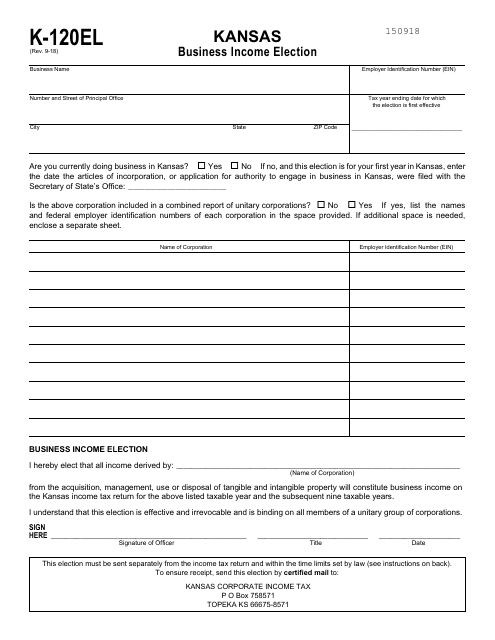

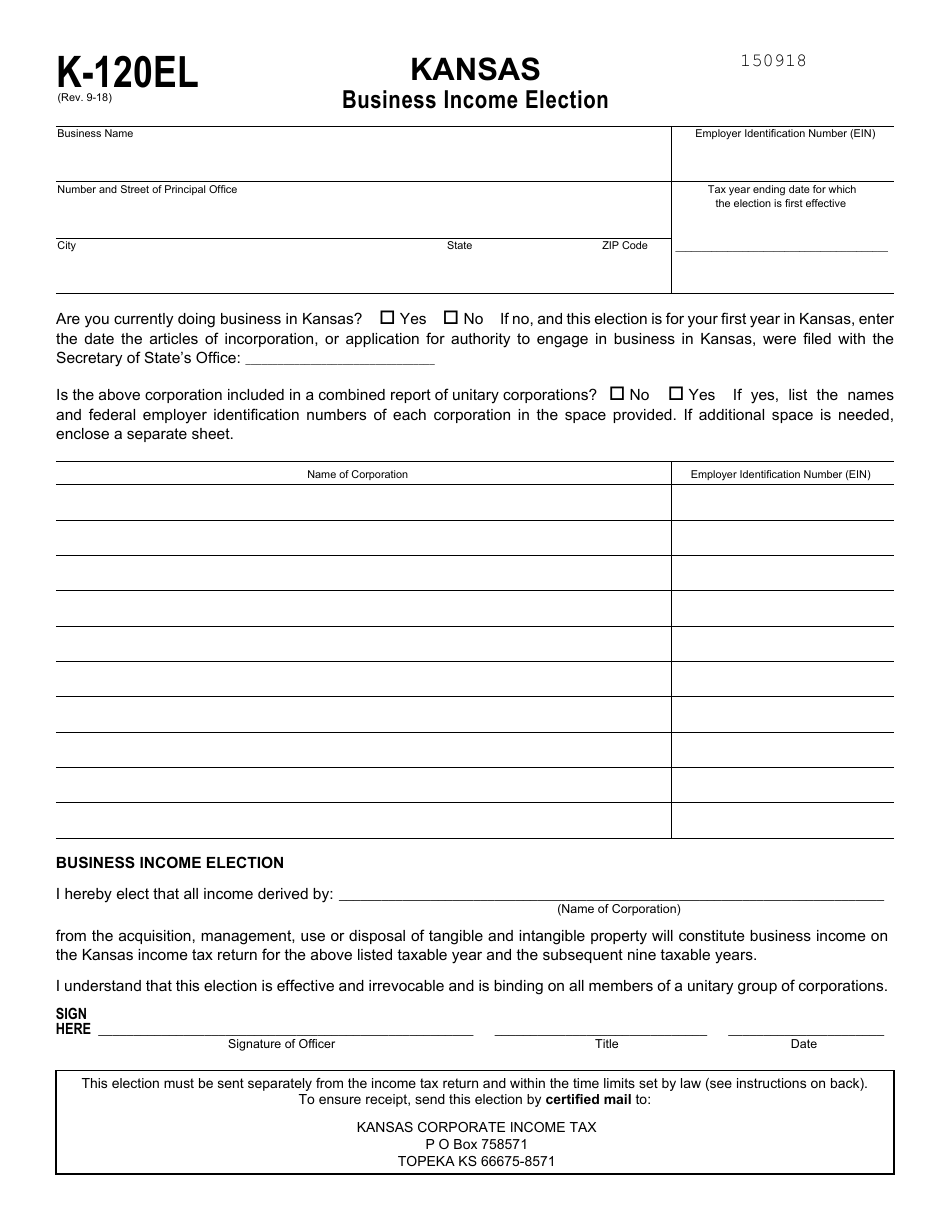

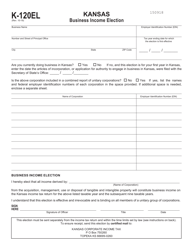

Form K-120EL Kansas Business Income Election - Kansas

What Is Form K-120EL?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-120EL?

