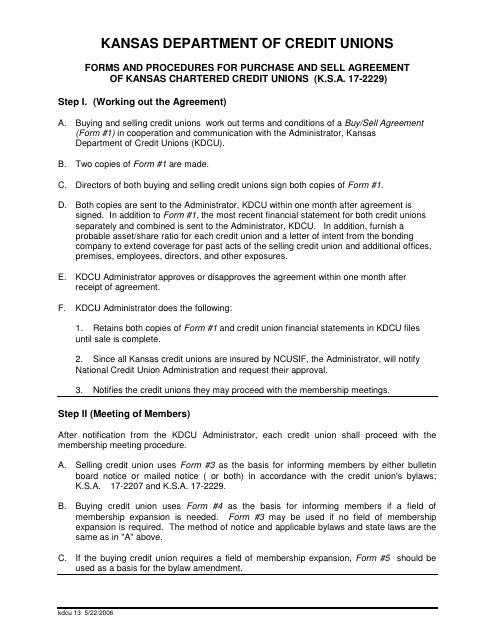

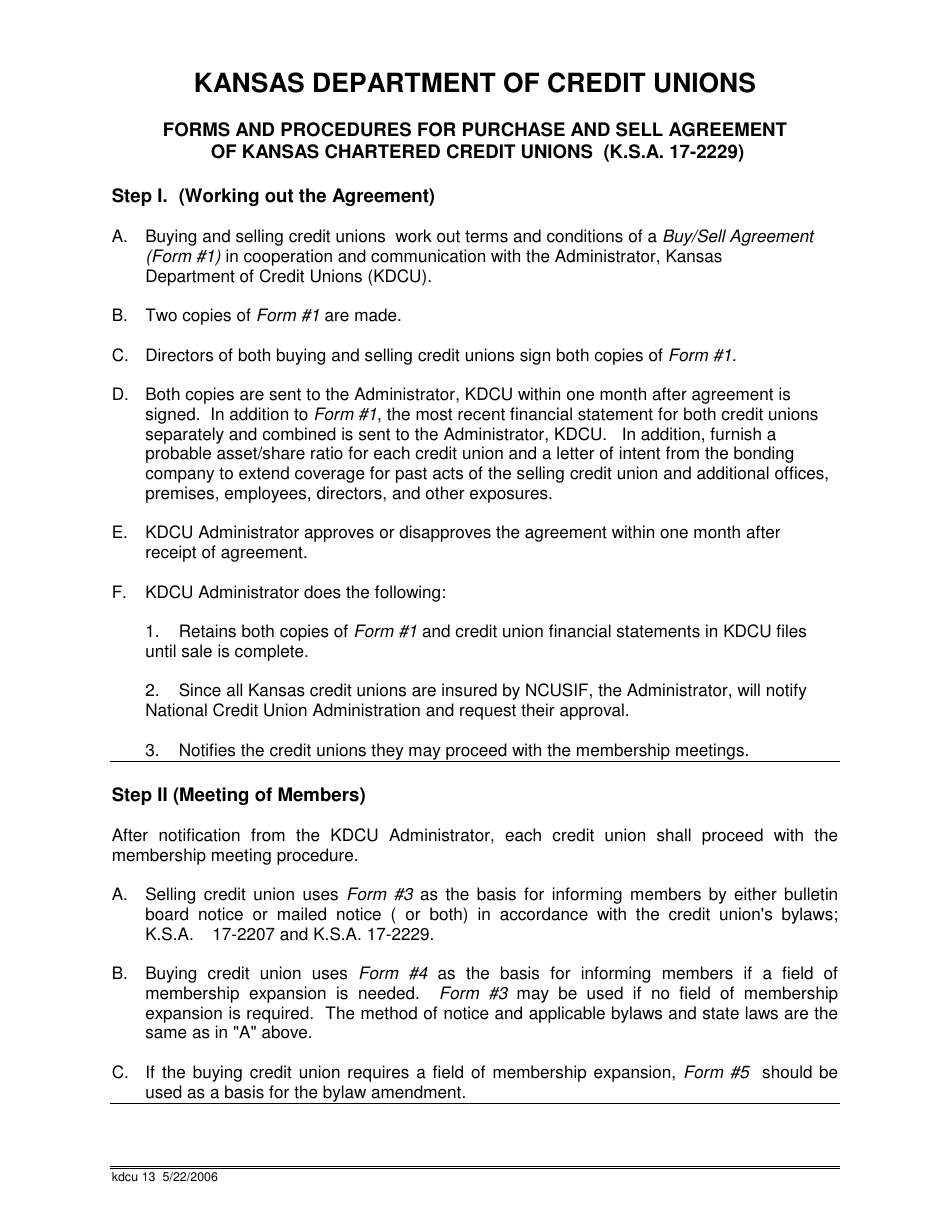

Forms and Procedures for Purchase and Sell Agreement of Kansas Chartered Credit Unions - Kansas

