This version of the form is not currently in use and is provided for reference only. Download this version of

Form 70-020

for the current year.

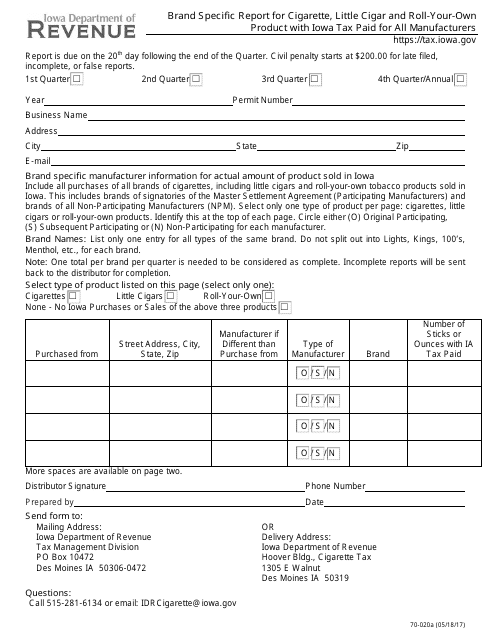

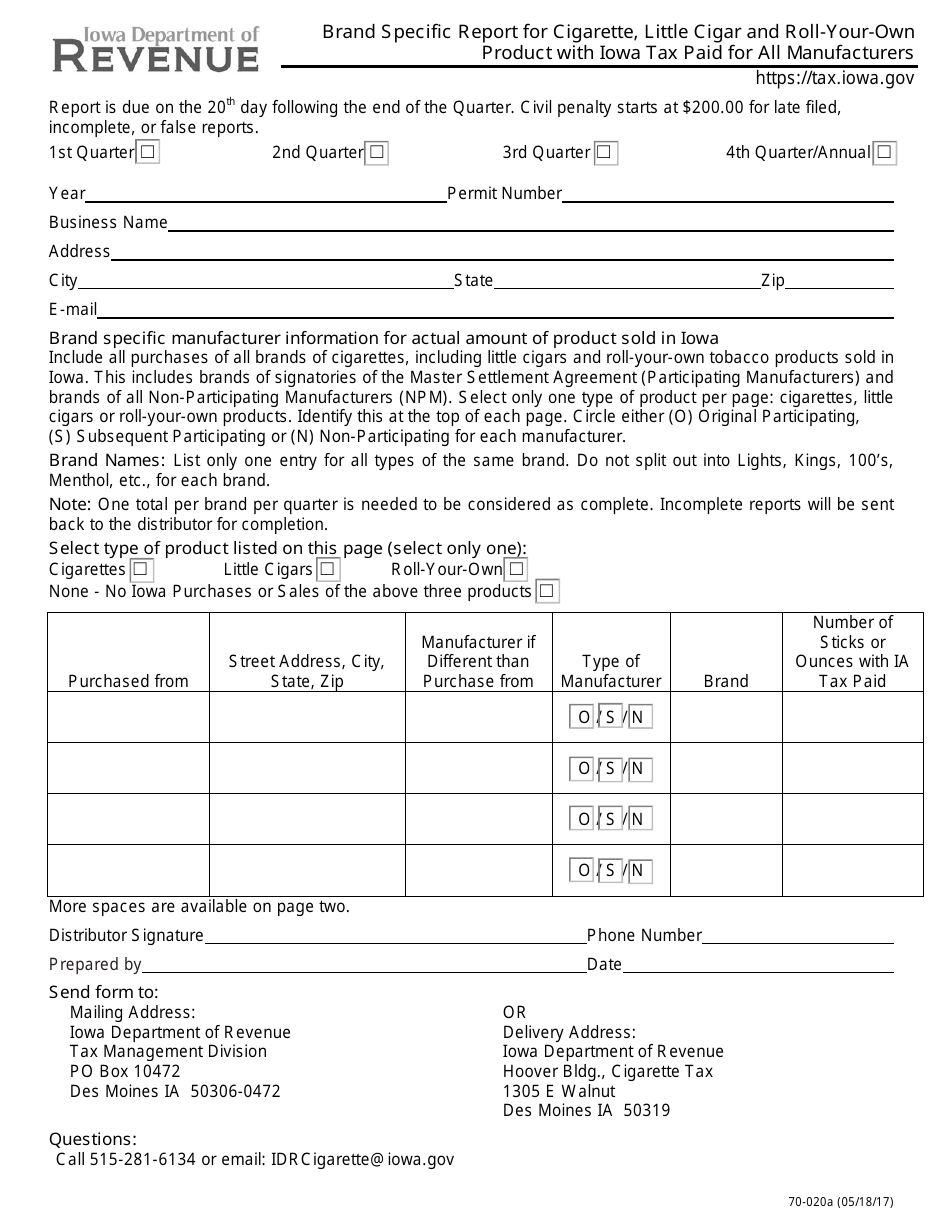

Form 70-020 Brand Specific Report for Cigarette, Little Cigar and Roll-Your-Own Product With Iowa Tax Paid for All Manufacturers - Iowa

What Is Form 70-020?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 70-020?

A: Form 70-020 is a report used to provide information about cigarette, little cigar, and roll-your-own products with Iowa tax paid for all manufacturers in Iowa.

Q: Who needs to fill out Form 70-020?

A: All manufacturers of cigarettes, little cigars, and roll-your-own products in Iowa need to fill out Form 70-020.

Q: What information is required on Form 70-020?

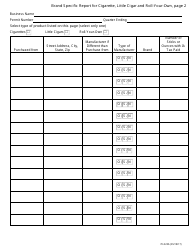

A: Form 70-020 requires manufacturers to provide details about their cigarette, little cigar, and roll-your-own product sales, as well as the amount of Iowa tax paid.

Q: What is the purpose of Form 70-020?

A: The purpose of Form 70-020 is to ensure compliance with Iowa tax laws and to track the sales and tax payments for cigarette, little cigar, and roll-your-own products.

Q: When is Form 70-020 due?

A: Form 70-020 is due on a quarterly basis, with deadlines falling on the last day of January, April, July, and October.

Q: Are there any penalties for not filing Form 70-020?

A: Yes, failure to file Form 70-020 or providing false information may result in penalties or fines imposed by the Iowa Department of Revenue.

Q: What if I have additional questions about Form 70-020?

A: If you have additional questions about Form 70-020, you can contact the Iowa Department of Revenue for assistance.

Form Details:

- Released on May 18, 2017;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 70-020 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.