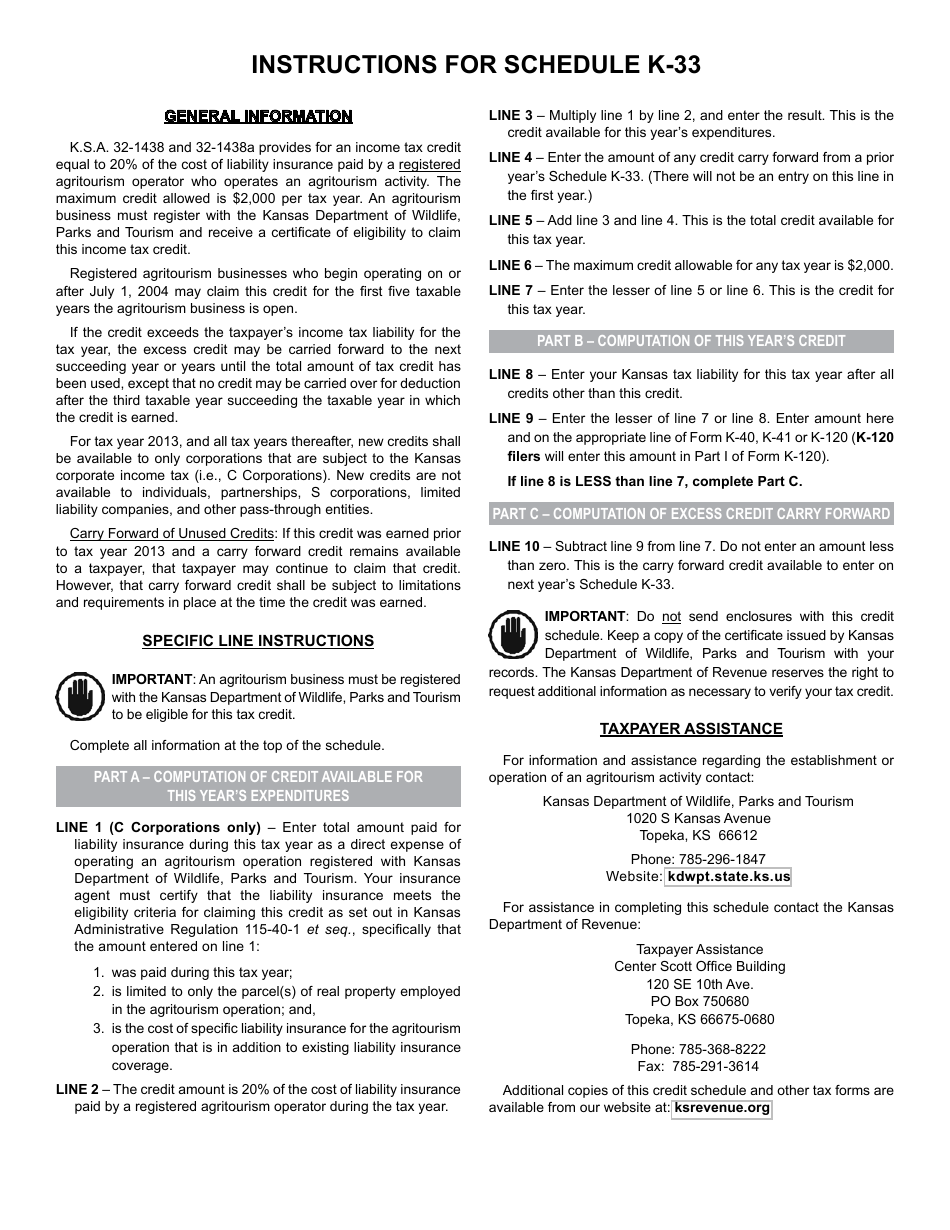

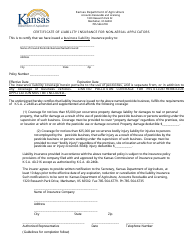

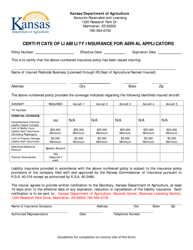

Schedule K-33 Agritourism Liability Insurance Credit - Kansas

What Is Schedule K-33?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-33 Agritourism Liability Insurance Credit?

A: Schedule K-33 is a form used for claiming the Agritourism Liability Insurance Credit in Kansas.

Q: What is Agritourism?

A: Agritourism refers to activities that combine agriculture and tourism, such as farm tours, pumpkin patches, or corn mazes.

Q: Who is eligible for the Agritourism Liability Insurance Credit?

A: Farmers or ranchers in Kansas who have an agritourism enterprise are eligible for this credit.

Q: What is the purpose of the Agritourism Liability Insurance Credit?

A: The credit is designed to provide financial assistance to farmers or ranchers to help cover the cost of liability insurance for their agritourism activities.

Q: How much is the Agritourism Liability Insurance Credit?

A: The credit is equal to 40% of the premium cost paid by the farmer or rancher for liability insurance coverage, up to a maximum credit of $6000.

Q: How can farmers or ranchers claim the Agritourism Liability Insurance Credit?

A: Farmers or ranchers can claim the credit by completing and filing Schedule K-33 along with their Kansas income tax return.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-33 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.