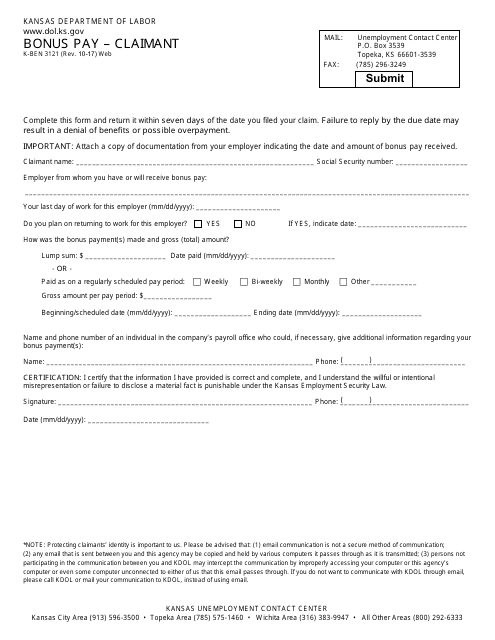

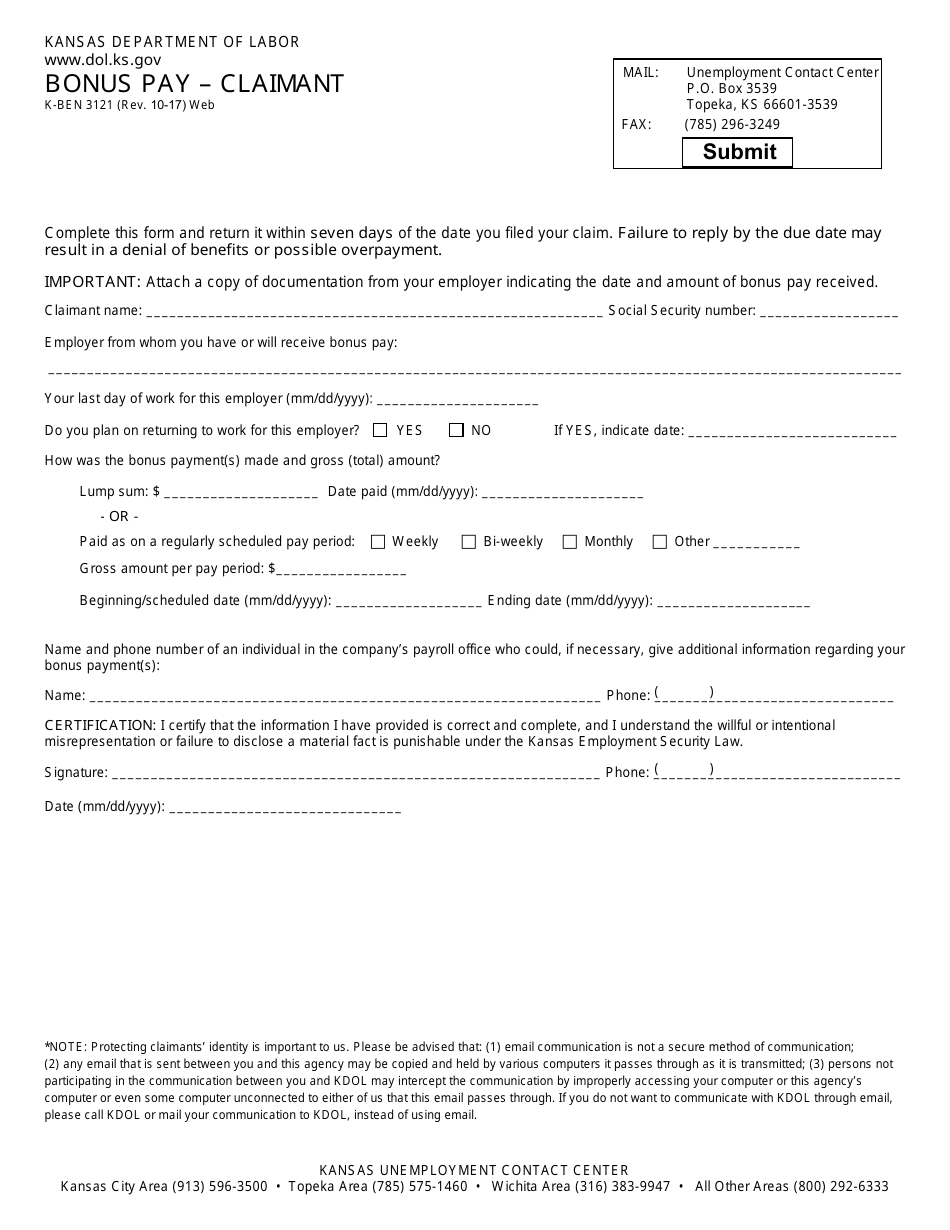

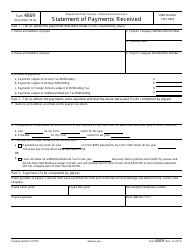

Form K-BEN3121 Bonus Pay - Claimant - Kansas

What Is Form K-BEN3121?

This is a legal form that was released by the Kansas Department of Labor - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-BEN3121?

A: Form K-BEN3121 is a form used by claimants in Kansas to claim bonus pay.

Q: Who can use Form K-BEN3121?

A: Claimants in Kansas can use Form K-BEN3121.

Q: What is bonus pay?

A: Bonus pay is an additional payment given to an employee, usually for meeting certain criteria or achieving specific goals.

Q: Why would someone need to claim bonus pay?

A: Someone may need to claim bonus pay if they believe they are eligible for it and have not received it.

Q: Is Form K-BEN3121 specific to Kansas?

A: Yes, Form K-BEN3121 is specific to Kansas.

Q: Are there any eligibility criteria for claiming bonus pay?

A: Yes, eligibility criteria for claiming bonus pay may vary depending on the employer's policies or specific program requirements.

Q: How long does it take to process a claim for bonus pay?

A: The processing time for a claim for bonus pay can vary depending on the employer and the complexity of the claim.

Q: Can an employer deny a claim for bonus pay?

A: Yes, an employer may deny a claim for bonus pay if the employee does not meet the eligibility criteria or if there are other valid reasons for denial.

Q: What can someone do if their claim for bonus pay is denied?

A: If a claim for bonus pay is denied, the claimant may have the option to appeal the decision or seek legal advice.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Kansas Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-BEN3121 by clicking the link below or browse more documents and templates provided by the Kansas Department of Labor.