This version of the form is not currently in use and is provided for reference only. Download this version of

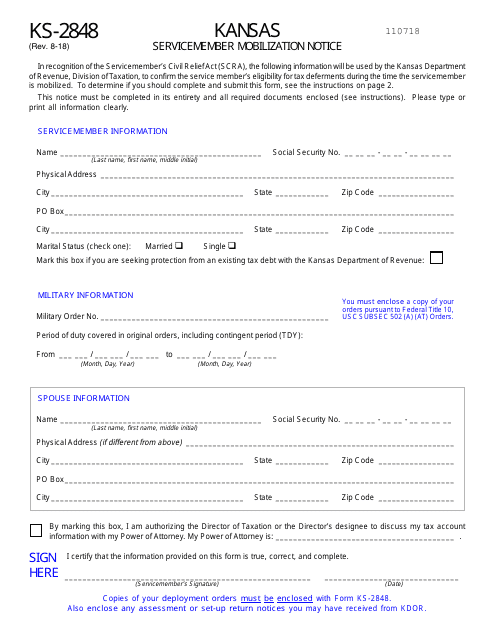

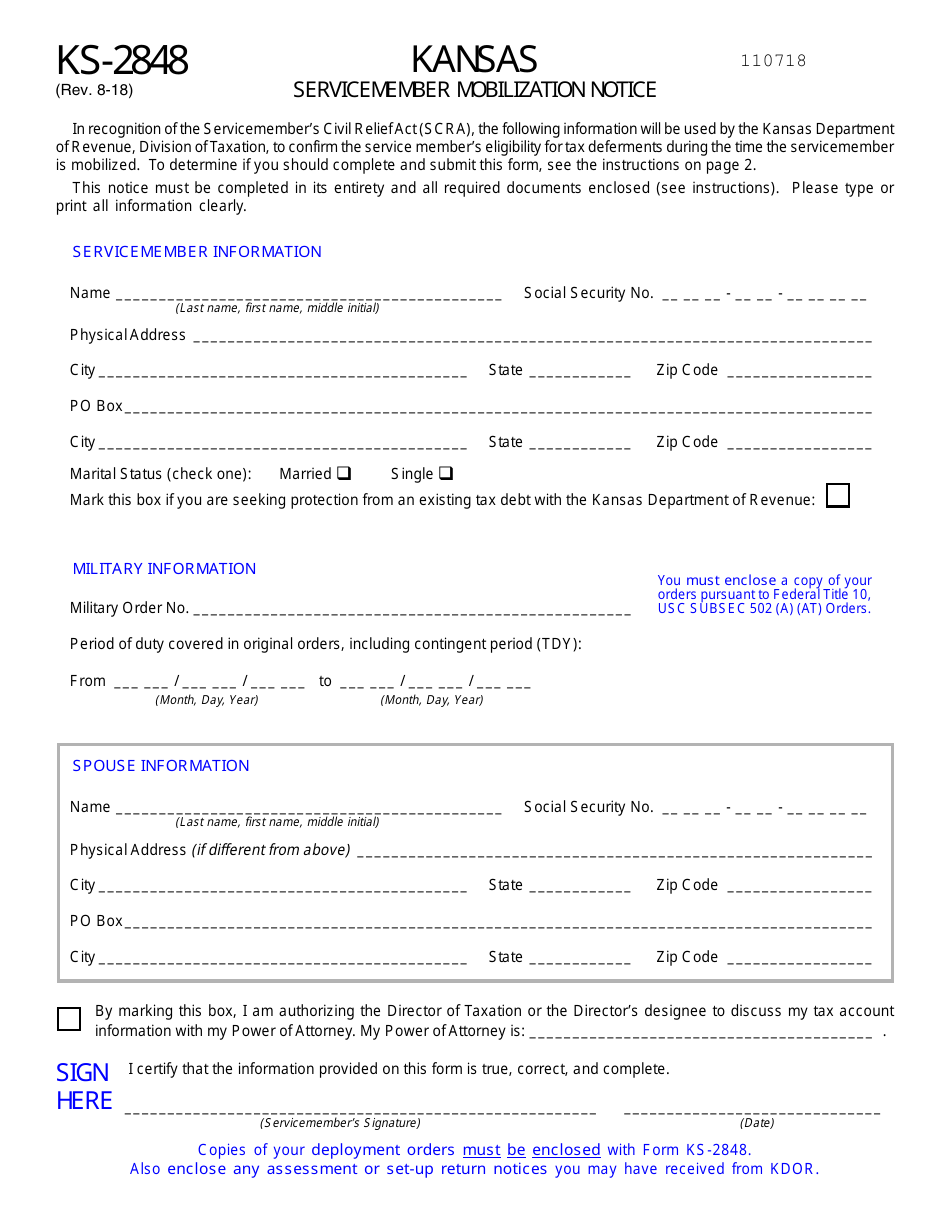

Form KS-2848

for the current year.

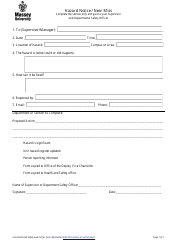

Form KS-2848 Kansas Servicemember Mobilization Notice - Kansas

What Is Form KS-2848?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form KS-2848?