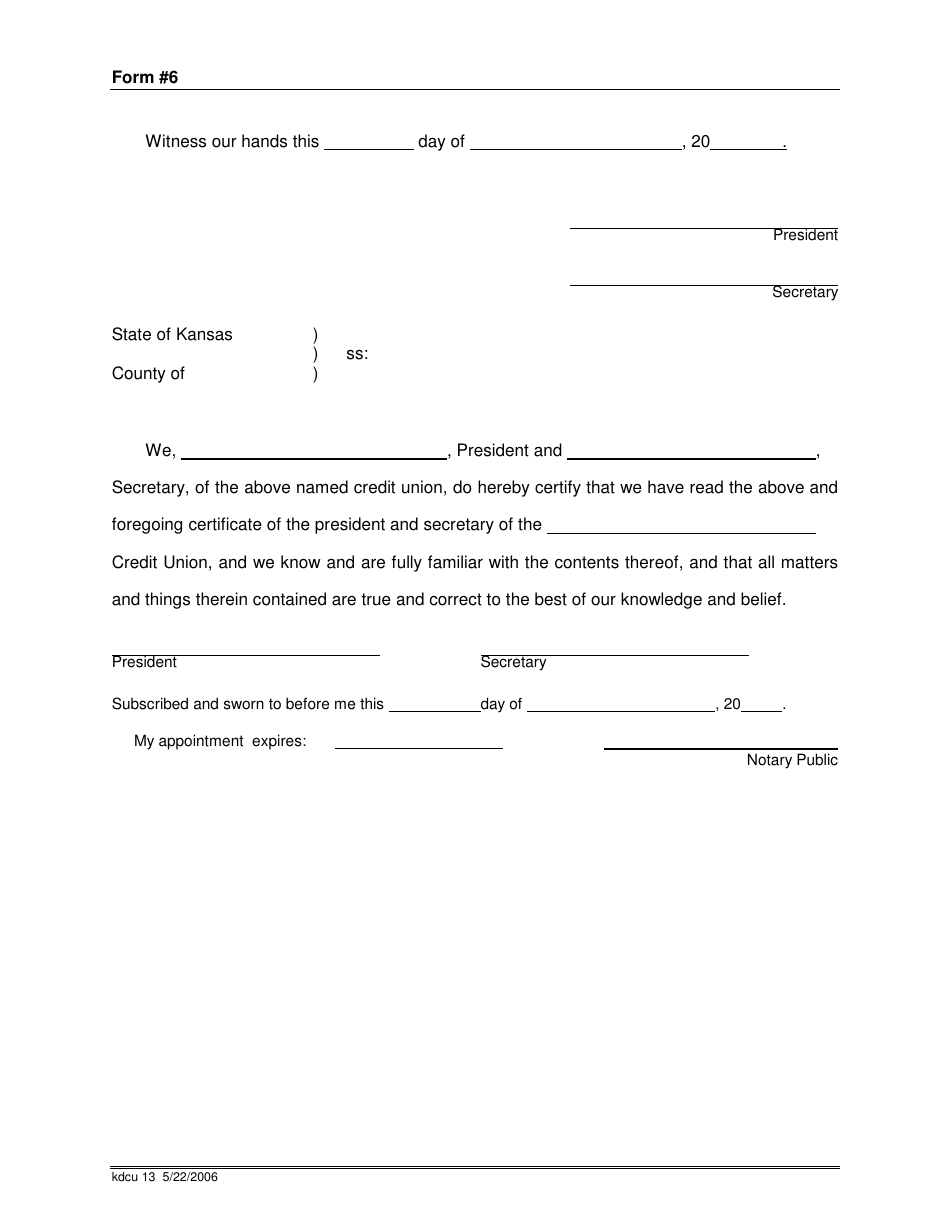

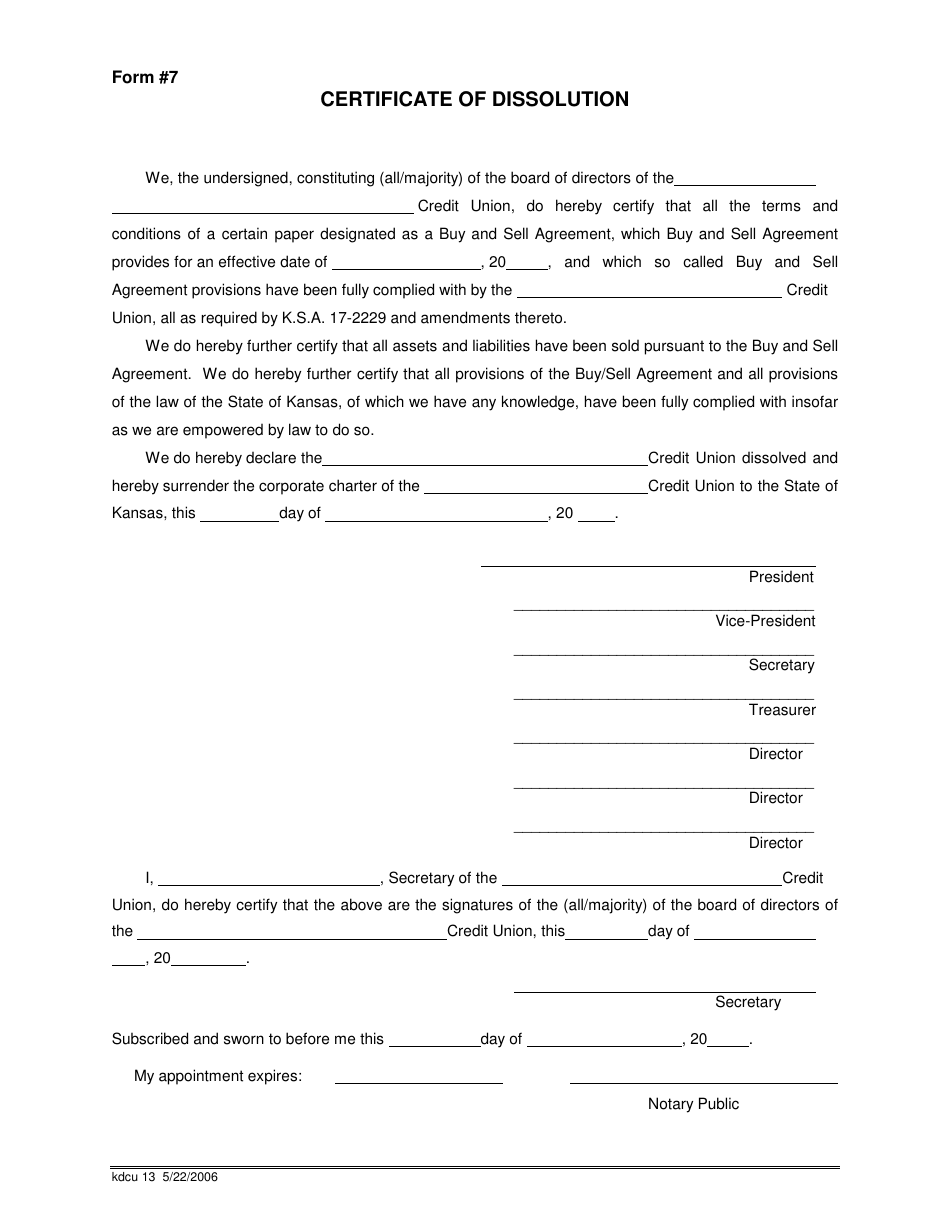

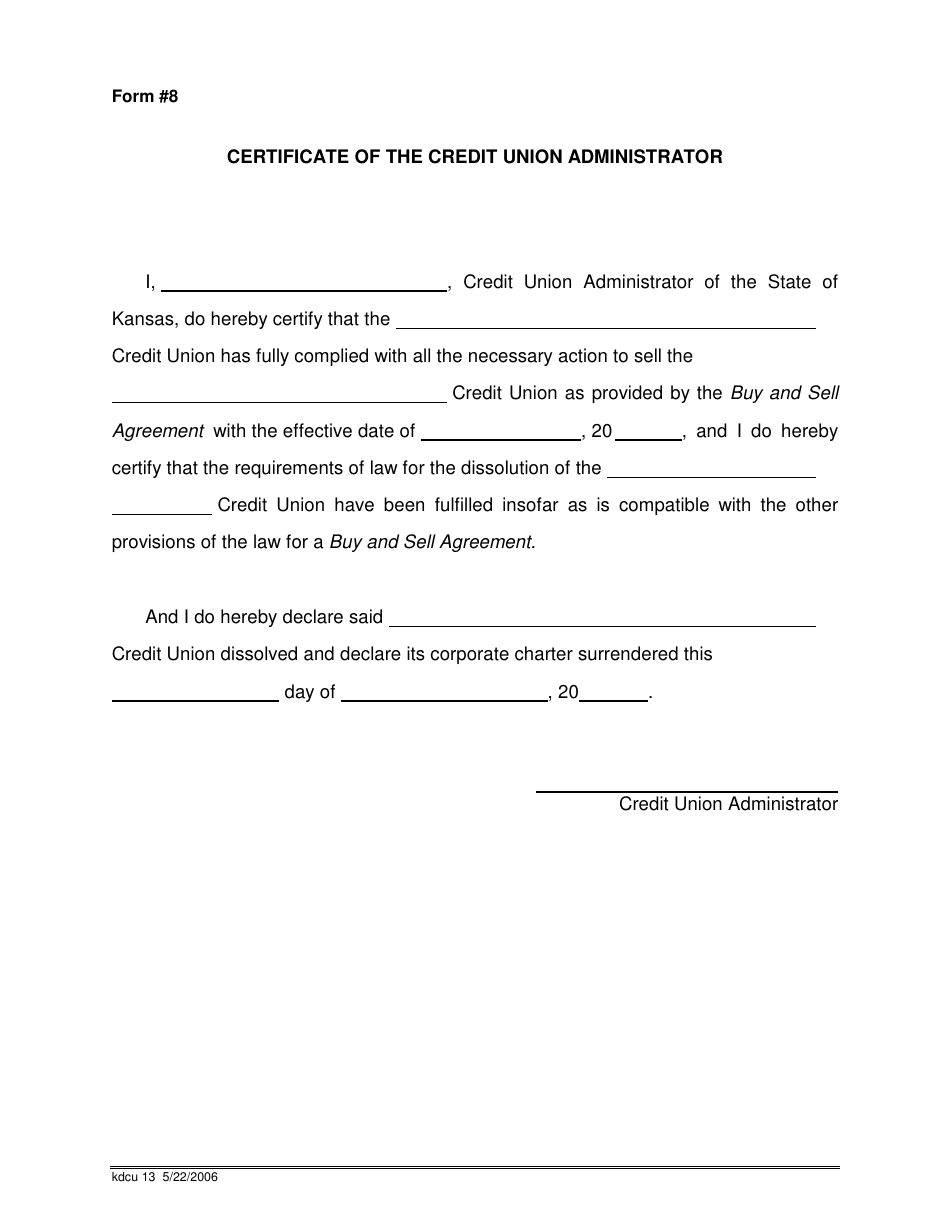

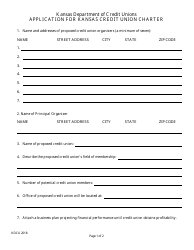

Forms and Procedures for Purchase and Sell Agreement of Kansas Chartered Credit Unions is a legal document that was released by the Kansas Department of Credit Unions - a government authority operating within Kansas.

FAQ

Q: What is a Purchase and Sell Agreement?

A: It is a legally binding agreement between two parties for the purchase and sale of assets or businesses.

Q: What is a Kansas Chartered Credit Union?

A: It is a credit union that is chartered by the state of Kansas.

