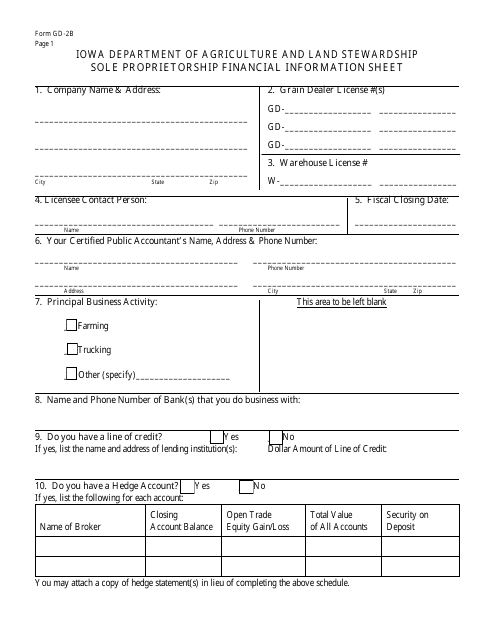

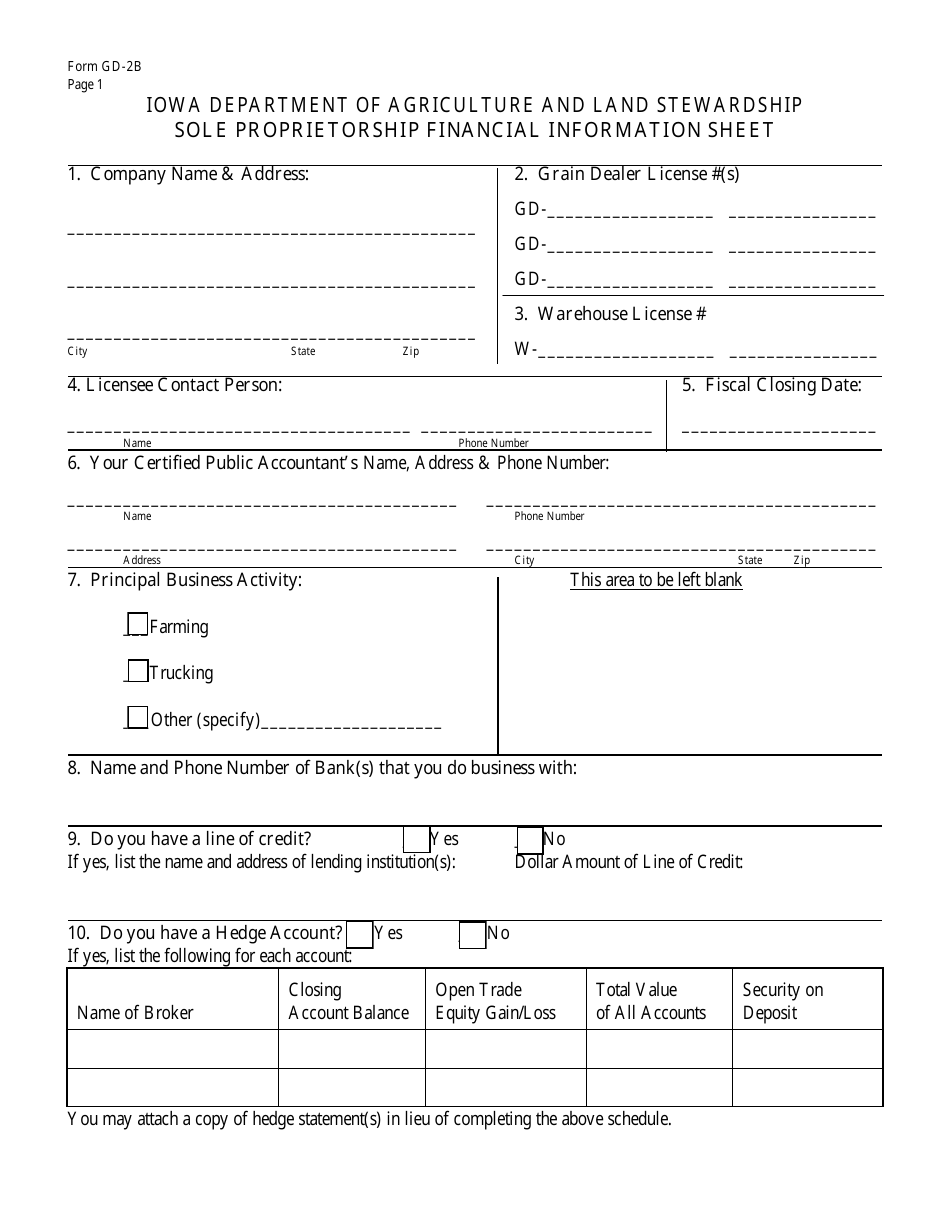

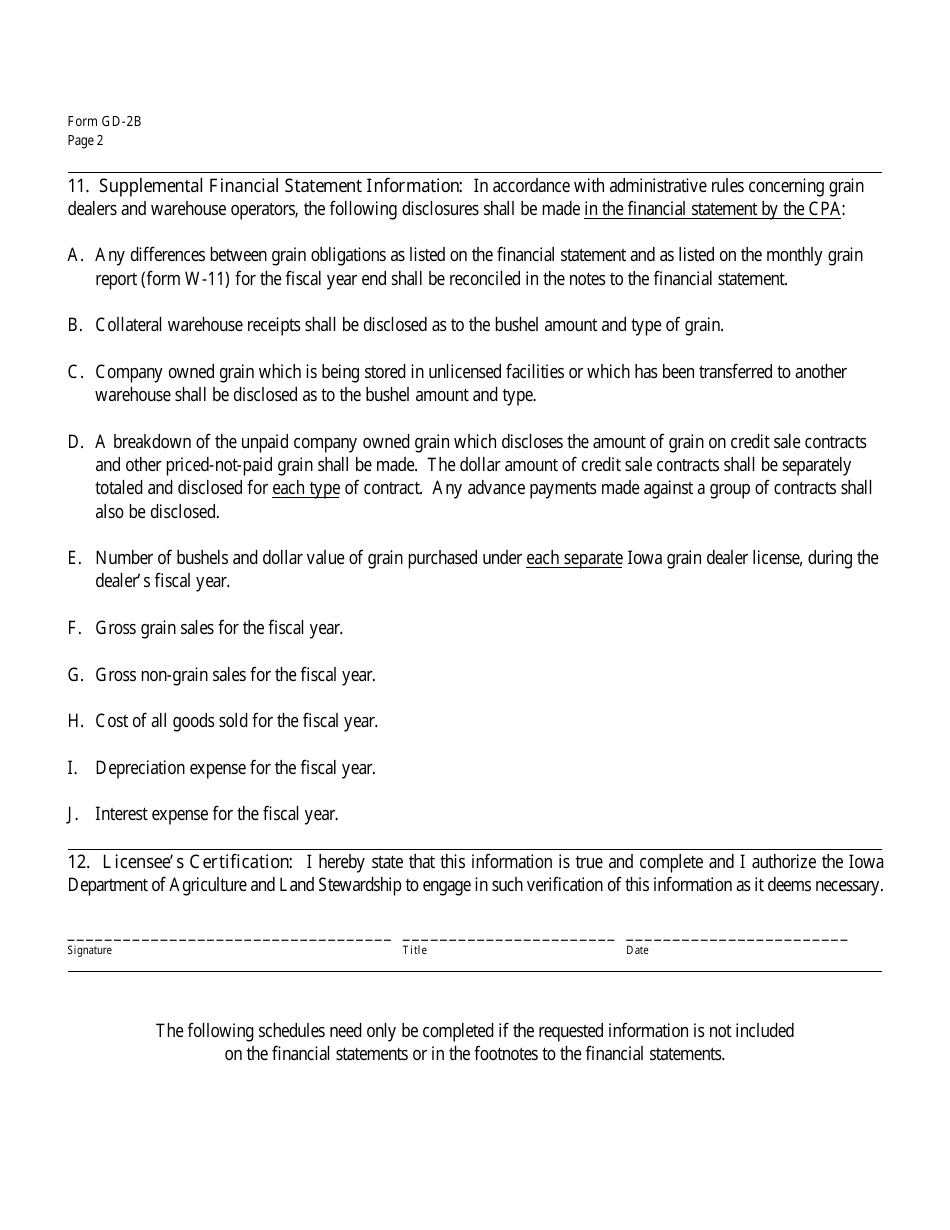

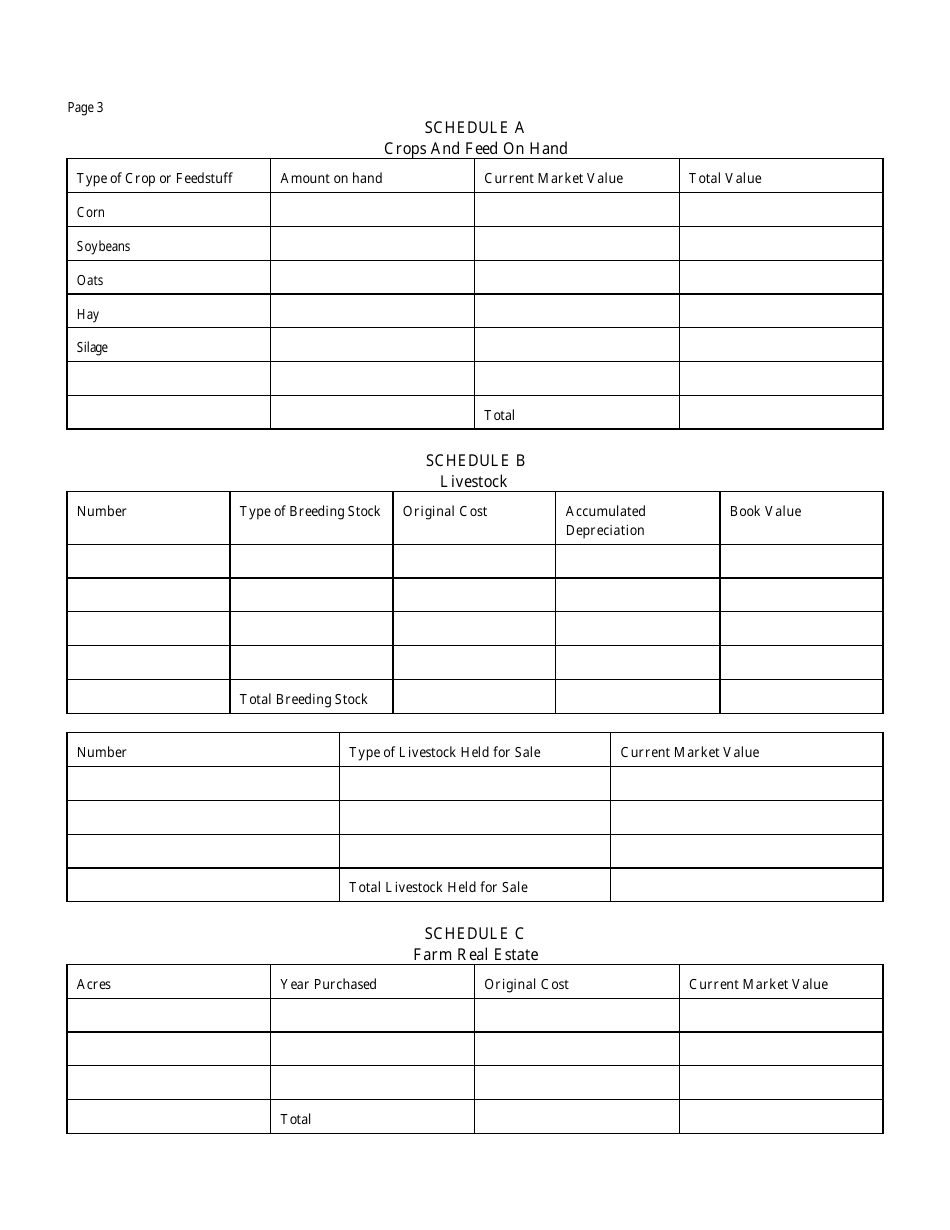

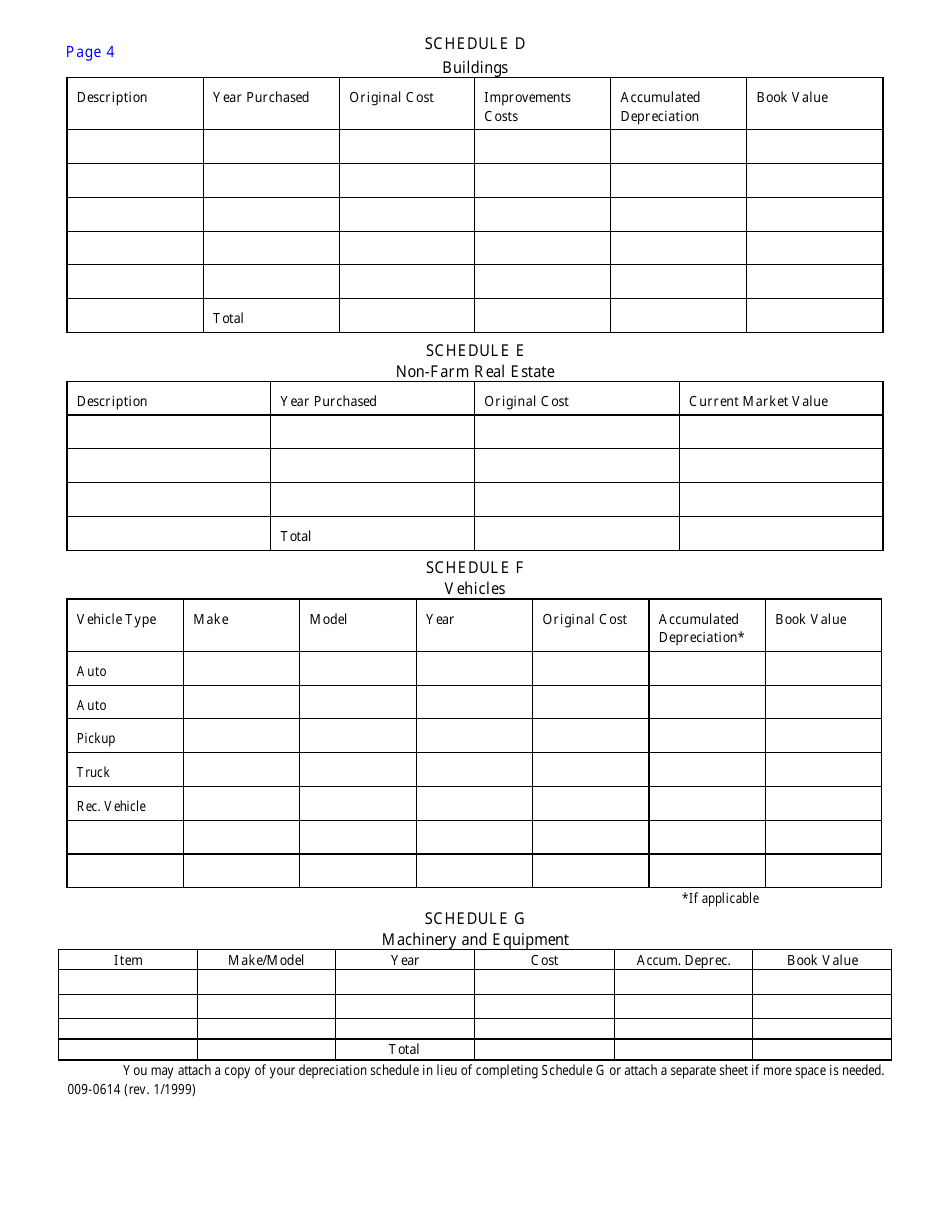

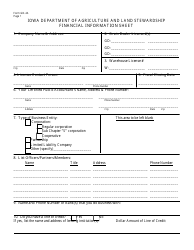

Form GD-2B Sole Proprietorship Financial Information Sheet - Iowa

What Is Form GD-2B?

This is a legal form that was released by the Iowa Department of Agriculture and Land Stewardship - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GD-2B?

A: Form GD-2B is the Sole Proprietorship Financial Information Sheet specifically designed for businesses in Iowa.

