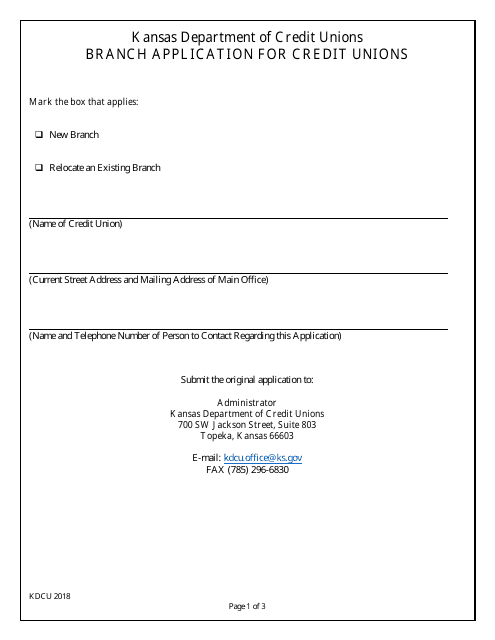

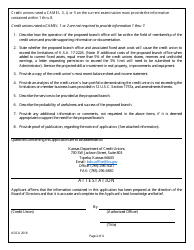

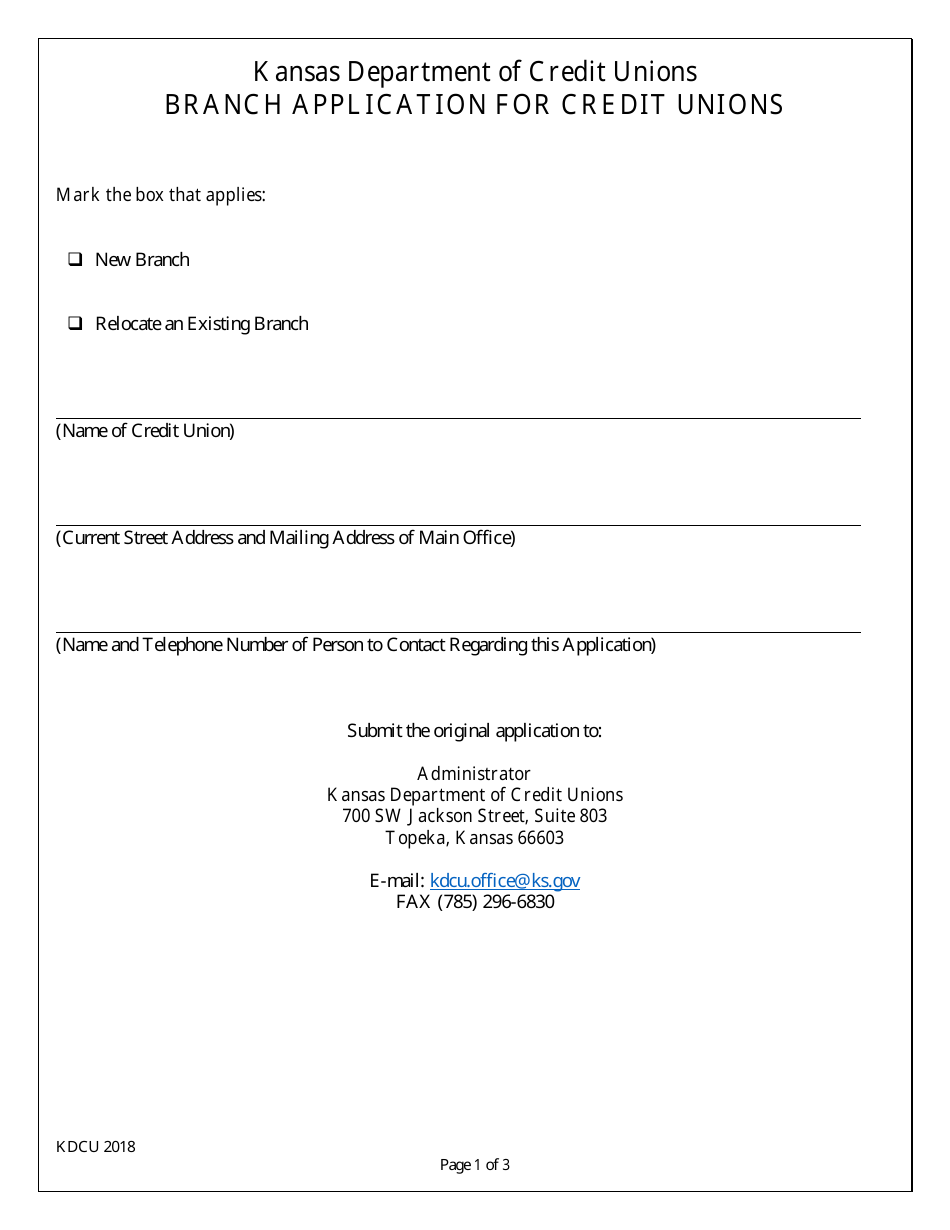

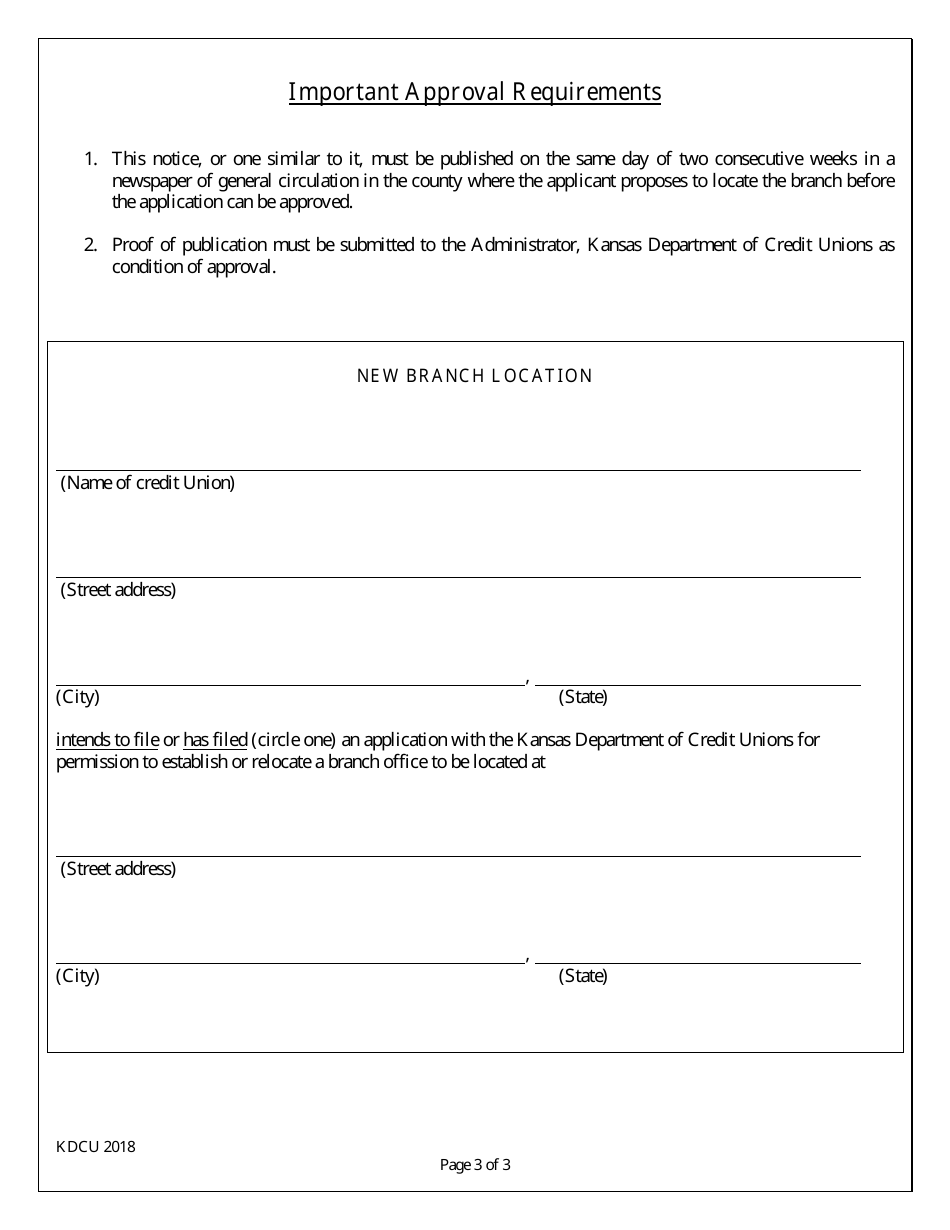

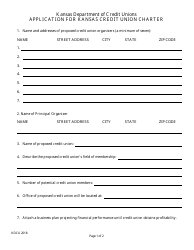

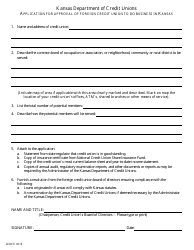

Branch Application for Credit Unions - Kansas

Branch Application for Credit Unions is a legal document that was released by the Kansas Department of Credit Unions - a government authority operating within Kansas.

FAQ

Q: What is a credit union?

A: A credit union is a non-profit financial institution that is owned and operated by its members.

Q: Why would I want to join a credit union?

A: Joining a credit union can offer benefits such as lower interest rates on loans, higher interest rates on savings accounts, and personalized customer service.

Q: How do I apply for a credit union membership?

A: To apply for a credit union membership, you will need to fill out an application form and meet the eligibility requirements, which typically include living or working in a specific area or being part of a particular group.

Q: What documents are required to apply for a credit union membership?

A: The specific documents required may vary, but typically you will need to provide identification such as a driver's license or passport, proof of address, and proof of eligibility.

Q: What services do credit unions offer?

A: Credit unions offer a wide range of financial services including savings accounts, checking accounts, loans, credit cards, and financial planning.

Q: Are credit unions insured like banks?

A: Yes, credit unions are insured by the National Credit Union Administration (NCUA) up to $250,000 per depositor, similar to how banks are insured by the FDIC.

Q: Are there any fees associated with credit union membership?

A: Some credit unions may have membership fees or require a minimum deposit, but many do not charge monthly service fees like traditional banks.

Q: Can I apply for a loan through a credit union?

A: Yes, credit unions commonly offer various types of loans including auto loans, home loans, personal loans, and business loans.

Q: What is the difference between a credit union and a bank?

A: While banks are for-profit institutions owned by shareholders, credit unions are non-profit institutions owned by their members and focused on serving their needs rather than maximizing profits.

Form Details:

- Released on January 1, 2018;

- The latest edition currently provided by the Kansas Department of Credit Unions;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kansas Department of Credit Unions.