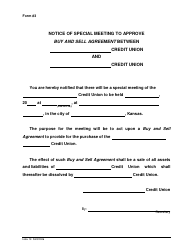

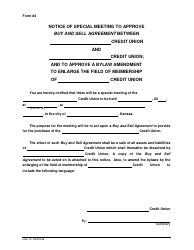

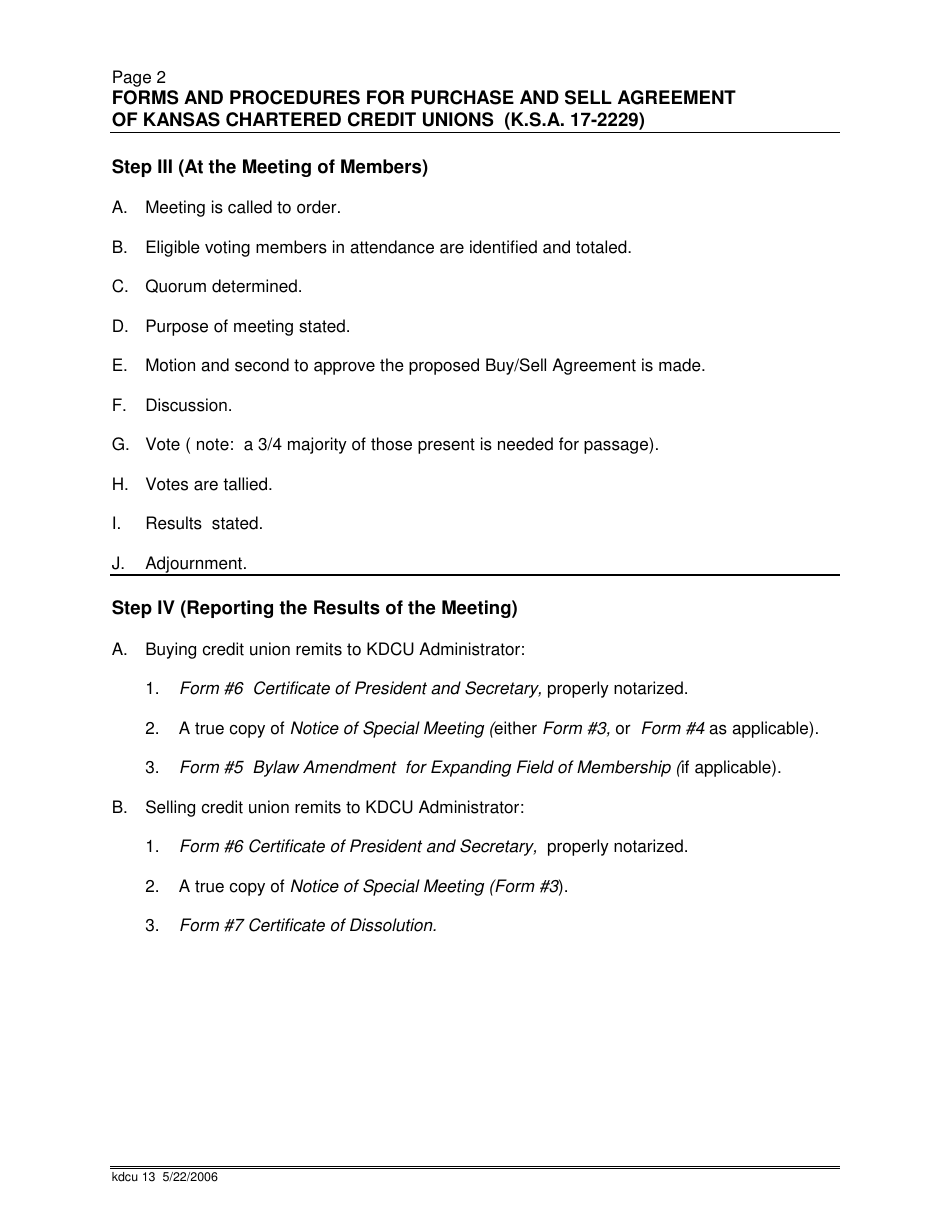

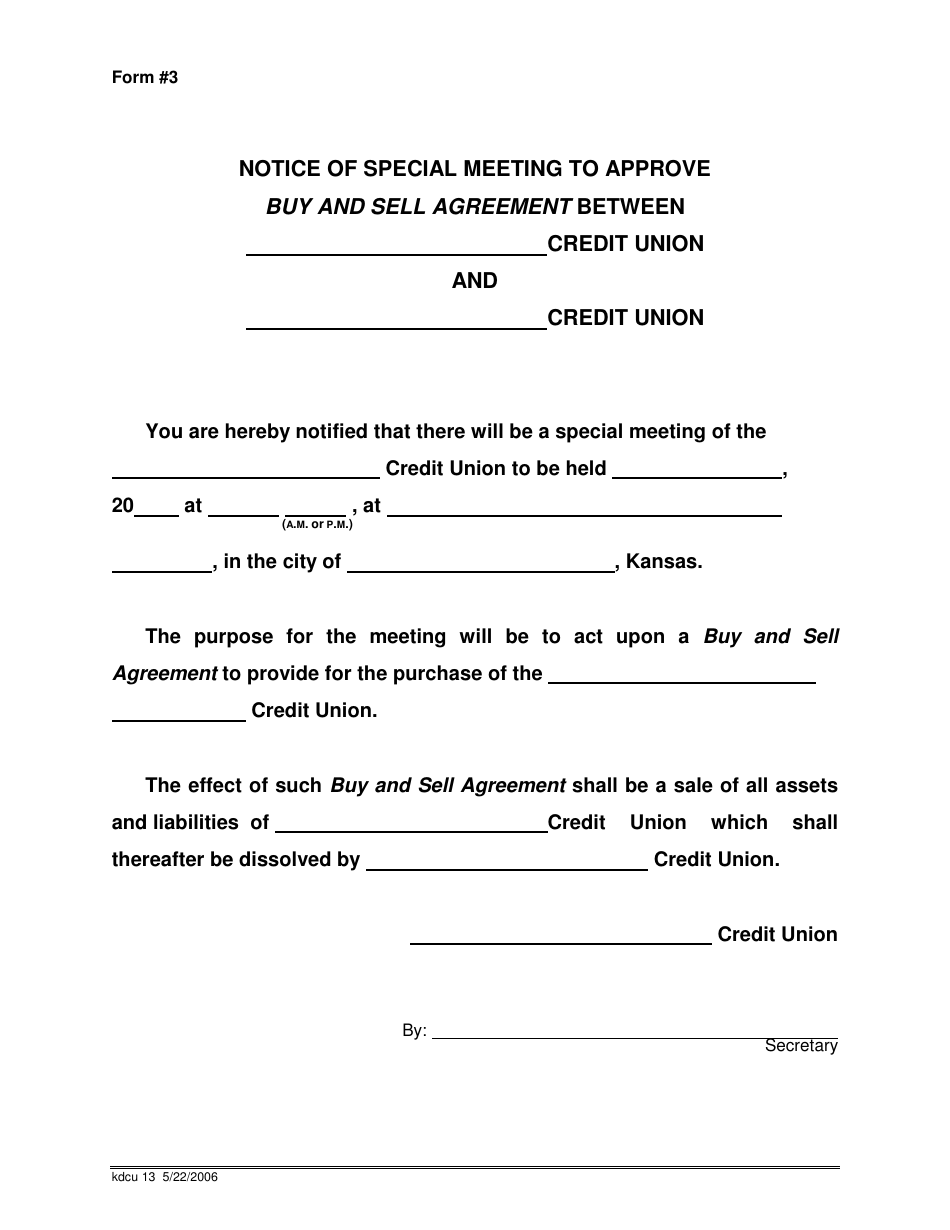

