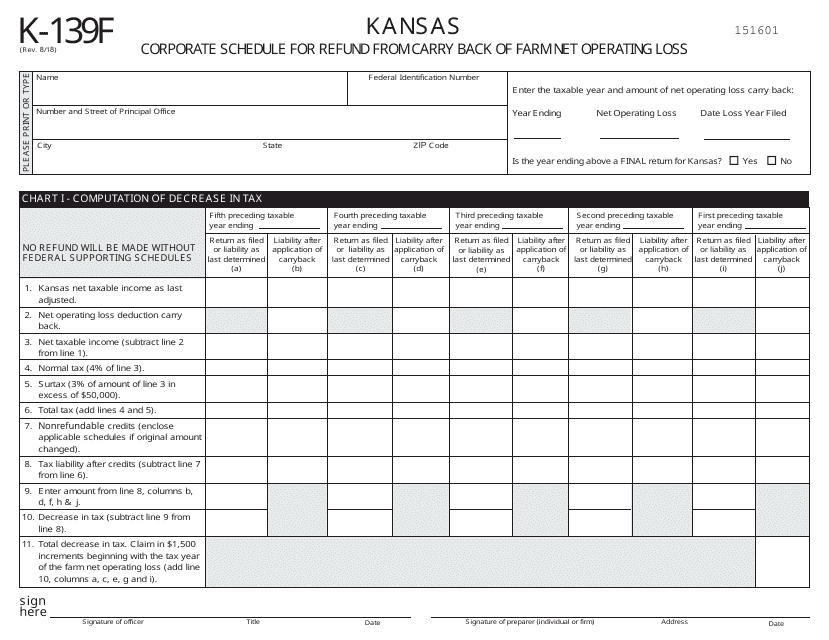

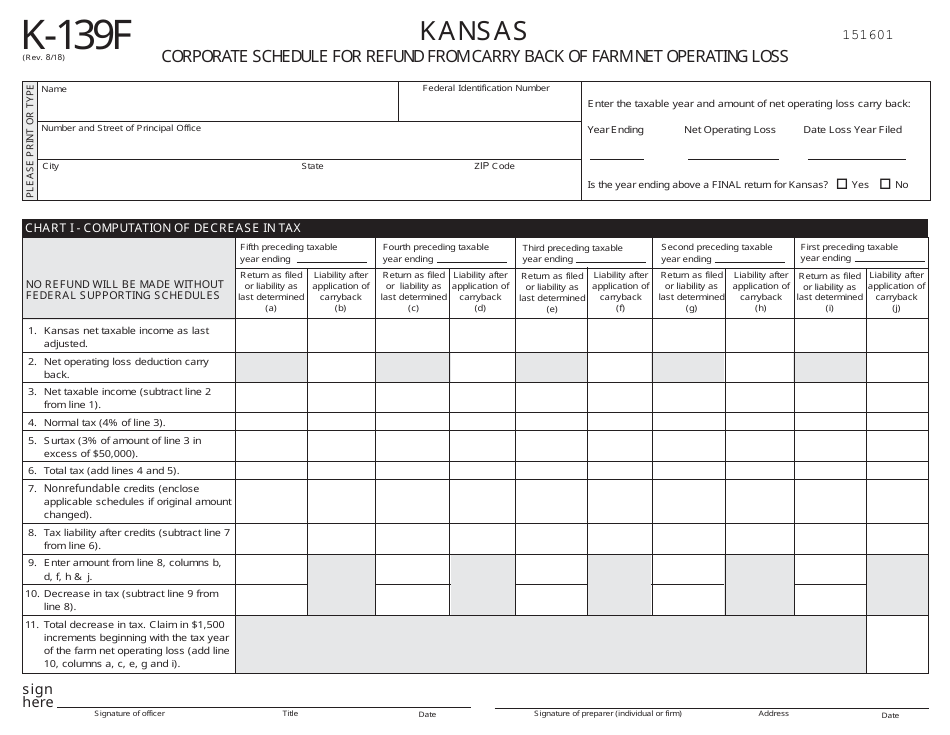

Schedule K-139F Kansas Corporate Schedule for Refund From Carry Back of Farm Net Operating Loss - Kansas

What Is Schedule K-139F?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-139F?

