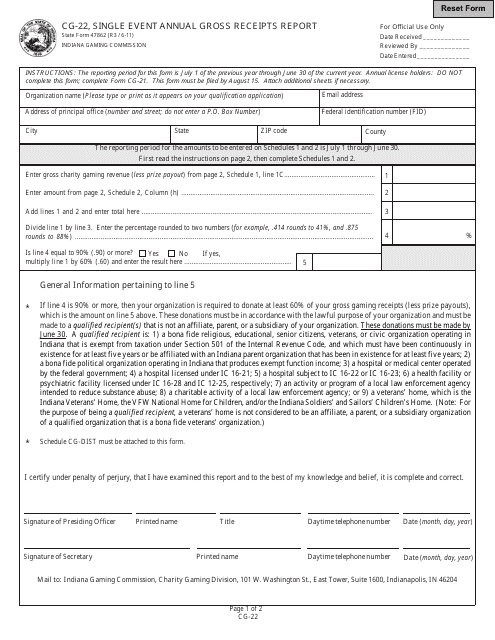

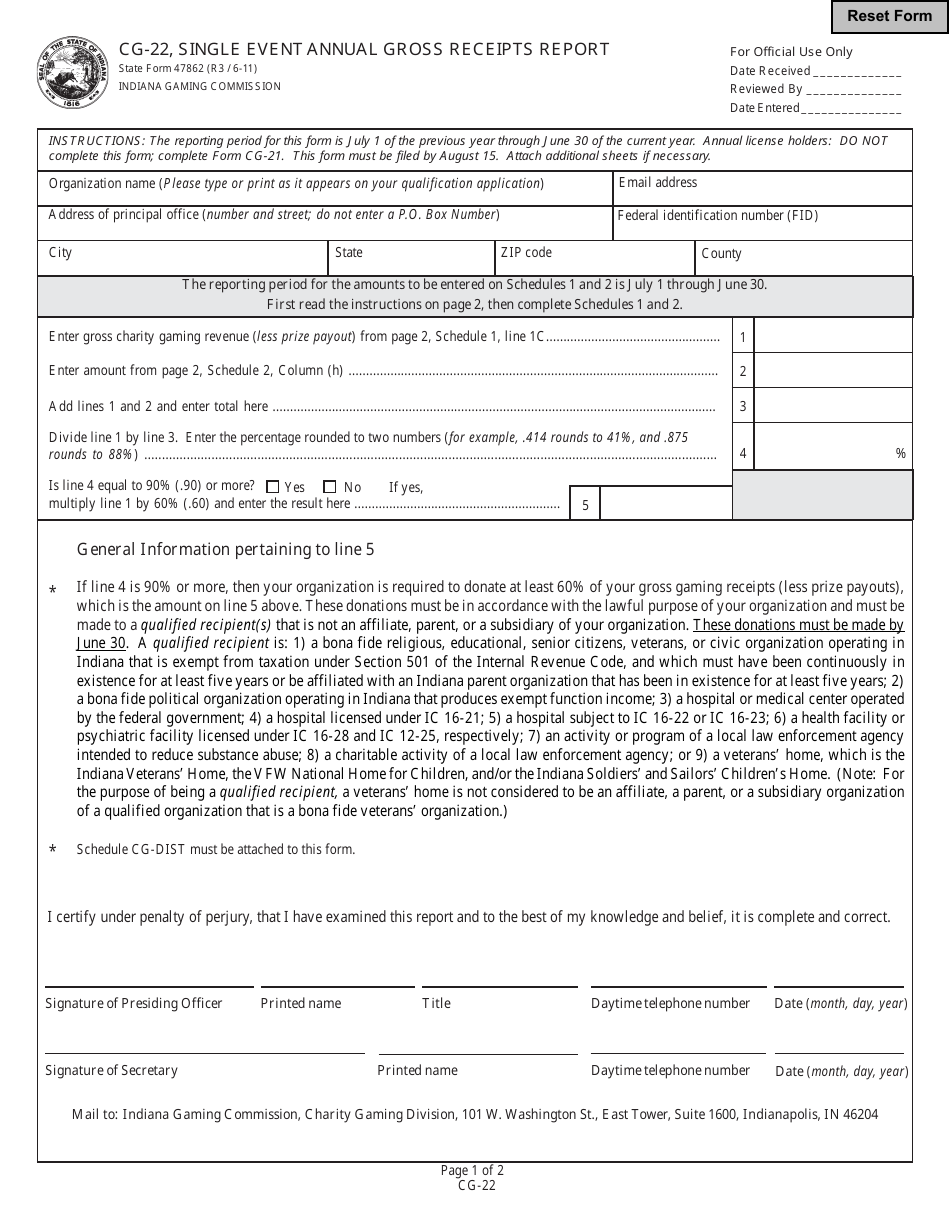

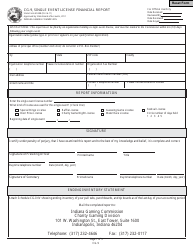

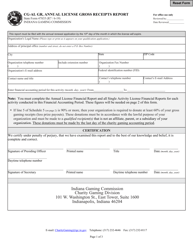

State Form 47862 (CG-22) Single Event Annual Gross Receipts Report - Indiana

What Is State Form 47862 (CG-22)?

This is a legal form that was released by the Indiana Gaming Commission - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 47862?

A: State Form 47862 is the Single Event Annual Gross Receipts Report form for Indiana.

Q: Who needs to file State Form 47862?

A: Any business or organization that holds a single event in Indiana and has gross receipts exceeding $1,000 must file State Form 47862.

Q: What is the purpose of filing State Form 47862?

A: The purpose of filing State Form 47862 is to report the gross receipts generated from a single event in Indiana.

Q: What is considered a single event?

A: A single event refers to a one-time gathering, exhibition, fair, carnival, festival, or similar activity conducted by a business or organization in Indiana.

Q: What are gross receipts?

A: Gross receipts are the total amount of money received by a business or organization from its activities, including ticket sales, entry fees, merchandise sales, and any other revenue.

Q: Is there a deadline for filing State Form 47862?

A: Yes, State Form 47862 must be filed within 30 days after the conclusion of the single event.

Q: Are there any penalties for not filing State Form 47862?

A: Yes, failure to file State Form 47862 or filing it late may result in penalties and interest being assessed by the Indiana Department of Revenue.

Form Details:

- Released on June 1, 2011;

- The latest edition provided by the Indiana Gaming Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 47862 (CG-22) by clicking the link below or browse more documents and templates provided by the Indiana Gaming Commission.