This version of the form is not currently in use and is provided for reference only. Download this version of

Form CM-16

for the current year.

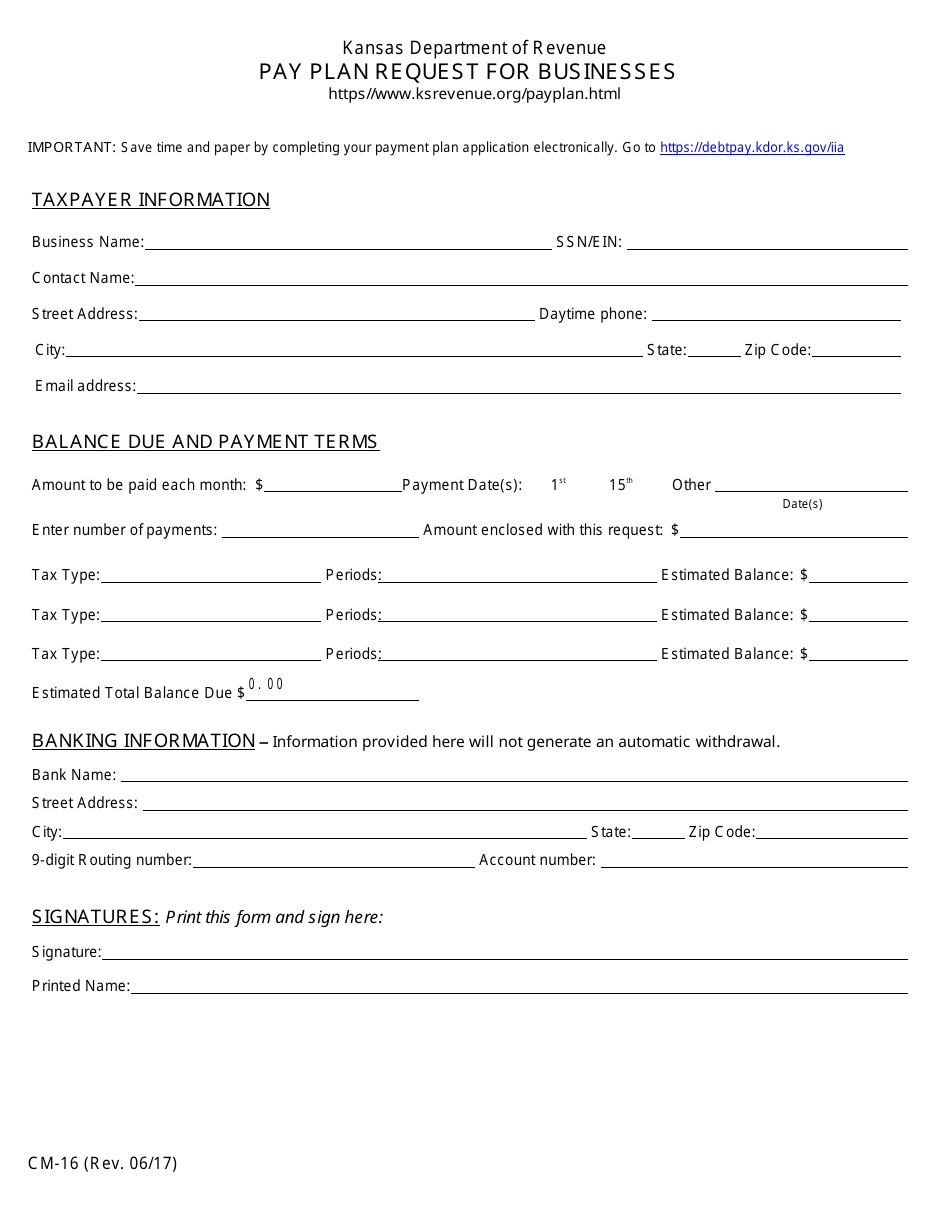

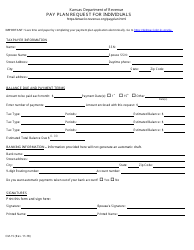

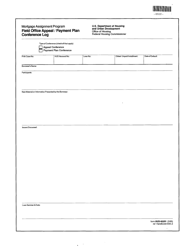

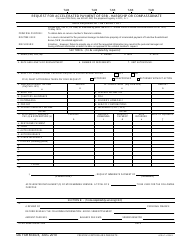

Form CM-16 Pay Plan Request for Businesses - Kansas

What Is Form CM-16?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CM-16?

A: Form CM-16 is a Pay Plan Request for Businesses in Kansas.

Q: Who needs to fill out Form CM-16?

