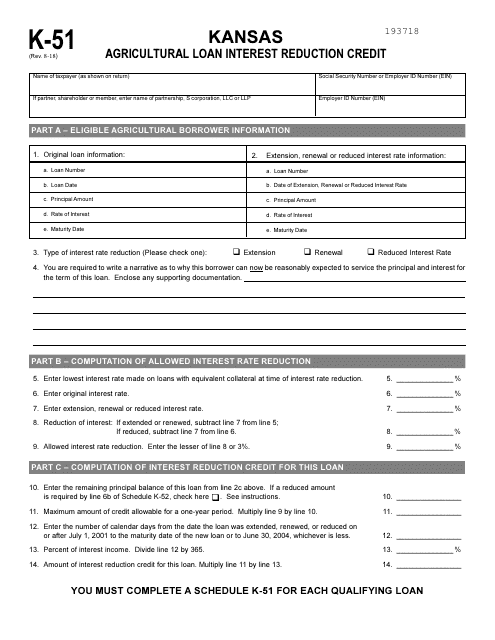

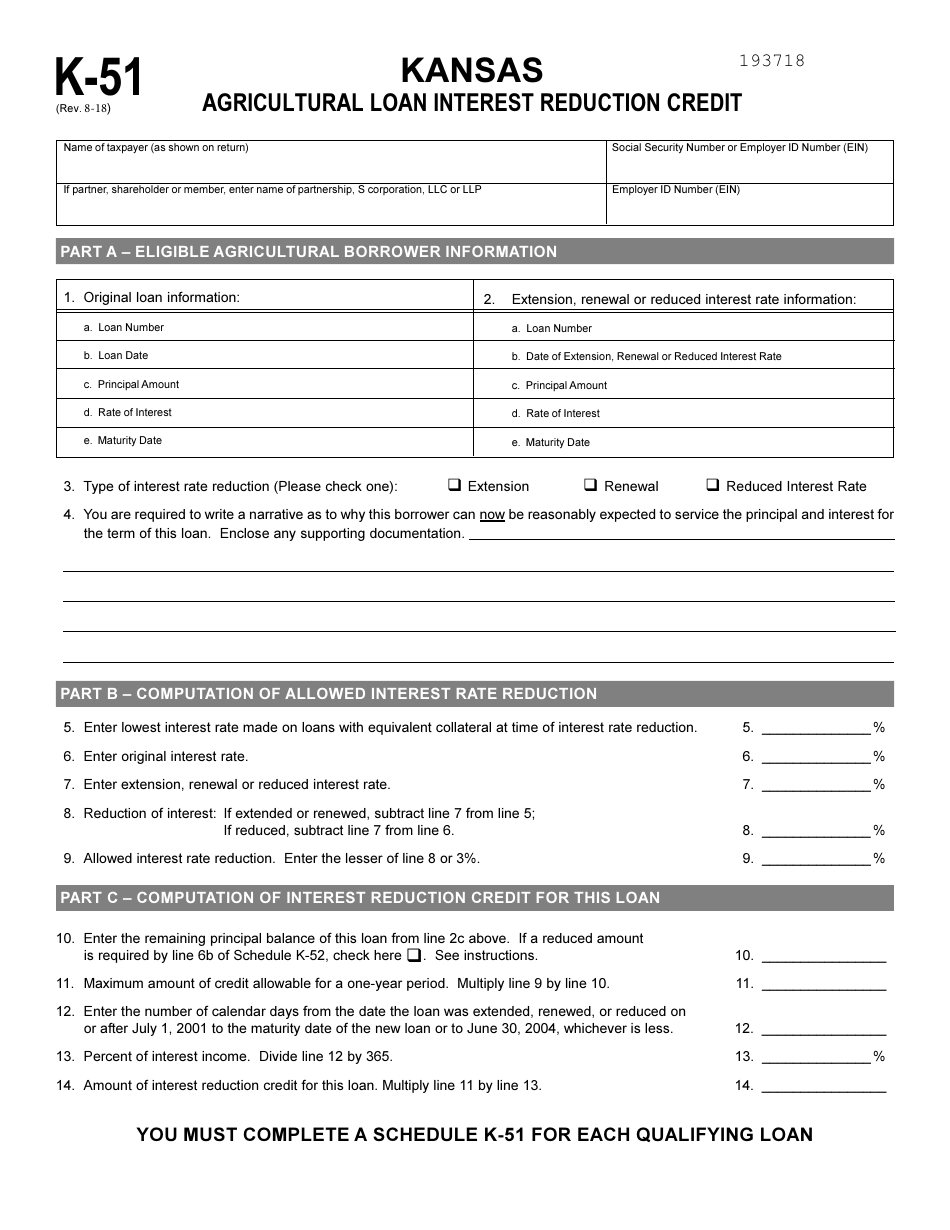

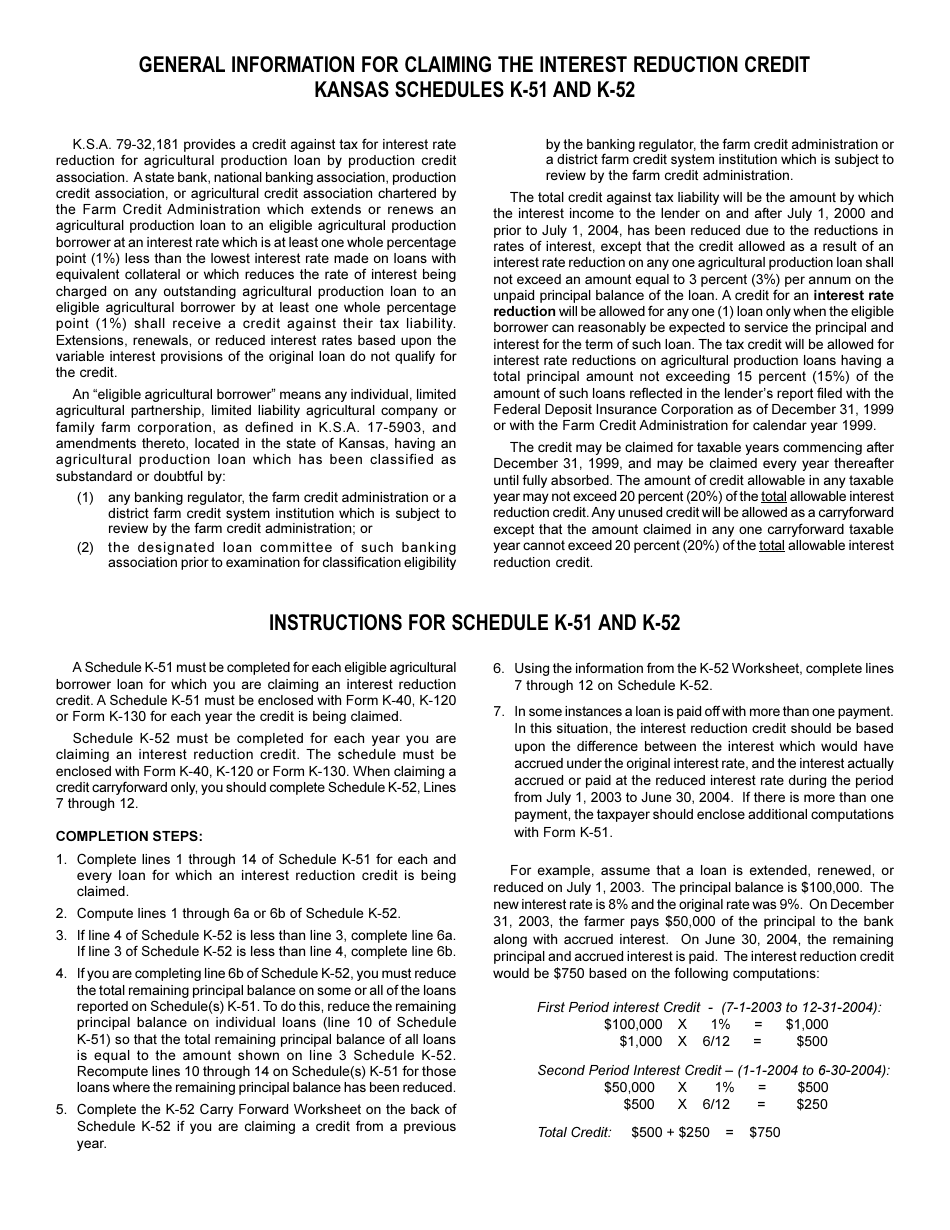

Schedule K-51 Agricultural Loan Interest Reduction Credit - Kansas

What Is Schedule K-51?

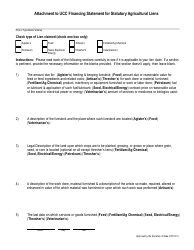

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-51?

A: Schedule K-51 is a form used in Kansas to claim the Agricultural Loan Interest Reduction Credit.

Q: What is the Agricultural Loan Interest Reduction Credit?

A: The Agricultural Loan Interest Reduction Credit is a credit that allows eligible farmers in Kansas to receive a reduction in the interest paid on their agricultural loans.

Q: Who is eligible for the Agricultural Loan Interest Reduction Credit?

A: Eligible farmers in Kansas may claim the credit if they have made interest payments on agricultural loans.

Q: How does the Agricultural Loan Interest Reduction Credit work?

A: Farmers who qualify for the credit can claim a credit equal to a percentage of the interest paid on their agricultural loans.

Q: Is there a deadline to file Schedule K-51?

A: Yes, Schedule K-51 must be filed with your Kansas tax return by the due date (usually April 15th).

Q: Can the credit be carried forward or back?

A: No, the Agricultural Loan Interest Reduction Credit cannot be carried forward or back. It can only be claimed for the tax year in which the interest was paid.

Q: Are there any limitations on the credit?

A: Yes, there is a maximum credit amount that can be claimed per taxpayer each year. The maximum credit is determined by the Kansas Department of Revenue.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule K-51 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.