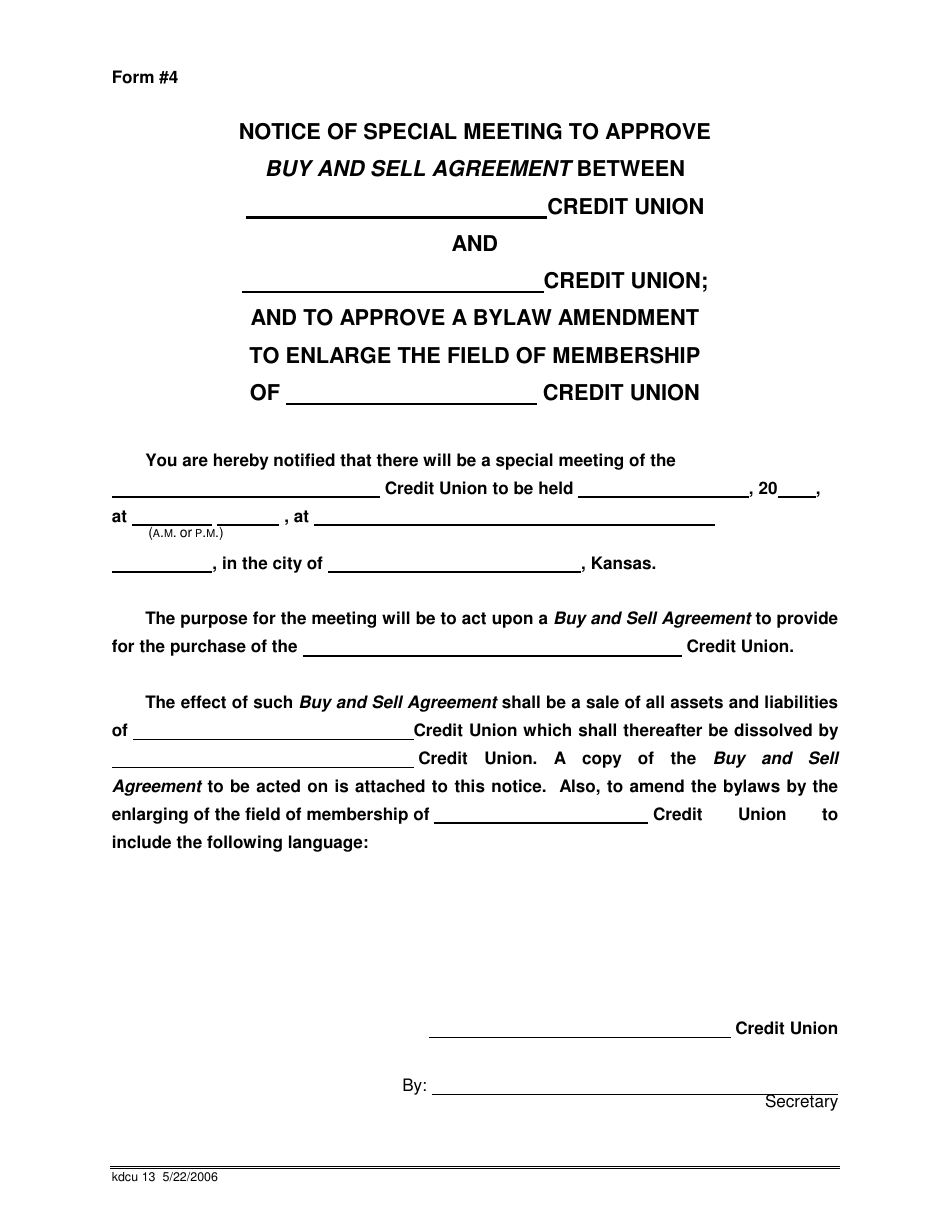

Q: What are the forms and procedures for a Purchase and Sell Agreement of Kansas Chartered Credit Unions?