A: Form K-120EL is a form used in Kansas to elect to apportion business income to Kansas.

Q: What is the purpose of Form K-120EL?

A: The purpose of Form K-120EL is to allow businesses to choose to allocate and apportion income to Kansas.

Q: Who needs to file Form K-120EL?

A: Businesses that have income or loss from business activity both within and outside of Kansas may need to file Form K-120EL.

Q: Do I need to file Form K-120EL if I have no business income in Kansas?

A: No, if you have no business income in Kansas, you do not need to file Form K-120EL.

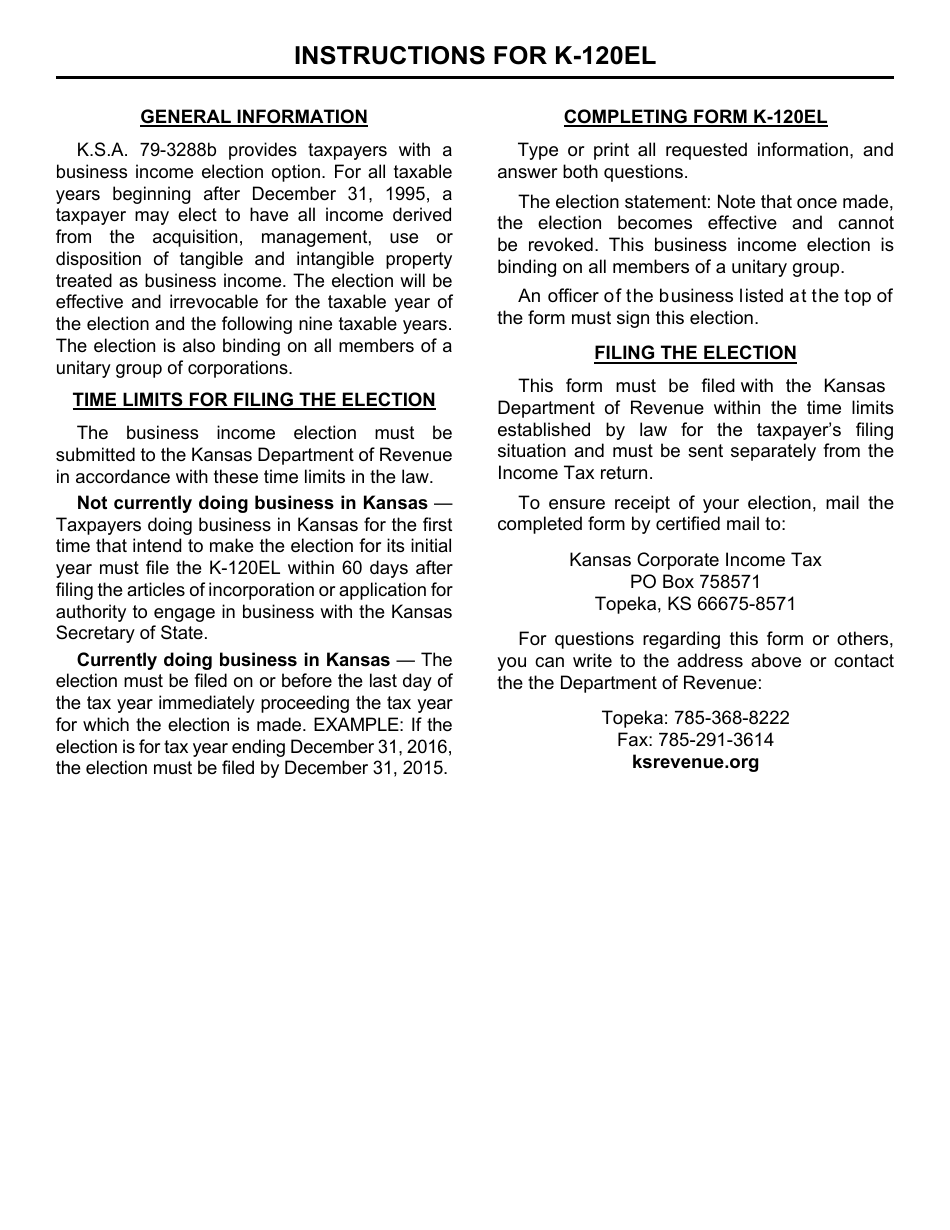

Q: What is the deadline for filing Form K-120EL?

A: Form K-120EL is due on or before the original due date of the Kansas income tax return.

Q: Can I amend my election on Form K-120EL?

A: No, once an election is made on Form K-120EL, it cannot be amended or revoked.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-120EL by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.