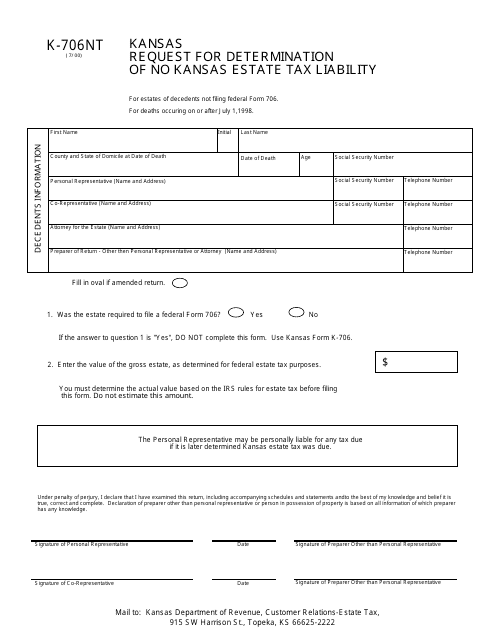

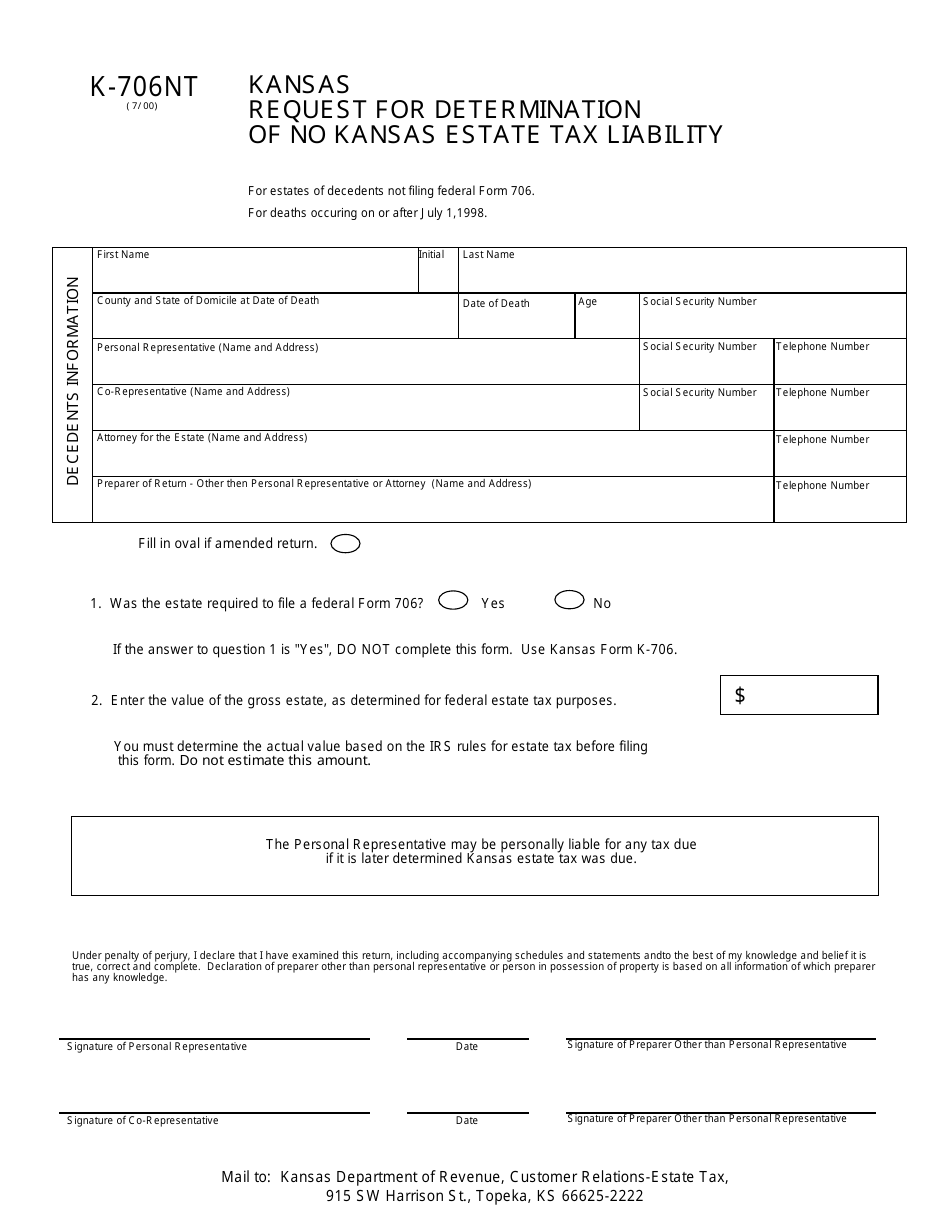

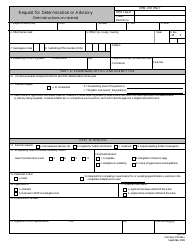

Form K-706NT Request for Determination of No Kansas Estate Tax Liability - Kansas

What Is Form K-706NT?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-706NT?

A: Form K-706NT is the Request for Determination of No Kansas Estate Tax Liability form in Kansas.

Q: What is the purpose of Form K-706NT?

A: The purpose of Form K-706NT is to request a determination of no Kansas estate tax liability.

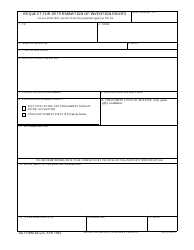

Q: Who is required to file Form K-706NT?

A: Individuals who believe they do not have any Kansas estate tax liability need to file Form K-706NT.

Q: Is there a deadline to file Form K-706NT?

A: Yes, Form K-706NT must be filed within nine months of the date of the decedent's death.

Q: Are there any fees associated with filing Form K-706NT?

A: No, there are no fees for filing Form K-706NT.

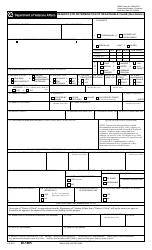

Q: What documents should be attached to Form K-706NT?

A: The following documents should be attached to Form K-706NT: federal estate tax return, Kansas inheritance tax return (if applicable), proof of payment of federal estate taxes (if applicable), and any other relevant supporting documents.

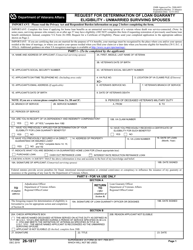

Form Details:

- Released on July 1, 2000;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-706NT by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.