Q: What is a sole proprietorship?

A: A sole proprietorship is a business structure where an individual is the sole owner and assumes all financial and legal responsibility for the business.

Q: Why is Form GD-2B needed?

A: Form GD-2B is needed to provide financial information about the sole proprietorship, including income, expenses, assets, and liabilities.

Q: Who needs to fill out Form GD-2B?

A: Sole proprietors in Iowa need to fill out Form GD-2B to report their financial information to the appropriate authorities.

Q: When is Form GD-2B due?

A: The due date for submitting Form GD-2B may vary, so it is important to check the specific deadlines set by the Iowa Department of Revenue.

Q: What happens if I don't fill out Form GD-2B?

A: Failure to fill out Form GD-2B or providing inaccurate information may result in penalties or legal consequences.

Q: Do I need to include supporting documents with Form GD-2B?

A: Supporting documents such as bank statements, tax forms, and financial records may be required to accompany Form GD-2B, depending on the specific instructions provided by the Iowa Department of Revenue.

Q: Can I get assistance in filling out Form GD-2B?

A: Yes, you can seek assistance from an accountant, tax professional, or the Iowa Department of Revenue to ensure accurate completion of Form GD-2B.

Form Details:

- Released on January 1, 1999;

- The latest edition provided by the Iowa Department of Agriculture and Land Stewardship;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GD-2B by clicking the link below or browse more documents and templates provided by the Iowa Department of Agriculture and Land Stewardship.