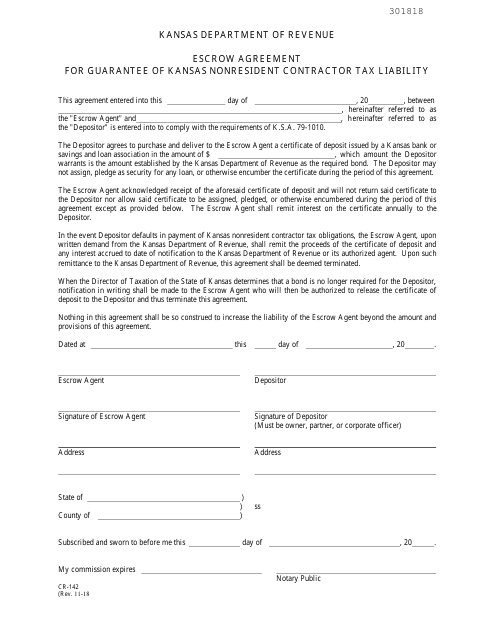

Form CR-142 Escrow Agreement for Guarantee of Kansas Nonresident Contractor Tax Liability - Kansas

What Is Form CR-142?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CR-142?

A: Form CR-142 is the Escrow Agreement for Guarantee of Kansas Nonresident Contractor Tax Liability in Kansas.

Q: Who is required to complete and submit Form CR-142?

A: Nonresident contractors working in Kansas are required to complete and submit Form CR-142.

Q: What is the purpose of Form CR-142?

A: The purpose of Form CR-142 is to establish an escrow account to guarantee payment of any unpaid nonresident contractor taxes in Kansas.

Q: How do I complete Form CR-142?

A: Form CR-142 requires you to provide information such as your business name, address, contractor identification number, and the amount to be deposited into the escrow account.

Q: How do I submit Form CR-142?

A: You can submit Form CR-142 by mail or in person to the Kansas Department of Revenue.

Q: What happens after I submit Form CR-142?

A: Once you submit Form CR-142, the Kansas Department of Revenue will review the form and establish an escrow account for your nonresident contractor tax liability.

Q: Do I need to maintain the escrow account after submitting Form CR-142?

A: Yes, you are required to maintain the escrow account until the Kansas Department of Revenue releases the funds or notifies you of any changes.

Q: What are the penalties for failure to submit Form CR-142?

A: Failure to submit Form CR-142 may result in penalties, fines, and legal consequences.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CR-142 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.