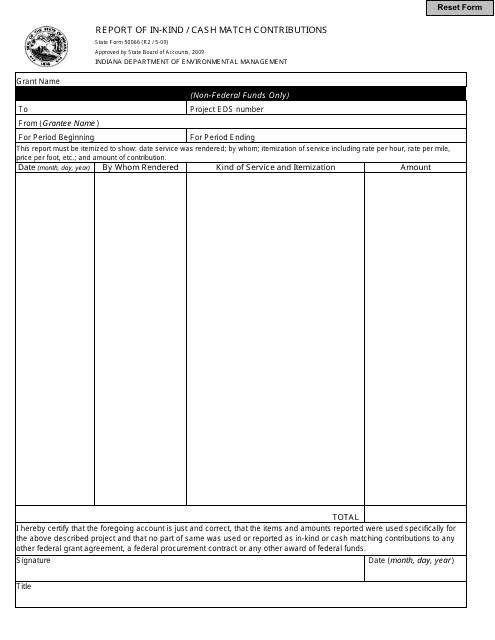

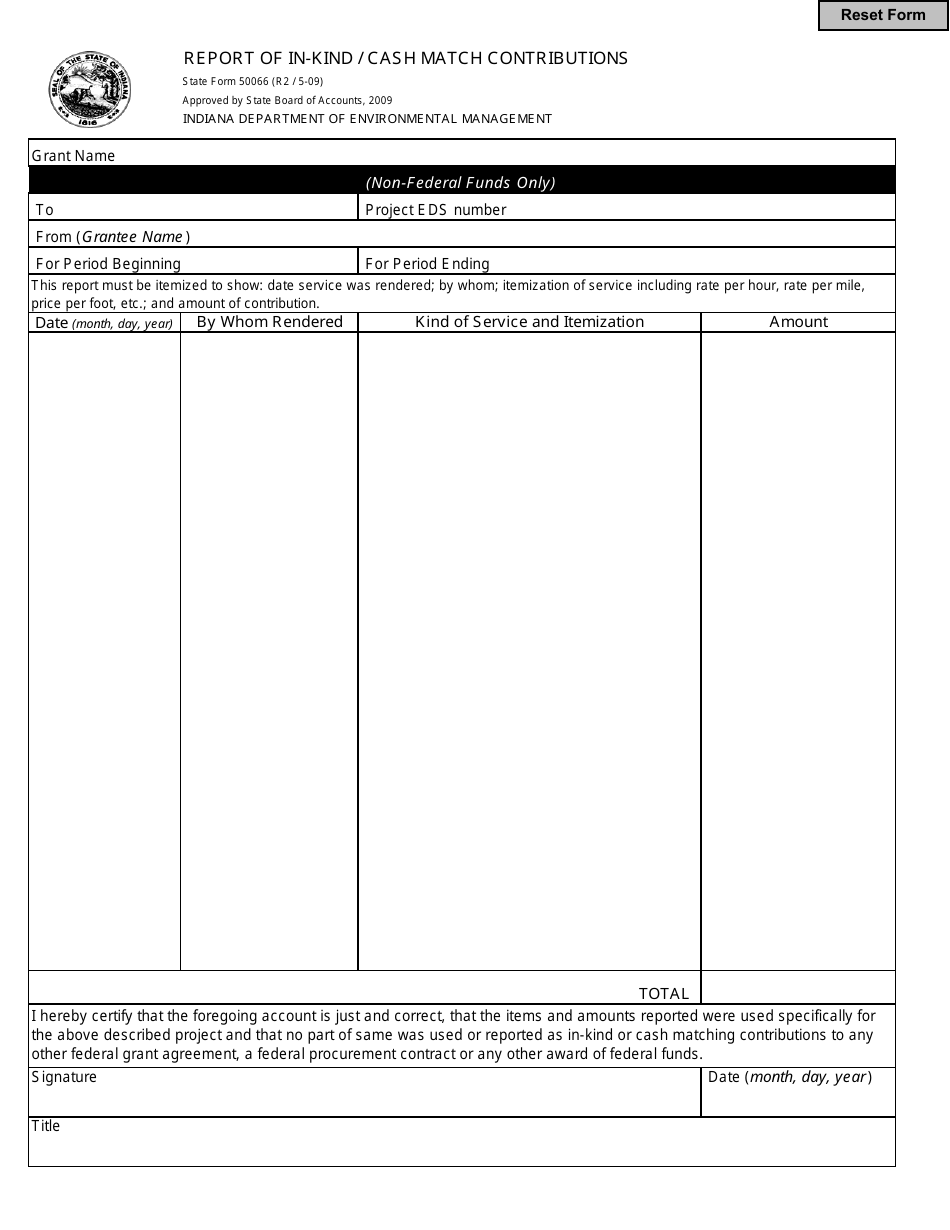

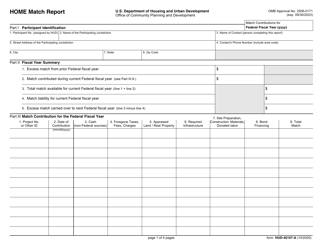

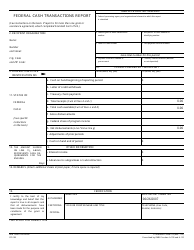

State Form 50066 Report of in-Kind / Cash Match Contributions - Indiana

What Is State Form 50066?

This is a legal form that was released by the Indiana Department of Environmental Management - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the State Form 50066?

A: The State Form 50066 is a Report of in-Kind / Cash Match Contributions specific to Indiana.

Q: What does the State Form 50066 report?

A: The State Form 50066 reports in-kind and cash match contributions.

Q: Who needs to file the State Form 50066?

A: Any entity or individual who has made in-kind or cash match contributions in Indiana needs to file the State Form 50066.

Q: What is considered an in-kind contribution?

A: An in-kind contribution refers to a non-monetary donation of goods, services, or property.

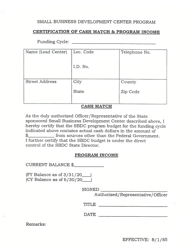

Q: What is a cash match contribution?

A: A cash match contribution is a monetary donation made to match or supplement other funding sources.

Q: Is the State Form 50066 required for all types of organizations?

A: Yes, the State Form 50066 is required for all types of organizations, including non-profit organizations.

Q: How often should the State Form 50066 be filed?

A: The frequency of filing the State Form 50066 depends on the specific reporting requirements set by the Indiana governing body.

Q: Are there any penalties for not filing the State Form 50066?

A: Failure to file the State Form 50066 or providing false information can result in penalties and legal consequences.

Q: Do I need to keep records of my in-kind and cash match contributions?

A: Yes, it is important to maintain records of in-kind and cash match contributions for auditing and verification purposes.

Form Details:

- Released on May 1, 2009;

- The latest edition provided by the Indiana Department of Environmental Management;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 50066 by clicking the link below or browse more documents and templates provided by the Indiana Department of Environmental Management.