A: The specific forms and procedures may vary, but typically include negotiation, due diligence, drafting the agreement, obtaining approvals, and closing the transaction.

Q: What is due diligence?

A: It is the process of investigating and reviewing the financial and operational aspects of the credit union being purchased.

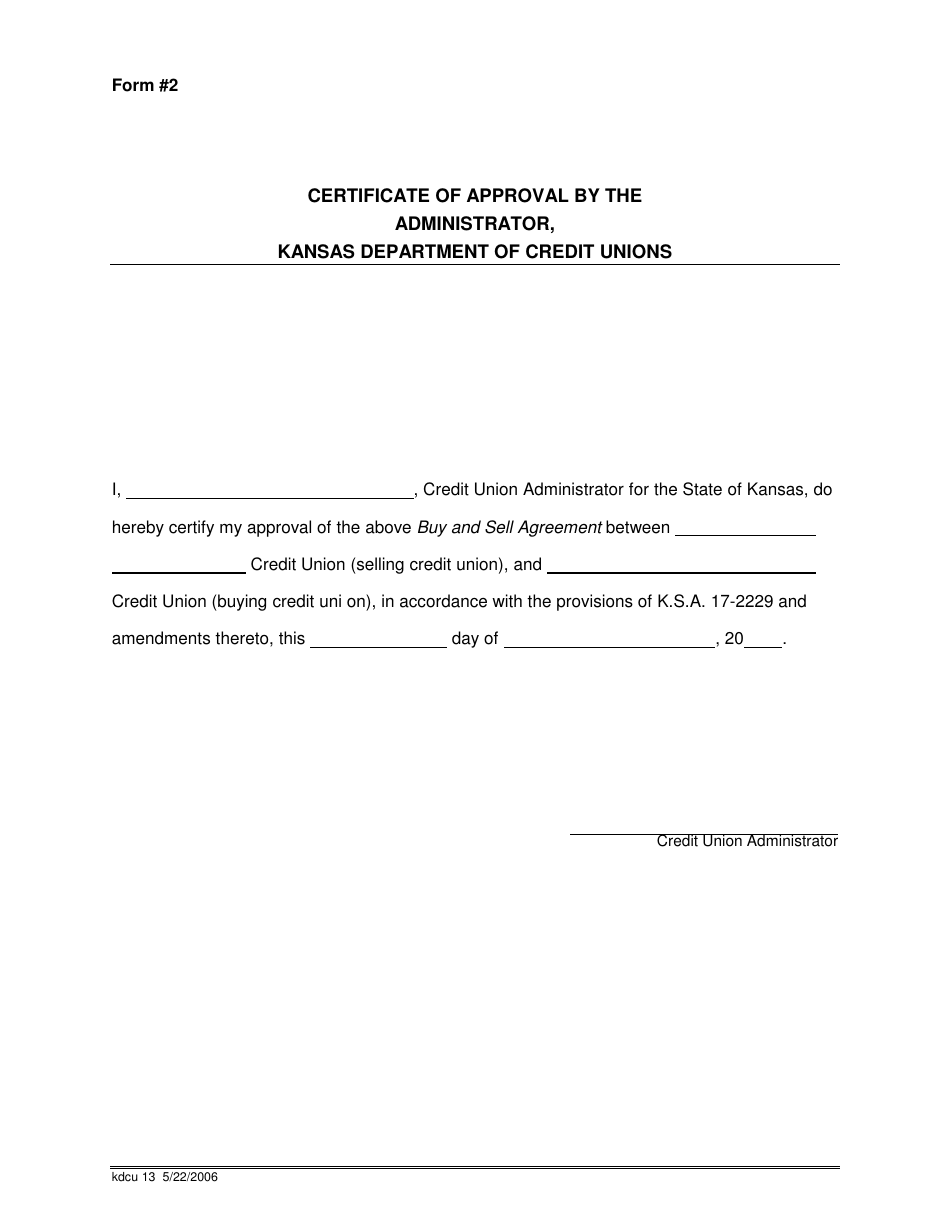

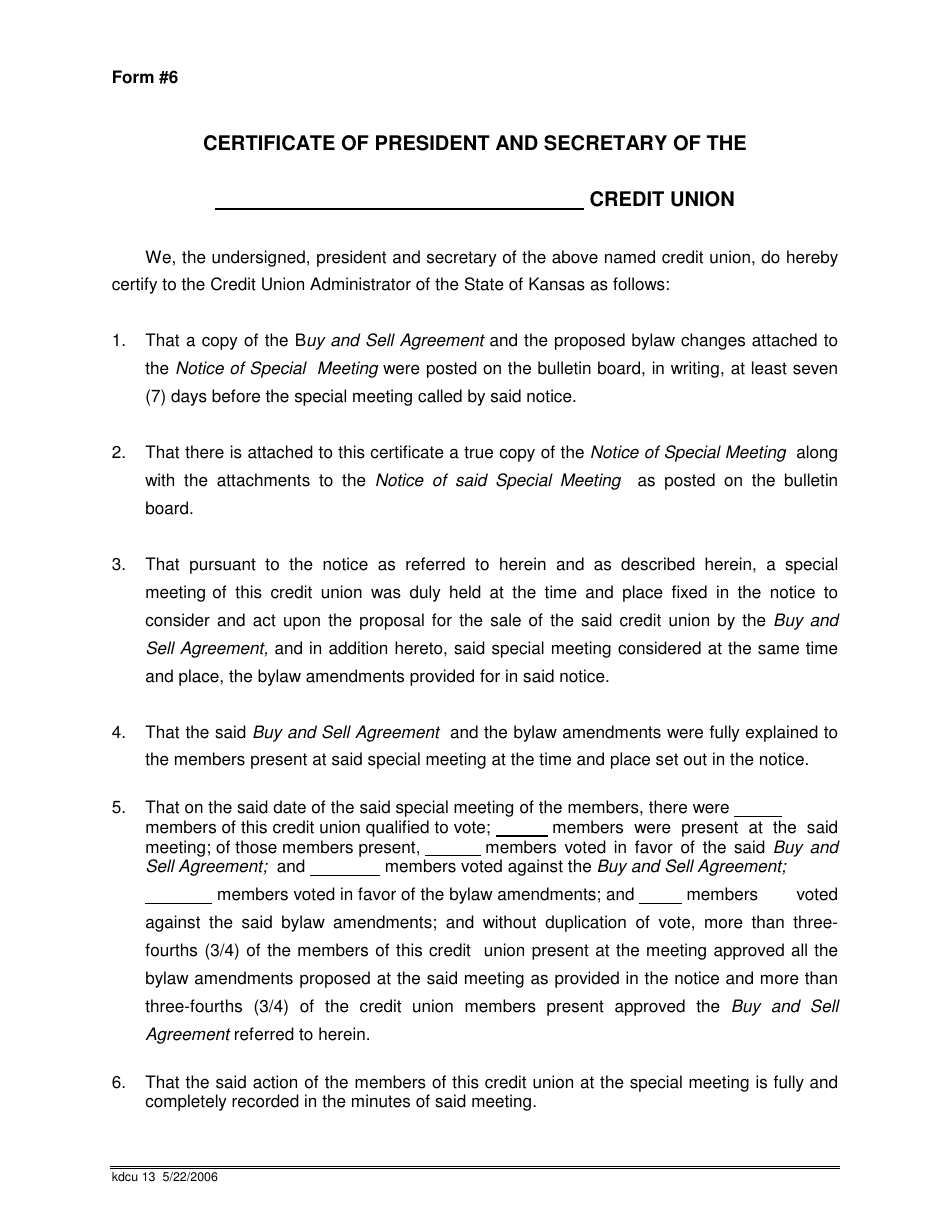

Q: What approvals are required for a Purchase and Sell Agreement?

A: Approvals may be required from regulatory agencies, such as the Kansas Department of Credit Unions, as well as the credit union's board of directors and members.

Q: What happens after the agreement is drafted?

A: After the agreement is drafted, both parties review and negotiate the terms until they reach a mutually acceptable agreement.

Q: What happens at the closing of the transaction?

A: At the closing, the purchase price is paid, and the assets or business are transferred from the seller to the buyer.

Q: Are there any specific rules or regulations in Kansas for Purchase and Sell Agreements of Credit Unions?

A: Yes, credit unions in Kansas are regulated by the Kansas Department of Credit Unions, and any Purchase and Sell Agreement must comply with applicable state laws and regulations.

Form Details:

- Released on May 22, 2006;

- The latest edition currently provided by the Kansas Department of Credit Unions;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kansas Department of Credit Unions.