A: Schedule K-139F is the Kansas Corporate Schedule for Refund From Carry Back of Farm Net Operating Loss.

Q: What is a net operating loss?

A: A net operating loss occurs when a farm's allowable deductions exceed its taxable income in a given tax year.

Q: Who is required to file Schedule K-139F?

A: Farm corporations in Kansas that have a net operating loss and wish to carry back that loss to a previous tax year to obtain a refund.

Q: What is the purpose of Schedule K-139F?

A: The purpose of Schedule K-139F is to calculate the amount of refund a farm corporation can obtain by carrying back their net operating loss.

Q: Are there any eligibility requirements for filing Schedule K-139F?

A: Yes, the farm corporation must have a net operating loss and meet certain criteria set by the Kansas Department of Revenue.

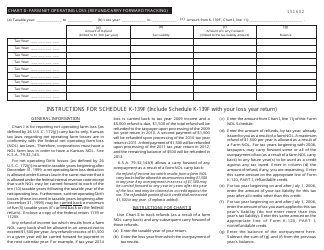

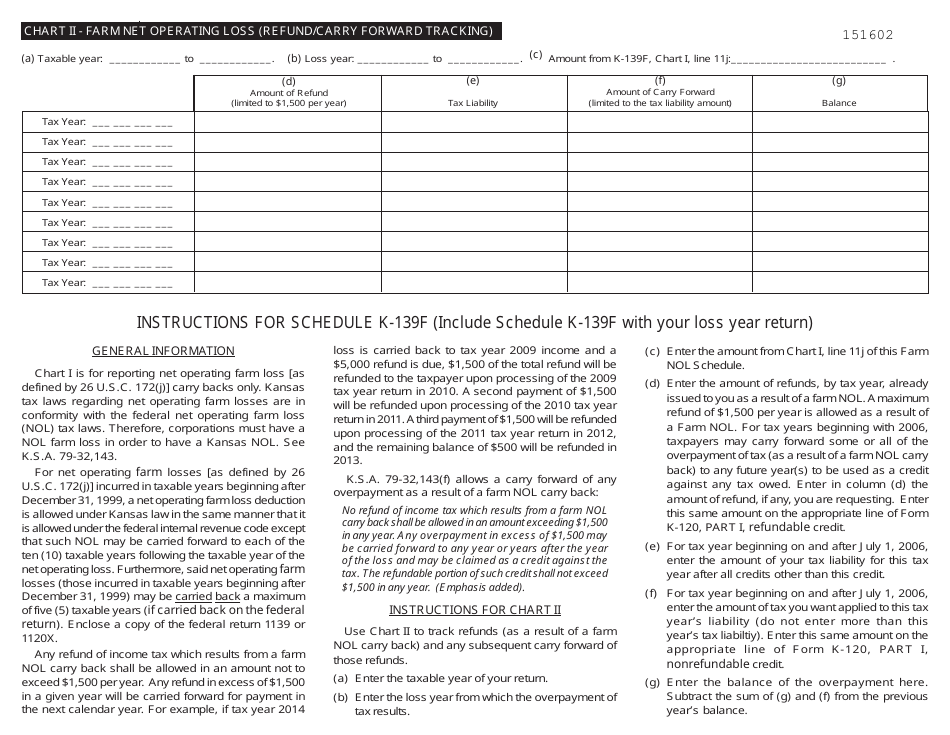

Q: Are there any specific instructions for completing Schedule K-139F?

A: Yes, the Kansas Department of Revenue provides detailed instructions that guide taxpayers on how to complete the form accurately.

Q: Is Schedule K-139F applicable for individual taxpayers?

A: No, Schedule K-139F is specifically designed for farm corporations and does not apply to individual taxpayers or non-farm corporations.

Q: When is the deadline for filing Schedule K-139F?

A: The deadline for filing Schedule K-139F is typically the same as the deadline for filing the farm corporation's income tax return, which is generally March 15th for calendar year taxpayers.

Q: Can I e-file Schedule K-139F?

A: Yes, the Kansas Department of Revenue allows taxpayers to e-file Schedule K-139F if they meet the necessary requirements.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-139F by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.