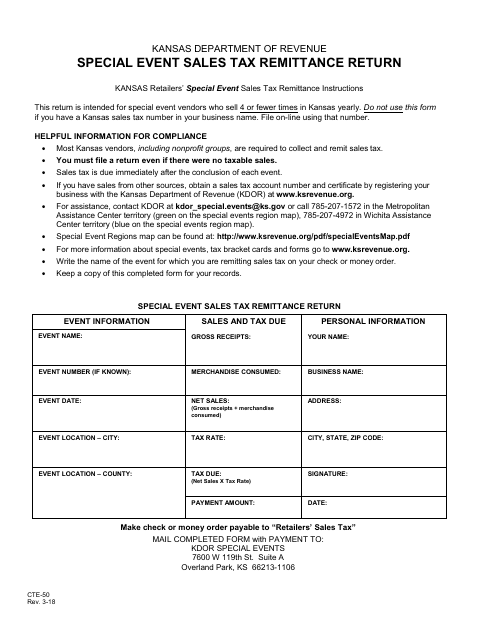

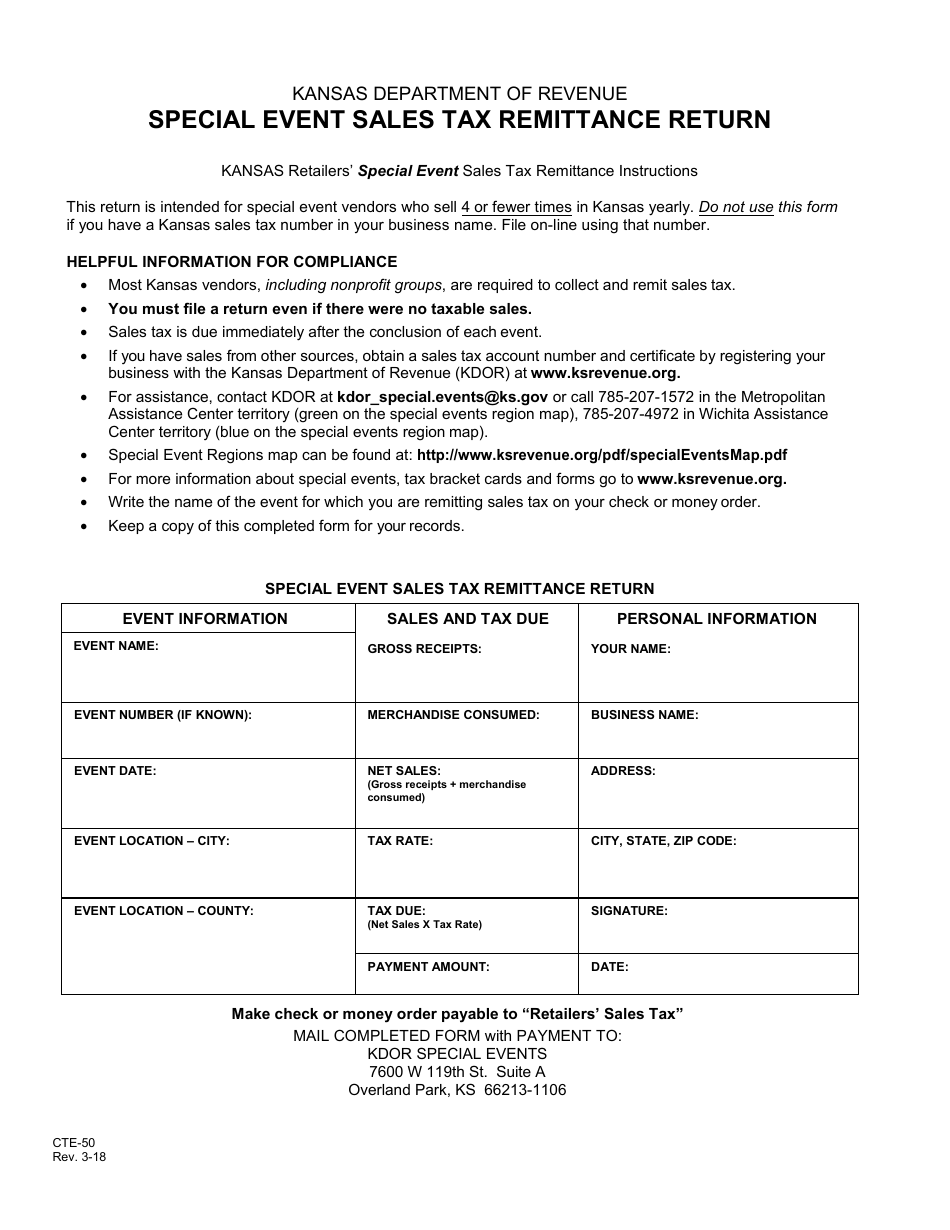

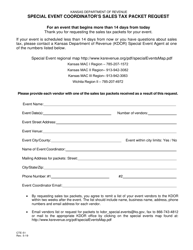

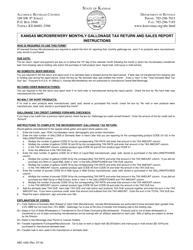

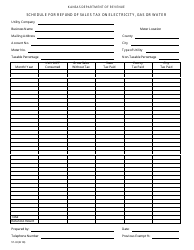

Form CTE-50 Special Event Sales Tax Remittance Return - Kansas

What Is Form CTE-50?

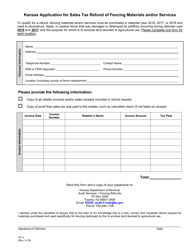

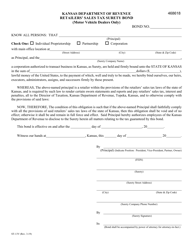

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CTE-50?

A: Form CTE-50 is the Special Event Sales Tax Remittance Return for Kansas.

Q: What is the purpose of Form CTE-50?

A: The purpose of Form CTE-50 is to report and remit sales tax collected from special events in Kansas.

Q: Who needs to file Form CTE-50?

A: Businesses or individuals hosting special events in Kansas that are required to collect sales tax need to file Form CTE-50.

Q: What is considered a special event?

A: Special events include concerts, fairs, festivals, and other temporary events where sales tax is collected.

Q: When is Form CTE-50 due?

A: Form CTE-50 is due on or before the 25th day of the month following the end of the special event.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing, ranging from a percentage of the tax due to a flat dollar amount per return.

Q: What information do I need to provide on Form CTE-50?

A: You need to provide information such as event details, sales amounts, and tax collected during the special event.

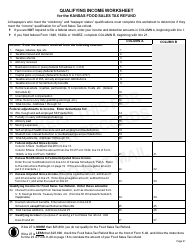

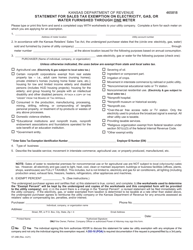

Q: Can I claim any deductions on Form CTE-50?

A: Yes, you can claim deductions for sales returned or refunded and sales made to other exempt entities.

Form Details:

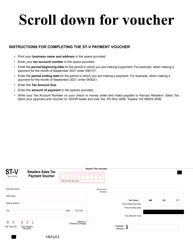

- Released on March 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CTE-50 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.