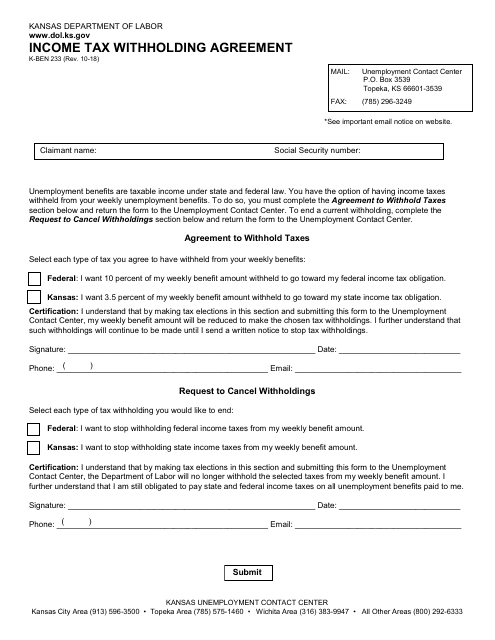

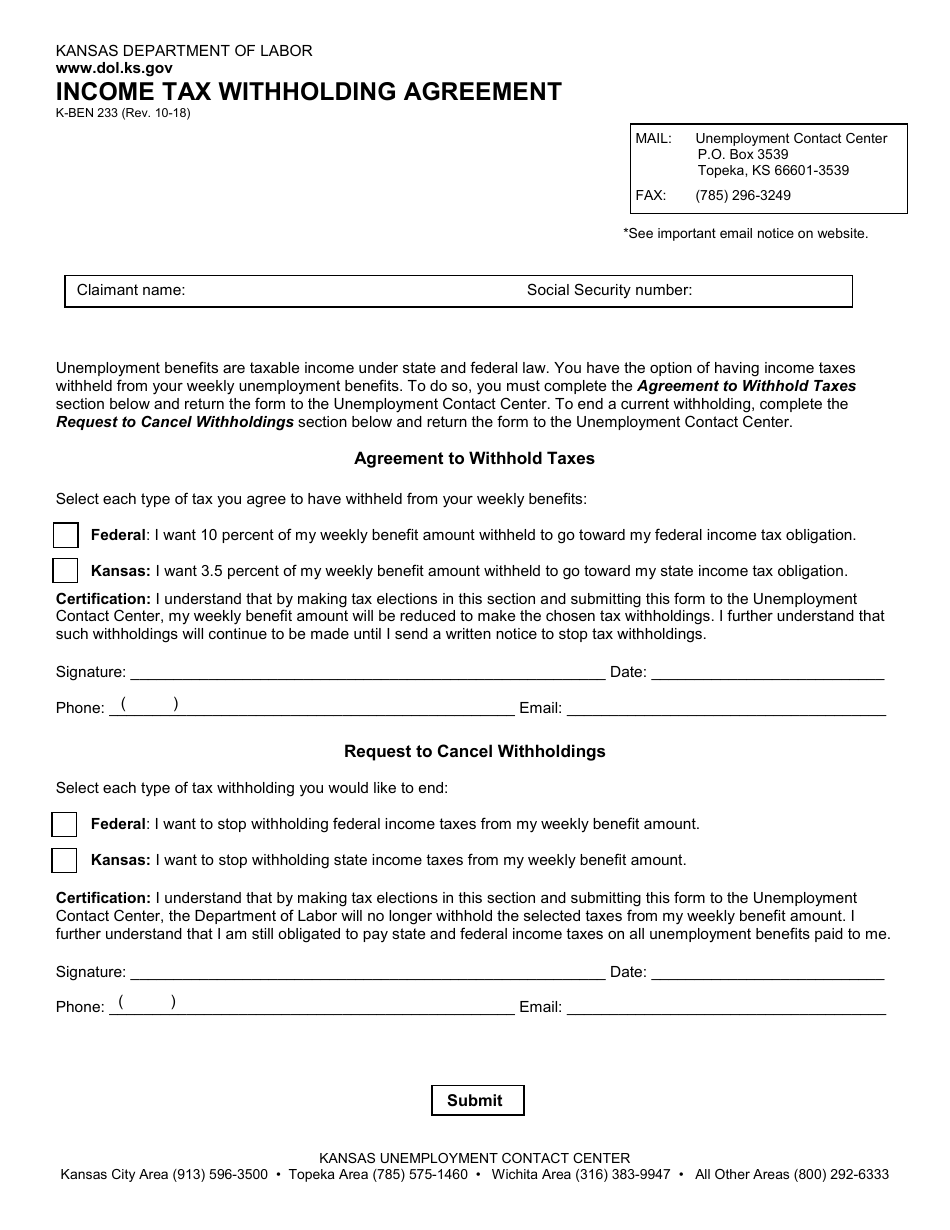

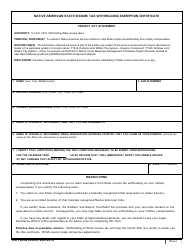

Form K-BEN233 Income Tax Withholding Agreement - Kansas

What Is Form K-BEN233?

This is a legal form that was released by the Kansas Department of Labor - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-BEN233?

A: Form K-BEN233 is an Income Tax Withholding Agreement used in the state of Kansas.

Q: Who needs to fill out Form K-BEN233?

A: Employers in Kansas who are required to withhold income tax from their employees' wages need to fill out Form K-BEN233.

Q: What is the purpose of Form K-BEN233?

A: The purpose of Form K-BEN233 is to establish an agreement between the employer and the Kansas Department of Revenue regarding the withholding of income tax.

Q: What information is required on Form K-BEN233?

A: Form K-BEN233 requires basic information about the employer, such as the employer's name, address, federal employer identification number (FEIN), and contact information.

Q: How does Form K-BEN233 affect employees?

A: Form K-BEN233 ensures that the employer withholds the correct amount of income tax from employees' wages and remits it to the Kansas Department of Revenue.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Kansas Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-BEN233 by clicking the link below or browse more documents and templates provided by the Kansas Department of Labor.