This version of the form is not currently in use and is provided for reference only. Download this version of

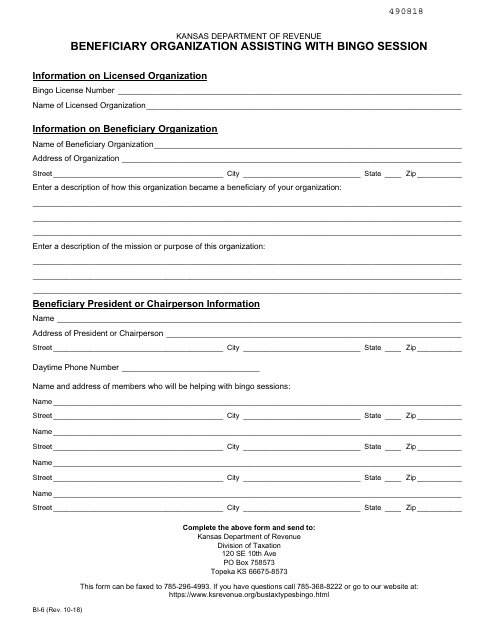

Form BI-6

for the current year.

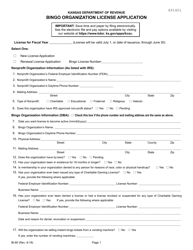

Form BI-6 Beneficiary Organization Assisting With Bingo Session - Kansas

What Is Form BI-6?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BI-6?

A: Form BI-6 is a document for a beneficiary organization assisting with a bingo session in Kansas.

Q: What is a beneficiary organization?

A: A beneficiary organization is a nonprofit organization that receives the proceeds of a bingo session.

Q: Who needs to fill out Form BI-6?

A: The beneficiary organization assisting with a bingo session in Kansas needs to fill out Form BI-6.

Q: What information is required on Form BI-6?

A: Form BI-6 requires information such as the organization's name, address, contact information, and the date and location of the bingo session.

Q: How should Form BI-6 be submitted?

A: Form BI-6 should be submitted to the Kansas Department of Revenue along with any other required documentation.

Q: Is there a fee for submitting Form BI-6?

A: No, there is no fee for submitting Form BI-6.

Q: When should Form BI-6 be submitted?

A: Form BI-6 should be submitted at least 15 days before the bingo session.

Q: What happens after submitting Form BI-6?

A: After submitting Form BI-6, the beneficiary organization will receive a letter of approval or denial from the Kansas Department of Revenue.

Q: Can Form BI-6 be amended?

A: Yes, Form BI-6 can be amended if there are changes to the original information provided.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BI-6 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.