A: Businesses in Kansas need to fill out Form CM-16 if they are requesting a pay plan.

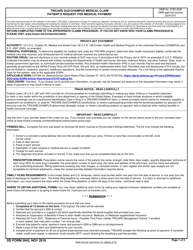

Q: What is a pay plan?

A: A pay plan is an arrangement between a business and the Kansas Department of Revenue to make installment payments for tax liabilities.

Q: Why would a business request a pay plan?

A: A business may request a pay plan if they are unable to pay their tax liabilities in full.

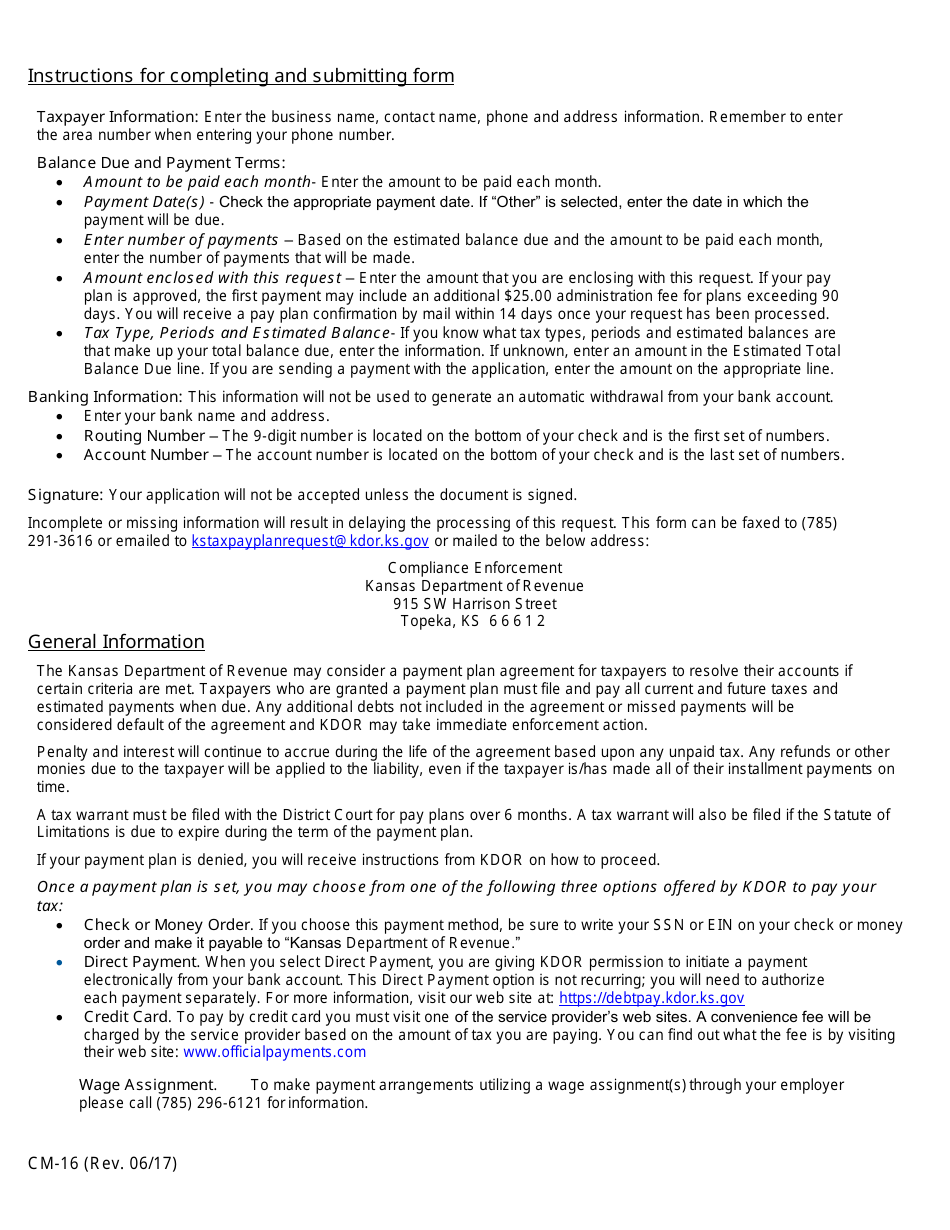

Q: Is there a fee for requesting a pay plan?

A: Yes, there is a non-refundable fee for requesting a pay plan, and it must be submitted with Form CM-16.

Q: What information is required on Form CM-16?

A: Form CM-16 requires the business's tax identification number, contact information, and details about their tax liabilities and proposed payment plan.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CM-16 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.