A: Form KS-2848 is the Kansas Servicemember Mobilization Notice.

Q: Who needs to fill out Form KS-2848?

A: Form KS-2848 needs to be filled out by Kansas servicemembers who are being mobilized or deployed.

Q: What is the purpose of Form KS-2848?

A: The purpose of Form KS-2848 is to provide notice to the Kansas Department of Revenue that a servicemember is being mobilized or deployed, so that certain tax benefits and protections can be applied.

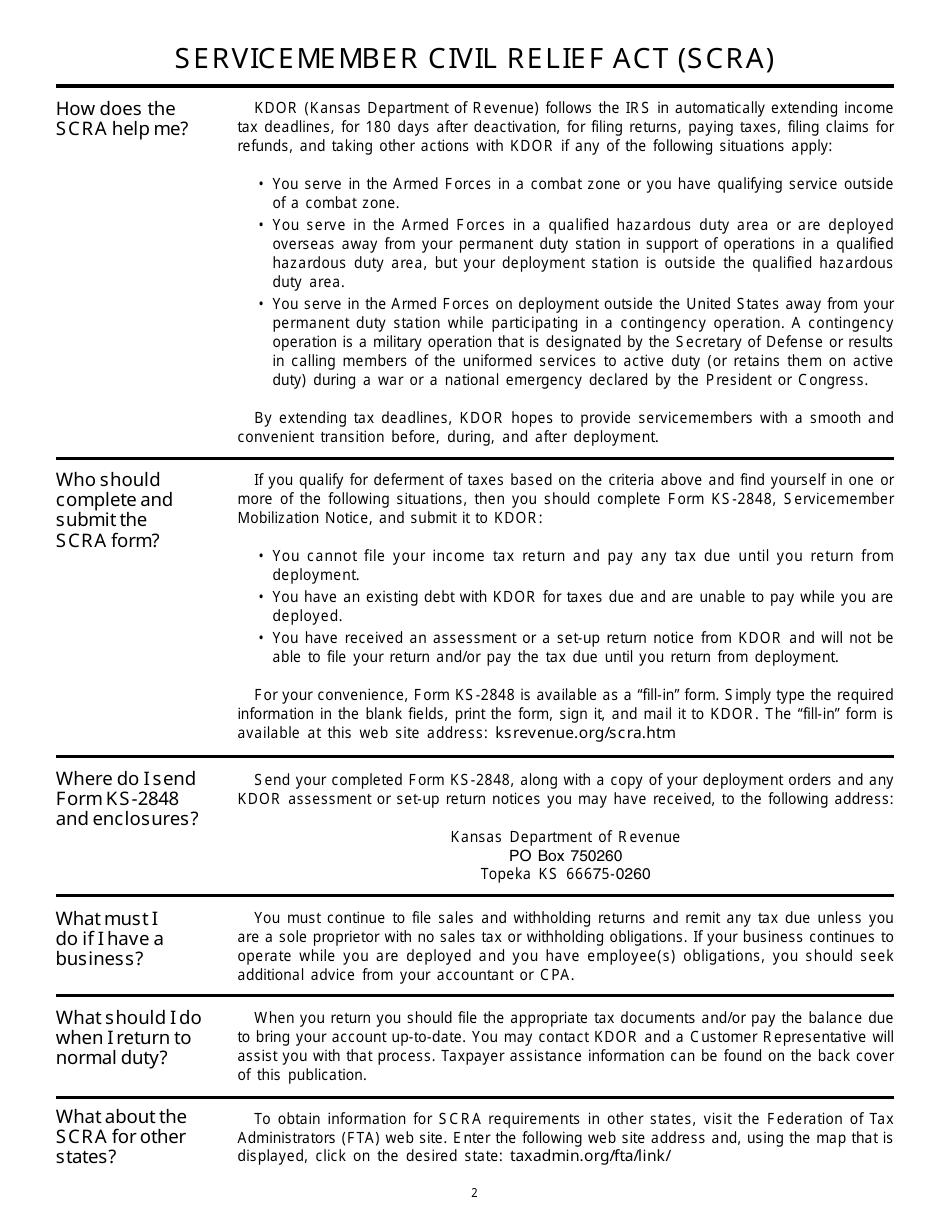

Q: What tax benefits and protections are provided through Form KS-2848?

A: Form KS-2848 provides tax benefits and protections to mobilized or deployed Kansas servicemembers, such as an extension of certain tax deadlines and relief from certain tax obligations.

Q: Do I need to fill out Form KS-2848 if I am not a Kansas resident?

A: No, Form KS-2848 is only for Kansas servicemembers who are being mobilized or deployed.

Q: How do I submit Form KS-2848?

A: Form KS-2848 should be mailed or faxed to the Kansas Department of Revenue. The contact information is provided on the form itself.

Q: What should I do if I have questions about Form KS-2848?

A: If you have questions about Form KS-2848, you can contact the Kansas Department of Revenue or seek assistance from a tax professional.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form KS-2848 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.